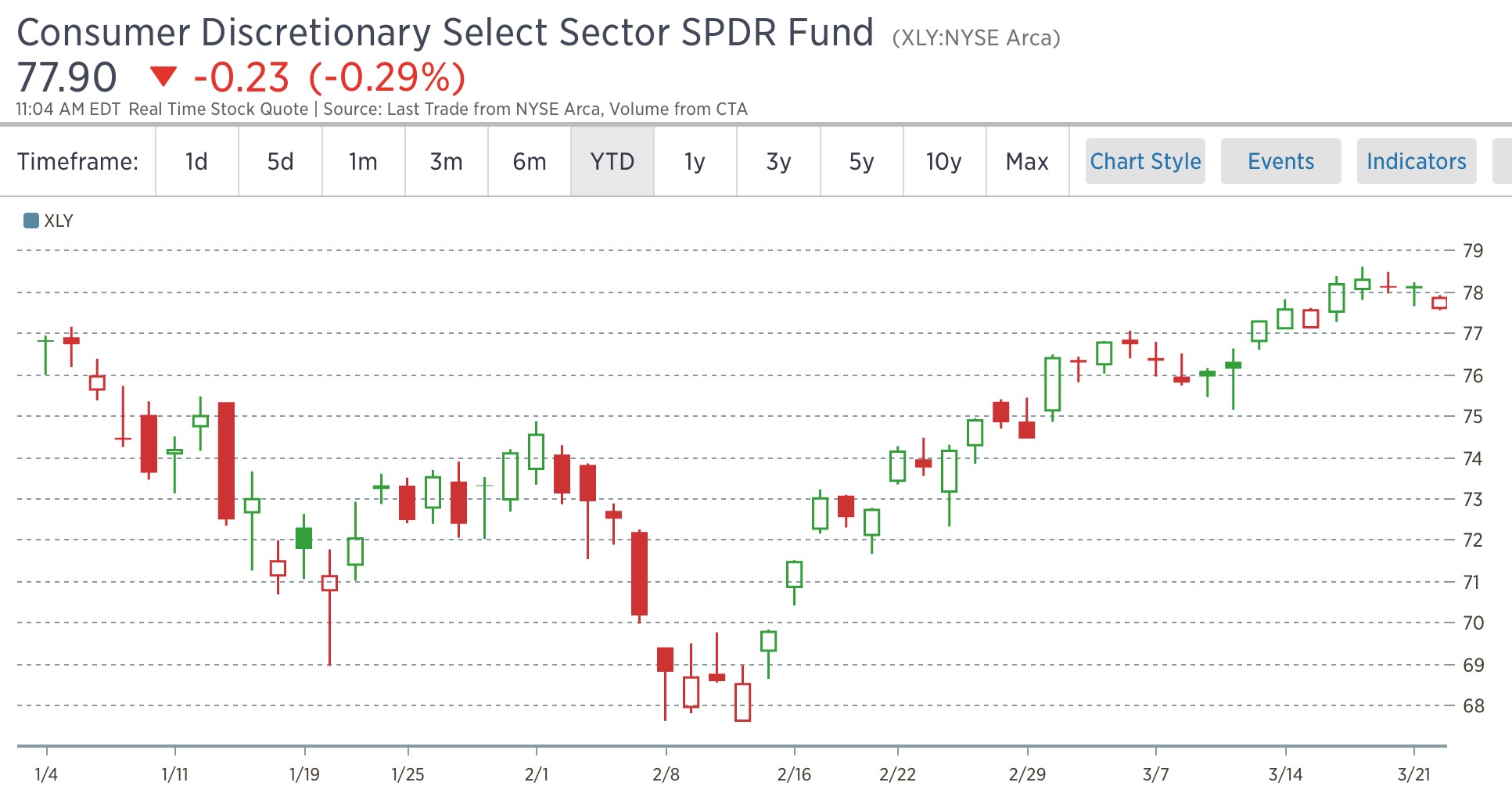

For the better part of 5 weeks, commodity related stocks have enjoyed huge upticks, after catastrophic losses were imposed on them through January and early February. Since 2010, the sector has been plagued by over supply concerns and a softening GDP outlook in China. More or less, the commodity segment of the market has been a dreadful place to reside. Even worse, it has been next to impossible to time bottoms.

UNTIL NOW!

Cramer’s chart girl is suggesting that “this is it” and “now might be the occasion” to dive into the cement pool, headlong, for it will be brimming with chlorinated water soon.

Cramer must think we’re all gypsy fuckheads playing with voodoo dolls, fireside, by a flaming barrel of garbage– clamoring for idiot advice. Naturally, commodities are entitled to rally and could be on the verge of a supernatural denial of gravity. But, given the recent history, supported by the indelible facts that economies of scale are getting WORSE and not better, it’s not likely to occur.

This time is different. It feels different. Global growth could be coming back. My chart girl is super awesome and amazing and says if this line breaks that line, then all pandemonium will break loose.

Here are some of the 1 month returns of mega-cap stocks in the commodity space.

CLR +61%

CVE +22%

ECA +85%

PBR +57%

MRO +51%

FCX +38%

VALE +27%

TCK +26%

It’s worth mentioning, there are a litany of gold/silver stocks up high double digits thus far.

Nevertheless, the commodity sector is on the verge of breaking out…now.

Complete horseshit.

Comments »