You won’t come to the Raul blog often and find my crying about wolves. I study the tape, like a psychopath stalker. Its nuances speak to me. We are waking up to a pro gap down this morning.

The overnight session managed to go second sigma range, something it has not done in quite some time. However, the volume behind the move was a bit less compelling. However there is still a half hour of globex to go.

The Greek situation is heating up in Europe where parties are growing frustrated with how much time is being wasted. Likely adding to European frustration is the quirky 3 week window where daylight savings throws them off with our time and markets. The economic calendar is otherwise quiet until tomorrow when we here about mortgage applications, oil inventories, and bank stress test results.

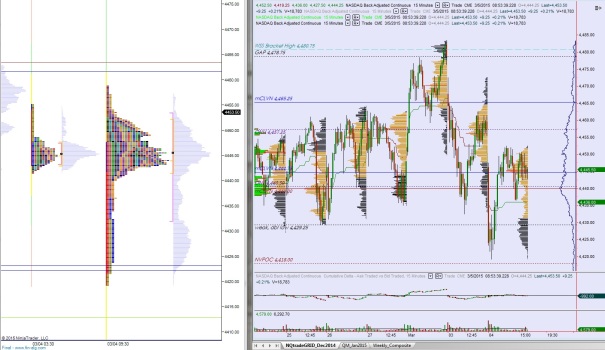

Yesterday we started the week quietly despite closing Friday out with a strong neutral extreme day. The up move in the Nasdaq occurred around 1pm and can be considered news driven, because it was closely associated with the Apple live event. However at the end of the session sellers began piling onto the bid.

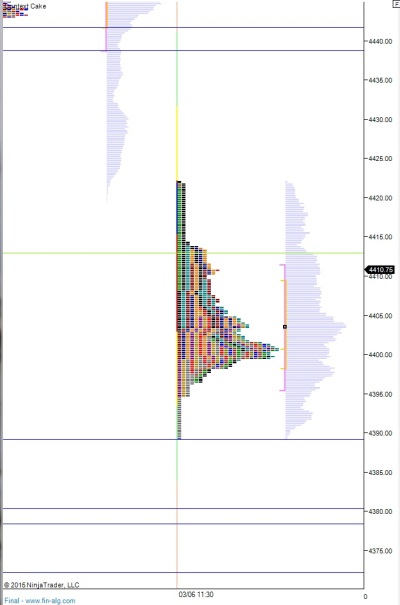

The overnight session managed to pushed down through the micro balance we formed from 2/16 to 2/18 before finding responsive buyers. This zone has a compelling VPOC at 4382 which we are currently priced to open upon.

Heading into today, my primary expectation is for an open auction outside range due to this VPOC. Look for 4372.25 and 4389.50 to contain price early on. Look for buyers to work the range gap up to 4391.75 before finding responsive sellers (responsive relative to the open, initiative relative to Monday) who step in and leg us lower to target the NVPOC at 4360. That would be a big day

Hypo 2 is we gap and go lower to target the NVPOC at 4360 then the gap down to 4345.75 to retest prior swing high 4343.25.

Hypo 3 is a strong responsive buy full gap fill to 4414.75. It has happened a few times in recent history and requires some serious resources to do so, hence the Pro Gap nomenclature.

Levels:

Comments »