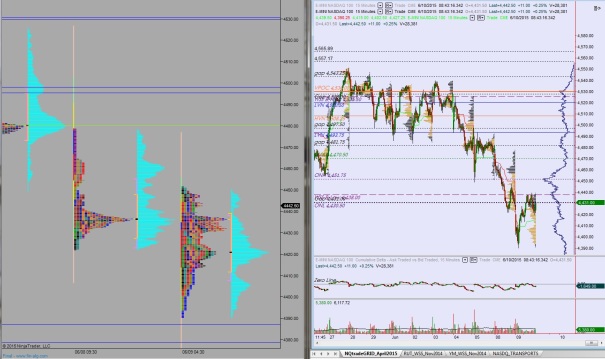

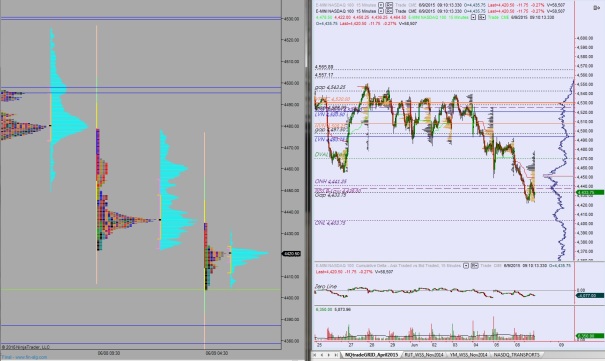

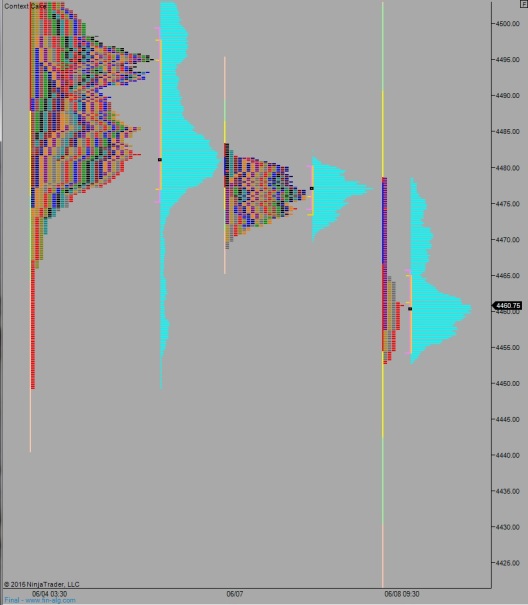

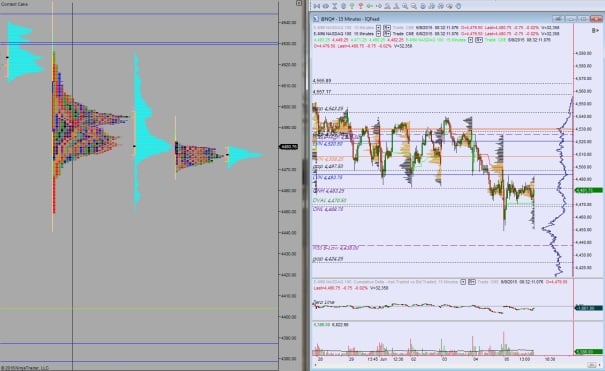

My expectation heading into the week was for volatility to be low in the beginning of the week. And while most other indices saw volatility decrease, the Nasdaq has been ripping around, especially overnight.

However volatility receded during this morning’s globex session, and we’re heading into cash open with a normal range and volume overnight session in tote.

This is a slow week for economic events, but the pace will pick up a bit on the tail end of the week. At 7am we had MBA Mortgage Applications, at 10:30am Crude/Gas Inventories, and at 2pm we have a Monthly Budget Statement. Tomorrow morning BMO we have Advanced Retail Sales.

Yesterday we printed a neutral day, and nearly a neutral extreme day. The variation that qualifies a neutral day as extreme, at least in my unwritten book, is closing in the upper quadrant of the day’s range. Neutral days feature a range extension on both sides of the initial balance and tend to occur at-or-near inflection points. The session also printed a healthy-looking excess low that may stick for the remainder of the week.

Heading into today, my primary expectation is for seller to push into the overnight inventory and close the gap to 4431. From here, it’s not a big distance to take out the overnight low 4430.50. Look for responsive buyers at 4411.50-4407.50 and two way trade to ensue, south of ONH 4451.75.

Hypo 2 buyers gap-and-go higher, instantly leaving unfinished business in their wake, to take out overnight high 4451.75 and continue exploring higher to target 4480.

Hypo 3 sellers push down through 4407.75 setting up a test of yesterday’s low. Look for responsive buyers from 4387.25 – 4379.

Levels:

Comments »