You can ‘get by’ being mediocre. You may even be so lucky as to afford the occasional weekend vacation from your modest suburban home. Your children can attend mediocre schools and earn mediocre grades in spelling and mathematics. You can buy a dog off craigslist and admire its scruffiness and lack of AKC certification.

You might even set up a horseshoe pit to occupy your red necked relatives while you barbeque hotdogs. Fun times will be had by all.

I’ve traded mediocre all day, when I should be trading like Chief Keef, if that makes sense. Sure, I’m long, with about 50 percent of my book. Yes, I took two planned trades today in the futures, that earned chicken and beer money. But where’s the tenacity? Where’s the gumption?

I’ll stop speaking to my own subconscious now and address you, good people of iBankCoin. I traded like a little baby today, hiding under my sheets from the risk reaper.

Buying END yesterday was so perfect. I sized the position perfect: 10 percent of my book. The light and sweet ripped overnight, so I woke up like, “now these shorts can’t leave.” Yet I SOLD 2/3 of my long below $4.50, for what? I don’t know! I wasn’t getting my fix fast enough. I should have been scaling off right here, at 4.67, earning me more meat before trimming down to a runner. The trade has tacked 50 basis points onto my YTD return already, but it could have easily tacked on 100. I’m keeping my runner and aggressively hunting out more oil opportunities.

My second $ES_F trade I played along inside The Pelican Room, it fruited early and I earned my first scale, 1.25 points. Already being a puss, I nudged my first scale in a tick. Don’t ask why? Because I don’t know except the market paused for like 30 seconds. Then I sat through the lunch hour baby sitting my final contract. I started thinking the upside progress would clunk out so I raised my stop a few ticks above the logical support. You can guess what happened next: the market stopped me out to the tick then went One Direction, up, for four handles. That was my pay day.

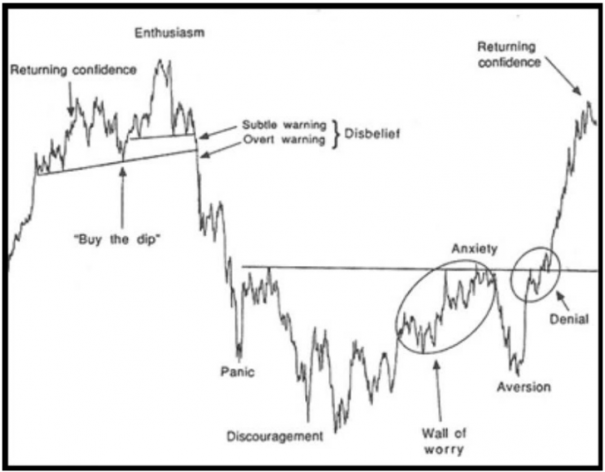

I feel really confident about my trading right now. I’m so close to making a breakthrough, closer than most of you will ever be. Perhaps you’re this close too or at least you have been, but just at this moment your willpower fails you and you give up. That must be what happens, why 90% of traders fail, because they give up when they’re so god damned close.

RISE UP MOTHA FUCKAS!

I’m close

Comments »