Interestingly enough, when we first traded up to 4000 in the Nasdaq futures back in August (at the time we were trading the September contract and the ‘spot’ was a bit different) the market gave the price no thought and simply pressed through it. Demand was high. Even more interesting is how the market is currently coming to terms with the millennial mark. As we approach US cash trade, price is straddling the 4000 handle after building support in the region during yesterday’s trade.

There were some fast selling rotations occurring overnight around the time the Swiss were releasing various economic data points, none of which were particularly soft. During today’s session look for a reaction to the UK’s GDP estimate around 10am. Aside from that we have some Fed speakers at 2:30pm, 3pm, and 4:30pm ahead of tomorrow afternoon’s FOMC minutes.

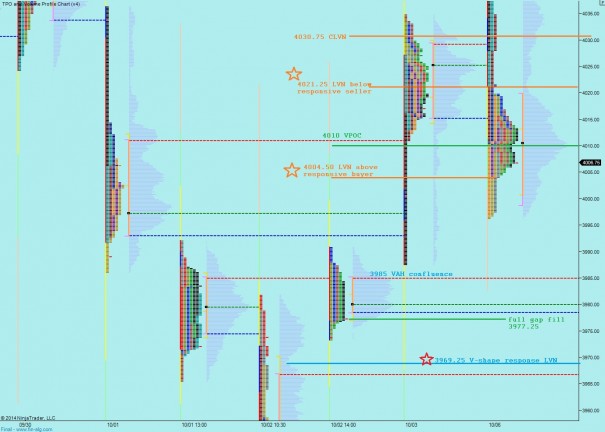

The intermediate term has a clear downward trend in tact as we enter Tuesday. This can be seen as a series of lower highs and lows. The most recent low was sharply rejected by a strong buyer response. However, it had to cut pretty deep to find a vein of buyers who were willing to participate. Buyers may be working on printing their first higher low since the failed auction on 09/19 this week. They did however leave a bit of unfinished business below. When we gapped higher on Friday price managed to close the range gap, or the space between the high of Thursday and the open on Friday. This increases the probability of a full gap fill to the closing print down at 3977.25. Should the market begin to soften at any point today, this will be a simple target for the sellers. I have highlighted this observation and others on the following volume profile chart:

Short term, we printed another distribution-type day where the bulk of volume occurred at or near the lower quadrant of the session range. This managed to push value lower. The buyers were active and responsive to defend Friday’s buying tail. This can be seen as the thin market profile near the bottom. Note however that the coinciding volume profile suggests much business was done near the lows. Overall, it provides us many interesting levels to observe and I have highlighted them below:

If you enjoy the content at iBankCoin, please follow us on Twitter

Primary hypothesis – responsive buyers off the open take price up to 4000 to test the millennial mark, press through to 4004.50 and target overnight gap fill to 4006.75 where we chop before targeting 4010 VPOC

Hypo 2 – sellers drive lower off open, take out thin profile down to overnight low 3983.25 and target full gap fill to 3977.25 where we find responsive buyers who give way to a test of 3969.25 where we find responsive buyers back up above 3985

Hypo 3 – sellers push lower on the open but stall before overnight low 3983.25 and responsive buyers work higher to target 4000, 4004.50, then VPOC/ONH 4010.25

It all started with a failed auction, again 🙂

hypo 2 then we found responsive buyers who pushed up through opening swing, now looking for gap fill to 4006.75 then test of VPOC at 4010

YELP stopped out