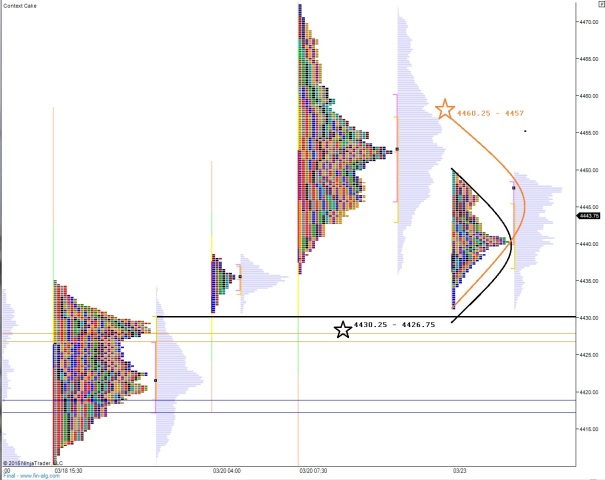

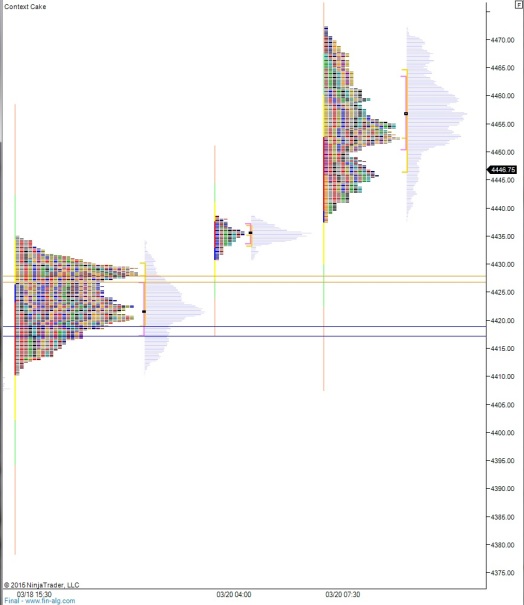

This morning promises to be a choppy one. After a sedentary session yesterday, price and value have settled into a stable pocket with a well-established distribution both above and below our current area. Please, see more clearly what I mean below where I have marked the key reference points and a two visual hypotheses:

Adding tinder to the potential for a choppy open is the sexy world of economic releases. CPI (Feb, YoY) was out at 8:30am and firmed up more than expected leading to rate hike talk. Price initial pushed lower by has since gone unchanged off the data. Several more data will spatter out this morning including House Price Index at 9am, Markit Manufacturing PMI at 9:45am, and New Home Sales at 10am.

Heading into today, my primary hypo is sellers work down into overnight inventory and take out overnight low 4431.25 and do their best to fill the gap down to 4424.50 and target the NVPOC at 4422.25 before finding responsive buyers.

Hypo 2 is buyers defend around 4438.50 (overnight gap fill) and push up through overnight high 4449.75 and continue on to work the value area high of the upper distribution around 4457-4460.

Hypo 3 is a strong drive higher up through VAH 4460 and a gap fill up to 4472.50.

Levels highlighted below:

Comments »