Canada’s own, Rafael Edward Cruz aka “Felito”, won big in Wisconsin this evening, crushing the orange one Donald J. Trump. The loss was so extreme and belligerent, it bordered on a violent act being committed on the reviled and insane republican front runner.

Immediately after Cruz was projected the winner, MSNBC host, Chris Mathews, skewered Trump, declaring the people have spoken and if he’s unable to complete the task of getting 1,237 delegates he would have lost the game–likening it to a game of golf. He furthered the American people do not like Trump and will not give him anything, aside from millions of votes.

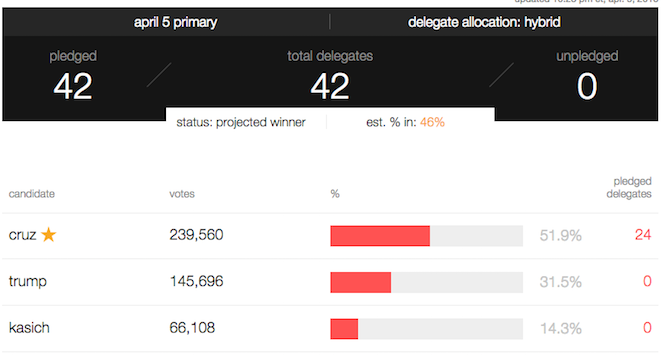

In a victory speech this evening, Rafael warned Hillary Clinton that he was coming for her, celebrating victory over Trump in the cheeseheaded state of Wisconson, sacking an astounding 24 delegates in the process.

Republican hack and troll-like human being, Newt Gingrich, said in a Hannity interview that the establishment is nuts if they think an outside candidate will grab the nomination in a brokered convention. The menace of a Paul Ryan or Mitt’d Romney selection has the social media circles atomic bombing one another. Newt put that fear to rest, insisting that the winner will be either Trump or Cruz, in spite of the indelible facts that Rafael cannot win the election without causing a great hazard to the personal health of The Donald. According to the laws of mathematics, even after this glorious triumph in the tundra of Wisconsin, Cruz needs to take 85% of all existing delegates, a feat only possible in the 5th dimension or another realm of the multiverse.

NOTE: Like Barack Obama dismays his muslim middle name Hussein, Rafael Cruz would like to strike the name Rafael from the public record, in favor of the more american sounding “Ted”, in an effort to appeal to an otherwise racist trailer truck driving under-educated white male.

Comments »