I’d be remiss if I didn’t at least mention all of the rumors and shit talking taking place online about an imminent DB-CS collapse, which will make Lehman Brothers look like child’s play. On paper, or at least CDS spreads, it seems to be happening.

If in fact it does happen, MAXIMUM FUCKERY and chicanery will take place, all thanks and praise to shmita.

I can tell you if they go, C will go too. It’s all cobbled like a nice weave together and as soon as that weave gets pulled — odious looking bald people will be presented to the world and everyone will sell. No one likes a bald man.

And then there’s this.

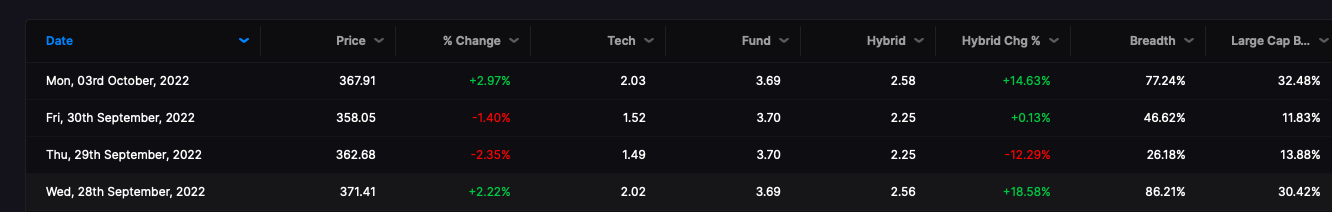

These are the banks trading with most risk now, subjugated well below book value — indicative of high risk afoot.

Plainly, I don’t view this crisis on par with 2008, only because there isn’t the same level of subprime risk associated with bank portfolios. HOWEVER, when price to market caps begin to sink like this — the market forces banks to raise capital and that process is dilutive and then there are next targets and the whole thing takes on an air of panic — spurred on by digital bank runs as large money managers move their money away from institutions that are thought to be in trouble.

Remember, banks are all Ponzi schemes and essentially insolvent, making their money off the capital of others. When that capital gets called in all at once — it’s over.

Carl Icahn chimes in.

Futures are up and oil is spiking nearly 3% on news OPEC is looking to slash production by 1m barrels come Wednesday. The futures mean nothing, especially when we are looking at banks runs.

Sleep tight tonight, fucked for faces.

Comments »