Nasdaq futures chopped about in an active session of trade overnight after yesterday printed a directional distribution-type day. The primary expectation after yesterday’s distribution is chop with a downward bias. The wildcard today comes in the afternoon, where the market will receive minutes from the September FOMC meeting.

Yesterday the market went neutral early. Prices wasted little time range extending higher in the morning and pressed into Friday’s range where we found responsive sellers who pressed us through the initial balance and out the other side. We were in a neutral print before noon. When buyers made a second attempt higher they could not and choppiness gave way to afternoon selling. The neutral extreme type print carries strong directional conviction by the sellers, second only to the trend day.

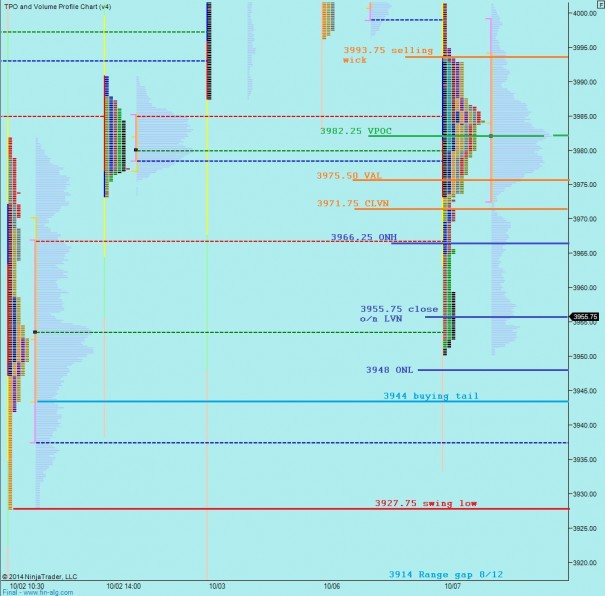

Below current prices we have the strong buyer reaction from last Thursday. Whether buyers carry the same conviction today will likely be tested. If not, then price is likely to continue discovering lower in an attempt to find a buyer. Below last Thursday’s low we might begin to explore the 8/12 price range where an open gap and naked VPOC exist. Have a look at the cumulative delta on the bottom of the chart as well which emphasizes the strength of the selling pressure yesterday. I have noted these prices and other observations on the following intermediate term volume profile:

I have noted the short term price levels I will be observing on the following market profile chart:

If you enjoy the content at iBankCoin, please follow us on Twitter

Primary hypo – sellers push lower off the open, take out yesterday LOD, and work down to ONL 3948 to test the 3944 buying tail where we find responsive buyers. If they cannot take price up above 3955.75 then continue testing lower to 3927.75 swing low and stretch target of range gap to 3914

Hypo 2 – buyers hold above ONL 3948 and press higher to test overnight high 3966.25 and CLVN 3971.75 where we find responsive sellers who work lower toward 3944 buying tail

Hypo 3 – drive out of yesterday’s range and head lower, take out swing low 3927.75 and target range gap to 3914 and full gap to 3904.5

what numbers are these corresponding to? Which security?

Always the Nasdaq front month contract, in this case the December contract

2

two sort of, more going into hypo 3, expecting us to start chopping soon, headed out for a 20 mile mind clear before FOMC fun, this market has no bid

cheers, enjoy

back in the YELP