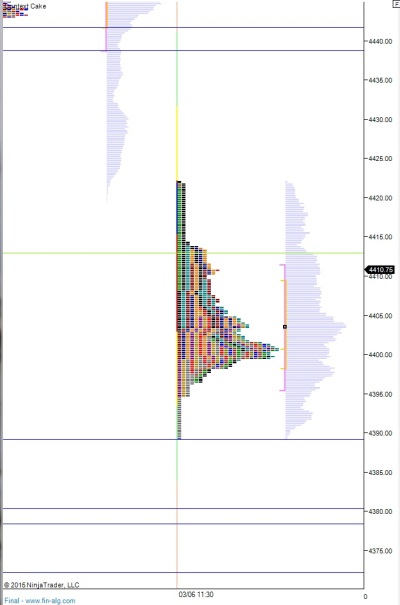

Nasdaq futures are indicating a gap up on the open after a session which mostly featured selling. In the wake of this normal range and volume session, participants left behind a somewhat weak looking low at 4396.25.

The economic calendar is quiet today so the market will be left to its natural discovery device with the exception of Greek news flow.

Looking at the bigger picture, the Nasdaq went on a strong rally which started early February around 4220. Part of the catalyst was news from Greece. Before this rally we spent several months in a 2-way grind. Here is an interesting look at the forest:

Last week we started March with a gap up and strength through Monday. The rest of the week was mixed action which ultimately gave way to selling on Friday. Buyers managed to step in ahead of the mini value area around 4380 last week. Heading into today that zone may behave like a magnet.

My primary expectation this morning is for sellers to work into the overnight inventory and press the gap closed to 4406. By doing so they assert their responsiveness and increase the likelihood we continue discovering lower prices. I will look for them to take out overnight low 4396.25 and target the discrete gap down at 4386.25.

Hypo 2 is sellers cannot close the overnight gap and strong buyers take back much of Friday’s selling starting with acceptance above 4414. Buyers will look to target the low end of the value zone above at 4436.

Hypo 3 is we fill the overnight gap down to 4406 and then revert to quiet, two-way trade.

The short term levels I will be operating from are highlighted below:

If you enjoy the content at iBankCoin, please follow us on Twitter

Hypo 3 so far, no range extension yet, stats stacked up against the buyers but they’re holding up ok