What a fantastically well day to be long the stock market, fine chaps. Chip, chap-a-rue! Looking at all of the indicators on the indices, and the profile development, you may have thought we would see some weakness today. Certainly the extended nature of the markets as we entered a new month could raise concern. However, the stock gods (no Buffet) would not have any part in a red Monday in March. As a matter of fact, they saw fit to make it a rather green day for all the leprechauns peering at the sunrise.

Speaking of sunrise, did you catch my morning thoughts? I’m sure most of you didn’t and that’s super great news. I’m really not sure why I share such sage knowledge with you untidy troglodytes. You’re better off being shown how to maintain proper hygiene, for instance, more than you should be taught anything else. Anyhow, if you missed it, the plan was to cut long exposure if we traded south of 1509 on the S&P March future contract. We didn’t, so I didn’t. Actually, let’s look at what I did today.

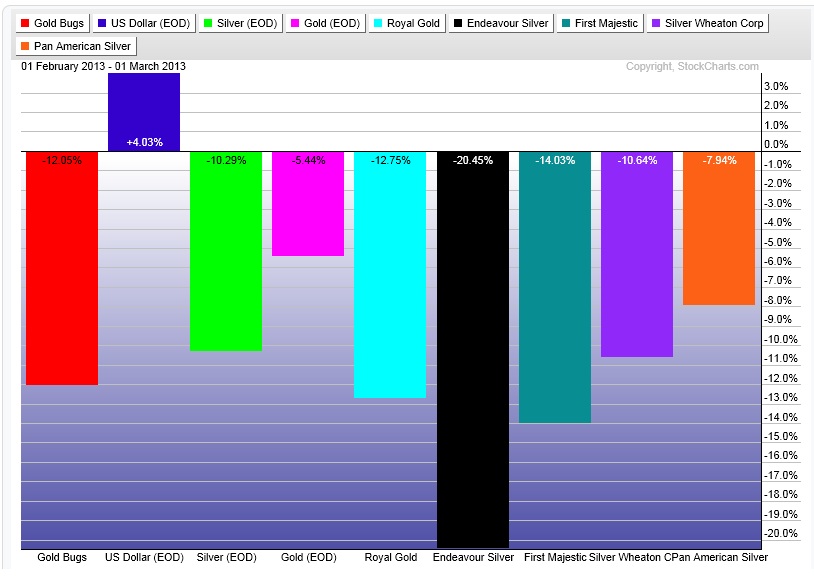

Bought and sold RGLD, losing a dollar per share but nothing more

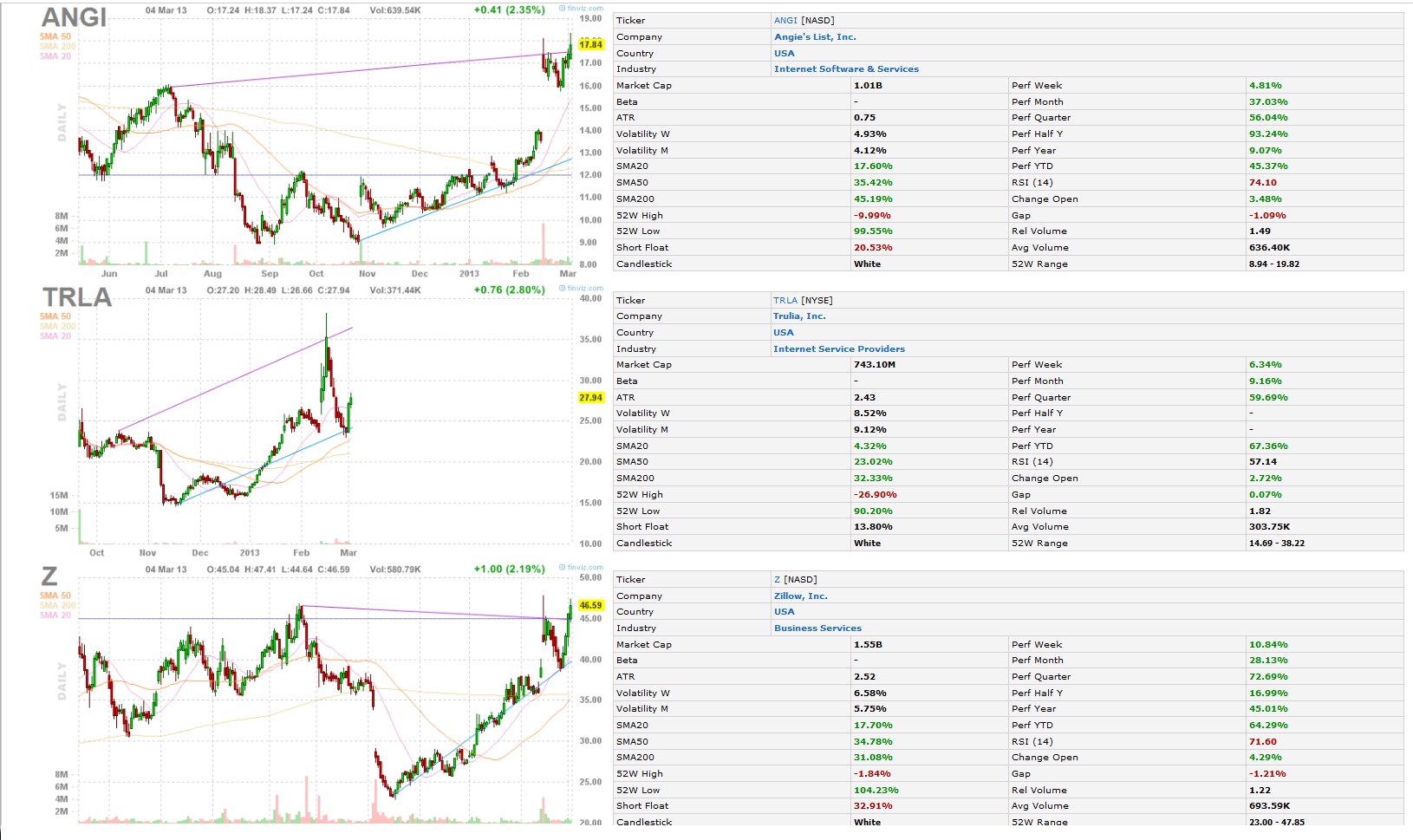

Bought some TRLA around 11am

Scaled some profits in ANGI amidst the HOD spike #flawless execution

Scaled some profits in ZNGA but retain a ½ position #readyformore

Bought CCJ down here on deal, per Premier Obama electing a #nuclear czar

Scaled some profits off on RH, the stock I bought near the LOD on Friday, easy five banger

I must say, all of that action was rather rewarding but at the same time left me parched. Much water had to be consumed. I walked to a cool river and drank side-by-side with a grizzly bear. I noticed he caught a fish, a very tempered fish. I slapped said fish from his mouth, setting it free into the river. Then I mounted his fat body and demanded he become my transportation. His stupid-harry head hung in shame as I rode him back to my trading terminal. It was a good Monday.

Comments »