Nasdaq futures are down on heavy volume overnight. As we approach US cash trade prices are trading below yesterday’s range. Prices were soft overnight and accelerated at 8:30am when Advanced Retail Sales and Empire Manufacturing came in lower than expected. We also have Business Inventories at 10am and Fed’s Beige Book at 2pm.

Whenever the market gaps outside of the prior day range we know with certainty we are out of balance on the short timeframe. Overnight participants have rejected yesterday’s range and once the stocks which comprise the index begin trading the new development needs to be priced into the market.

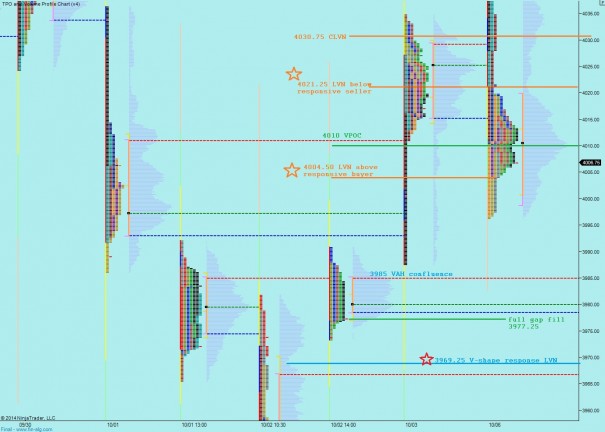

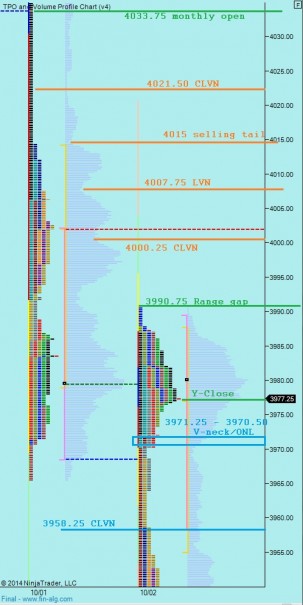

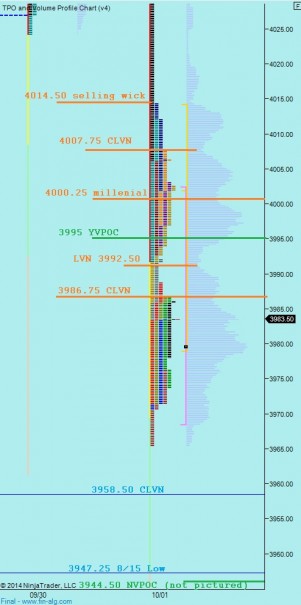

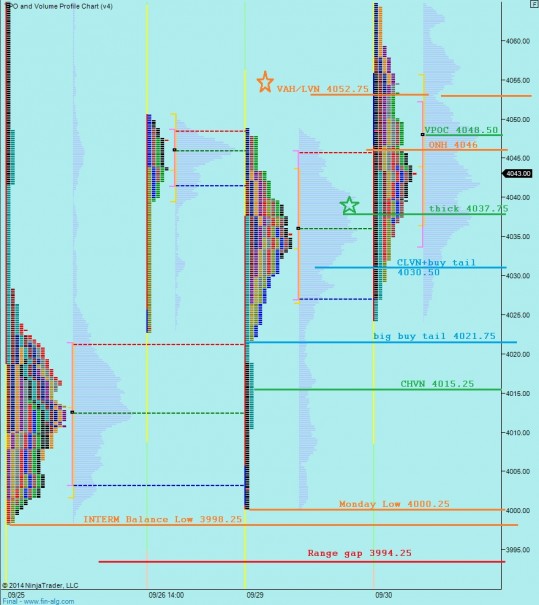

The daily chart illustrates just how fast this market is travelling down and how little difficult it has been, this week especially, to find a motivated buyer. Once Monday rejected the V-shaped bounces of last week it sent a strong indication that sellers were in control. Until we see buyers able to take out a prior day’s high the momentum is lower. What is lending to the velocity of the move is the toothy volume profile we built on the way up. Each time we slide down through an high volume zone there is another volume pocket which provides little support. The question now is whether we will traverse the next region to return to the very thick profile developed the first two quarters of this year. I have noted this and a few more observations on the following daily bar chart:

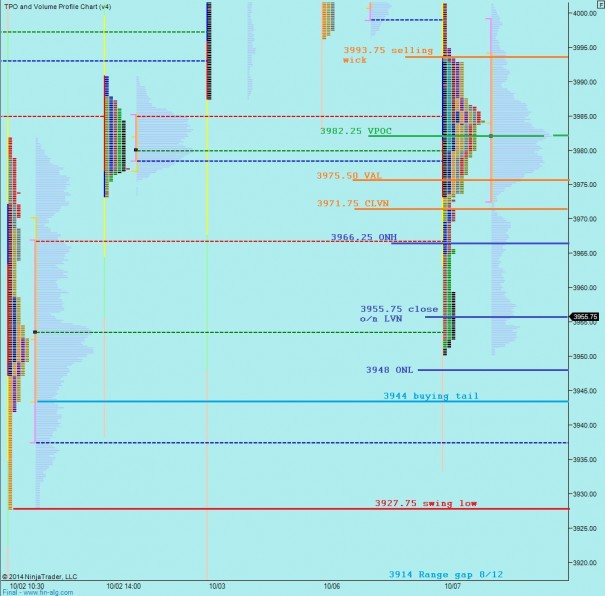

One might make the argument that the daily chart is neutral or even bullish, however there is no confusion on the intermediate term timeframe which is trend down seller controlled. Yesterday I suggested we needed to see something drastic to change that control. To clarify, an event would need to be drastic to alter the intermediate term control in one day. Something less drastic, perhaps lasting 5-6 trading days, could also serve to put this timeframe back into balance. In the market profile webinar I discussed how high volume nodes don’t make good entries. That is because often times we traverse the entire high volume region and test the other side of it before determining if it was an effective zone for turning price. That is what we are looking for today, as we test the low volume nodes on the other side, if it is in fact support. I have note the key price levels I will be observing on the seller controlled chart below:

Comments »