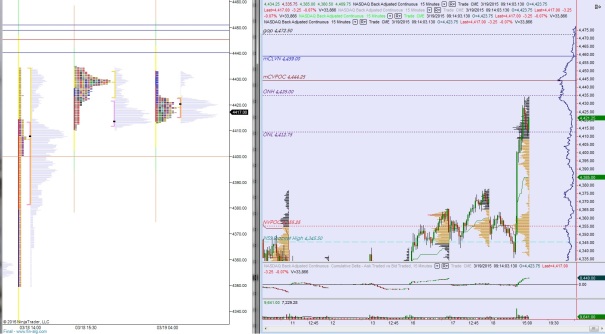

After the strong rally yesterday we have a benign market which is digesting the move via a sideways correction. Shorts working the range extension down were rewarded but only by 1.5 points before finding responsive buyers (responsive relative to the open, initiative relative to yesterday).

Despite the sellers winning the range extension battle, the best trades of the session have been from the outside-in. After a big up day markets tends to consolidate. On the surface, it makes sense to have a slight upward bias after yesterday’s neutral extreme print.

The hard part was buying what looked like an mid-day breakdown. Without a price level to lean on it’s not a simple trade to take. You could also do well shorting from the top-end of value as long as you managed risk when that push higher forced its way though most of the range.

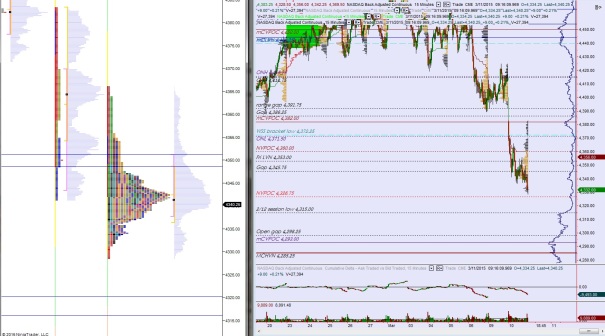

This is a strong version of hypo 2 from this morning’s report. Today could have been stronger had it featured a range extension up as opposed to down. Now bulls are playing for neutral at best.

The key is knowing the context of the session and trading accordingly. Today you were better off working the extremes and essentially playing ping pong. Having spent many days being the ping pong ball, I can tell you without doubt it is more enjoyable being the paddle, even if only on one side of the tape.

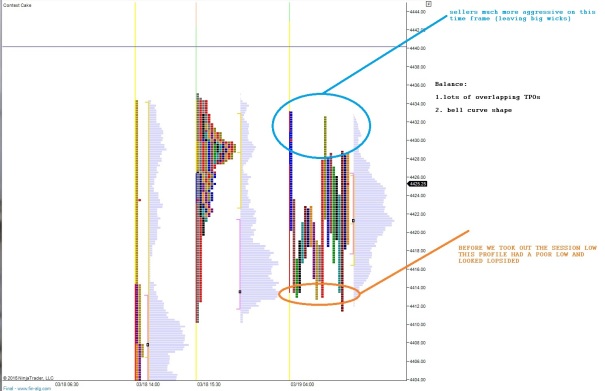

I wish I had a screen shot from earlier, but the Nasdaq market profile told the story for working the short side today, despite the higher-time frame context slightly favoring longs. Have a look at the current profile anyhow:

Comments »