Overnight volume in the Nasdaq futures slowed dramatically ahead of the 8:30am release of Non-farm Payrolls and Unemployment Rate and spent most of the session drifting higher. Prices managed to take out yesterday’s high and sustain trade above those levels ahead of the release. As one might expect, volumes increased after the 8:30am numbers which showed unemployment rate unexpectedly dropping to 5.9% but a mixed message overall with average pay still compressed. The initial reaction is higher prices. At 10:00am we have ISM Non-Manufacturing Composite on tap.

As we head into Friday, the intermediate term timeframe is in seller control. This can be seen as a sequence of lower highs and lows on the following chart. You might have noticed yesterday that there is only the blue volume composite on the right edge of the chart. That is because we have no micro-balance forming. Instead price is loose and discovering value. When the market trades lower it is searching for motivated buyers, yesterday’s strong responsive buy suggests we might be done looking for buyers, at least on the short term. Once they are found the auction begins in the opposite direction until buyers dry up and seller response exceeds demand. Since the bulls lack control on this timeframe, they are currently guilty until proven innocent by printing a higher low and higher high at the least. I have marked the key low volume nodes and a few other observations below:

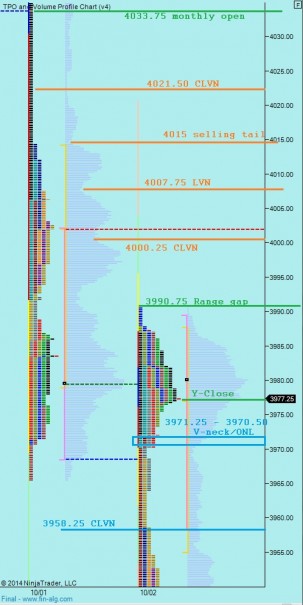

During the first three or four days of the month there is an expectation for increased demand in the marketplace. At this time, many of the institutional funds receive cash inflows from regular folks making fixed contributions to their 401k and other investment plans. There are studies proving this phenomenon. The question is how much funding is put to work and what is its impact on the marketplace. I have noted the key short term levels I will be observing on the following market profile chart:

If you enjoy the content at iBankCoin, please follow us on Twitter

Primary hypothesis – sellers at the open slide us down to 3990.75 range gap where we find buyers who are initiative in nature relative to yesterday’s value but responsive to the open. These buyers stall out around 4000.25 century mark opening to the door to a full gap fill down to 3997.25 and a test of V-neck at 3971.25. If buyers do not respond here then a continued move down to 3958.25

Hypo 2 – buyers reject an attempt back to yesterday’s range at 3990.75 and push up through LVN at 4007.75. Take out overnight high 4011.50 and target 4015 selling tail and possibly 4021.50 and stretch target 4033.75

hypo 3 – drive higher, opening out of yesterday’s range increases the risk of a drive

In at 3989.5 out at 4021. Damn near perfect hypothesis. Thank you sir. Hope you got some of the action as well.

nice work, indeud I did

Very timely story appeared on Wired today. The “Steamer Duck”…. has to be an omen of some sort…. http://www.wired.com/2014/10/absurd-creature-week-vicious-duck-beats-crap-anything-moves/

dude that duck is a pimp

added back share of RIG for the dividend port..seems way overdone here(?)

Dividend Yield (Annualized) 9.50%

Filled at $30.31

I am also resetting my Eddie Lampert trade(yeah..one of my old faves)

taking those shares just below 28 off the table(from the spin off of Lands End back on Feb 2014 which by the way are sitting at +119.14% $20.56 at the time of this post..still hold position)

I did add on most resent dip but did not post entry..sorry bout that.

will hold last ins SHLD

Acquired 09/25/2014 at 25 and pennies.

Huge spec..add back with END. why the h#ll not..(Gambool)

Jeezus, they have Whomped that one..

to think it hit 7.50 high in the 3rd week of Jan.

small position Filled at $0.1941

nice job if you were short..

paying back debt is a sonab!tch, alright!

Classic..

http://youtu.be/dDa1W9CE7L8

well now sh!t..better link here:

Nazareth ~Hair of the Dog

http://youtu.be/kyXz6eMCj2k

kickass

wow I can’t believe END has come this far low

Do you consider today’s action so far a strong rally?.Opening was great then it slowed down; i sense some pullback is coming to balance out for the rest of day. But given we’re nearly 2% higher from yesterday’s low, and are trading above the gap zone, it’s great. Guess i just expected something stronger. What’s your opinion?

pardon my late response, juggling a few plates today, my main takeaway is the responsive buyer yesterday was strong, and today’s initiative buyer completely rejected Thursday’s range. To me it looks like someone about soiled themselves at the sales they saw when they walked in the candy store and totally loaded up.