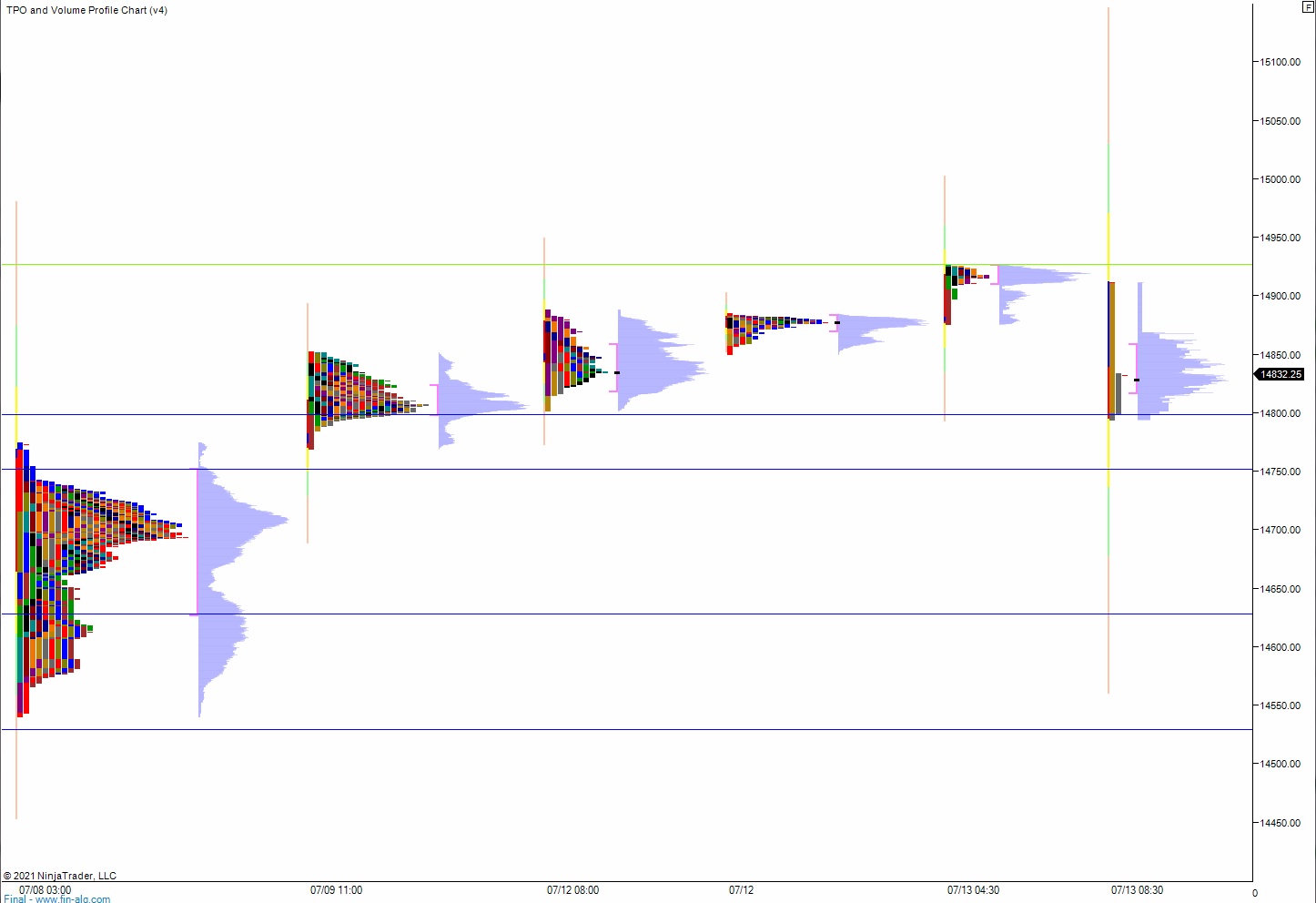

NADSAQ futures are lower by about -70 as we make our way to the opening bell after an overnight session featuring extreme range and volume. Price worked higher overnight, pressing to a new record high and sustaining the gains until 8:30am when CPI data came out higher than consensus range. In the moments after the print price fell -80 and has continued to move lower since, off more than -120 from the high. As we approach cash open price is bouncing along the Monday lows.

Also on the economic calendar today we have a 52-week T-bill auction at 11:30am, 30-year bond auction at 1pm and a Treasury Statement at 2pm.

Yesterday we printed a normal day which is anything but. Normal days only print about 20% of the time. The day began with a gap up beyond the Friday high, nearly at all-time high but not quite. Sellers drove lower off the open, successfully campaigning the gap fill and taking out overnight low by a few ticks all within the first 45 minutes. Then responsive buyers stepped in and worked price back to the daily mid. Sellers defended for several hours, and we chopped until about 2pm New York on the bottom-side of the mid before ramping higher into the bell. We never made a range extension however.

Heading into today my primary expectation is for buyers to work into this CPI reaction, working price higher to close the overnight gap 14,880 then continuing higher, up through overnight high 14.927.50. Look for sellers up at 14,948.50 and for two way trade to ensue.

Hypo 2 stronger buyers take out 14,948.50 and sustain trade above it setting up a run to 15k.

Hypo 3 sellers press down through overnight low 14,814 setting up a quick move down to 14,751.75.

Levels:

Volume profiles, gaps and measured moves: