When I hear the dang boomers say, “it’s not a profit until you book it,” a dark part of me wants to make to kill.

We really made strides these last few years towards dismantling nationalism, nation-states and the whole concept of lines on a map. Big tech was blessed with giga-valuations, and checks being mailed out to every american simply for existing called fiat into question for real.

The old tiger (U.S. dollar reserve currency) sensed its last fight and went to battle systematically dismantling all this hubris.

Most stock charts have erased any progress made during that mysterious grey time that was 2021, back when we were in lockdown but weren’t in lockdown? When two jabs gave a chap freedom to go into a small hot room with a bunch of women and mouth breathe, but it was frowned upon by the weak immune systems of the american gen pop.

The truth is, we can now see, clear as a liberty bell, that those 2021 advances were fake. Anyone who cashed out during that time can now see that they were in fact a champion.

My google pixel pops up photo memories and this time last year I was putting the finishing touches on that bastard kitchen. That project was funded by the dang speculative markets, and I hated all those trips to the tile store and ikea and Lowes because I wanted those dollars to stay in the speculative markets.

In hindsight, of course, I am grateful. Because I built that super gay kitchen to stand the test of time. I no longer have to prepare meals on a busted ass stove or plate food on green Formica or worsh ma giant stock pot in a little baby sink. Would that 40-or-so thousand fiat american dollars bought some bored apes and become 400-or-so fiat dollars? Or would it have stayed in Tesla and doge for the great dismantling?

We dunno.

The great bull run of the last five-or-ten years was my second major economic cycle, and I was operating on hard learned lessons from the prior one, that my degeneracy would always lead to me pressing risk so I’d better convert some gains into something else because too much liquidity in my purse ends up being taken away by the citadel.

I guess this entry is a gratitude post for being somewhat in the right state of mind last year. I’m grateful for a clean kitchen and a new chunk of earth to grow corn upon. I turned into a real menace towards the end of the cycle. Putting my hair in braids and accosting Goldman Sachs bankers via Twitter. And of course I regret making my already too big TWTR position even bigger towards the end of ’21. But next cycle I shall do better. I’ll probably have a complete grey beard by then but those greys are wisdom yes?

I’ve been made to be humbled once a gain by market mechanisms, and I have no choice but to dig in for another few hard years of chopping wood.

It’s feast and famine at the House of Raul [HoR] always has been. Not sure if I’d enjoy life any other way.

I was out late last night, amongst the people, listening to loud house musics and chewing mushrooms, and I couldn’t help but appreciate how pretty dang decent Detroit’s trajectory seems to be.

A storm is coming and us post industrial wasteland folk have the infrastructure to thrive during it. Ten foot fences. Steel plate shutters. Walled gardens.

So maybe we just savor the sights and sounds of boomers and their chaos. The Ray Dalio’s of the world and their chronic paranoia.

A car might be the hardest thing in the world to build.

Raul Santos, May 22nd 2022

And now the 387th edition of Strategy Session. Enjoy.

Stocklabs Strategy Session: 05/23/22 – 05/27/22

I. Executive Summary

Raul’s bias score 2.65, medium bear. Buyers follow through on their late-Friday buying into the new week. Then watch for FOMC minutes out Wednesday afternoon to dictate direction into the second half of the week.

Major semiconductor NVIDIA is set to report earnings Wednesday after the bell.

II. RECAP OF THE ACTION

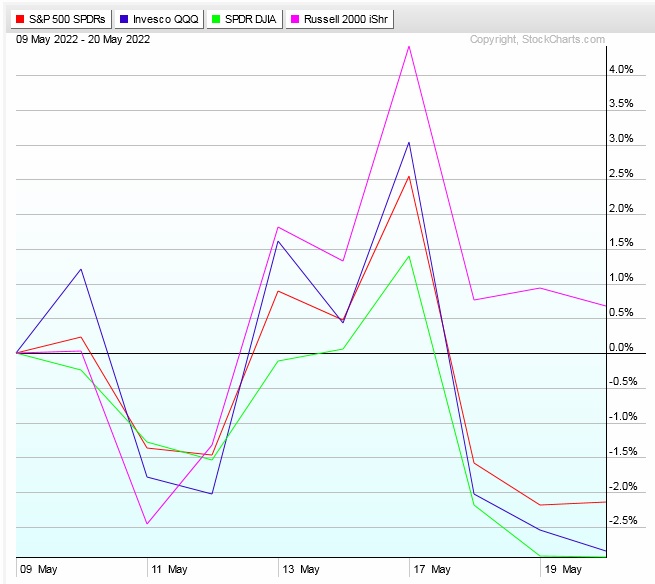

Bit of a rally through Tuesday then heavy selling came in and sent price down through last week’s lows on all indices except the Russell, which was bullish divergent. Then we had a moderately strong ramp rally into Friday close.

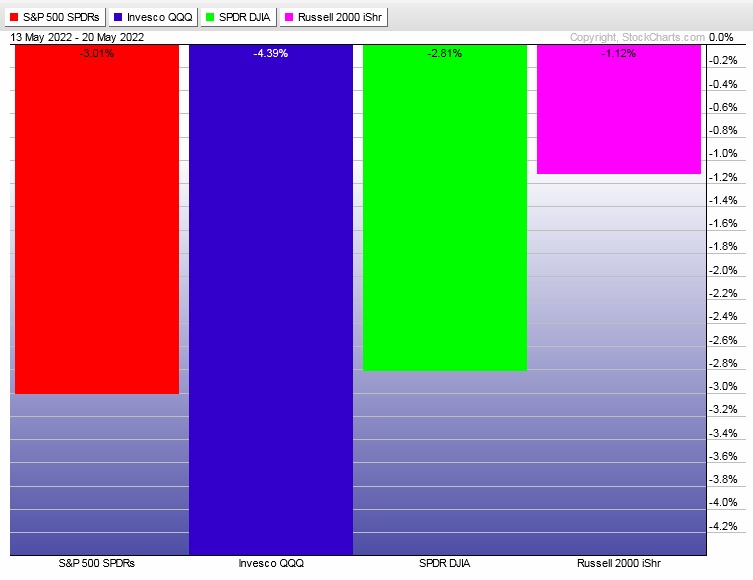

The last week performance of each major index is shown below:

Rotational Report:

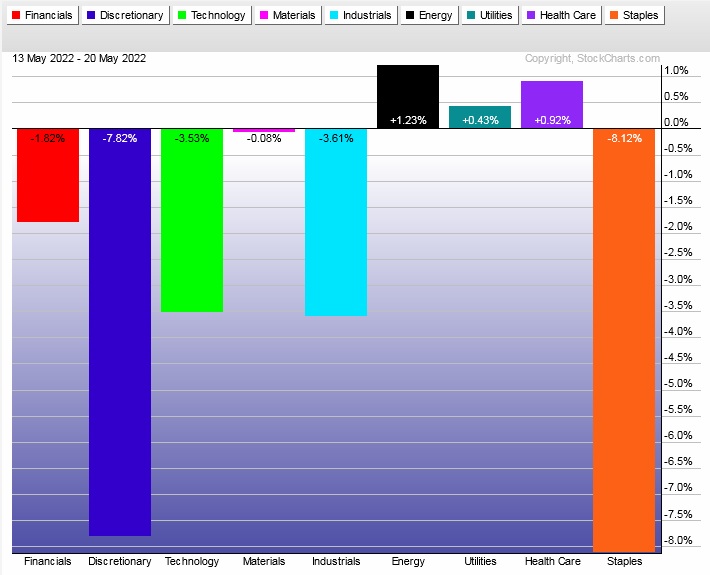

Wall Street punished share prices of several major retailers last week after they reported earnings and that is reflected in sector rotations which saw Staples and Discretionary heavily rotated away from. Meanwhile Utilities and Healthcare were positive on the week. Energy continues to trade independent of the overall market.

bearish

For the week, the performance of each sector can be seen below:

Concentrated Money Flows:

Bulls took back control of money flows ten weeks back after sixteen weeks dominated by sellers, dating back to mid-November.

But then seven weeks ago sellers negated that control.

The ledger once again skewed to the negative side, but not to as extreme a degree as the prior two weeks.

neutral

Here are this week’s results:

III. Stocklabs ACADEMY

Hybrid Change %

While both IndexModel and Stocklabs oversold signals have been having a rough go at this tape recently, both being in a draw down phase of their statistics, the Hybrid Change % has been a bit more reliable.

I use this daily reading to assess who is in control of the tape intermediate term. It has flip flopped a bit these last few days, but before then if you flip through the data the biggest absolute readings have been to the downside. This data point has done a decent job of staying on the dominant side of the tape.

Note: The next two sections are auction theory.

What is The Market Trying To Do?

Week ended searching for sellers.

IV. THE WEEK AHEAD

What is The Market Likely To Do from Here?

Weekly forecast:

Buyers follow through on their late-Friday buying into the new week. Then watch for FOMC minutes out Wednesday afternoon to dictate direction into the second half of the week.

Bias Book:

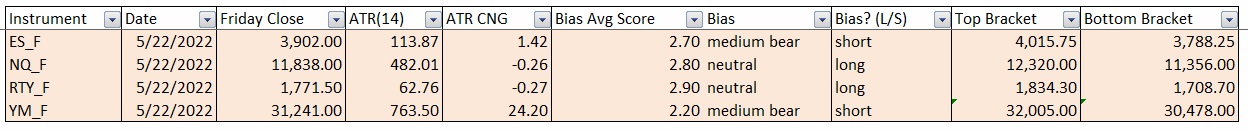

Here are the bias trades and price levels for this week:

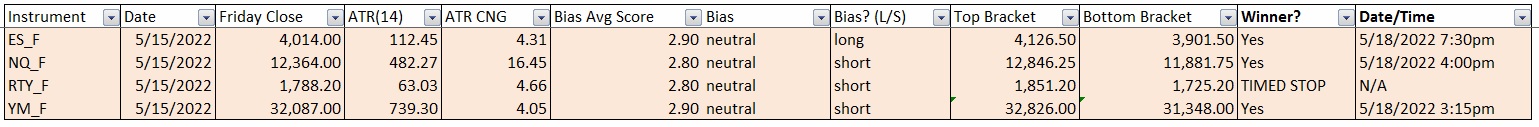

Here are last week’s bias trade results:

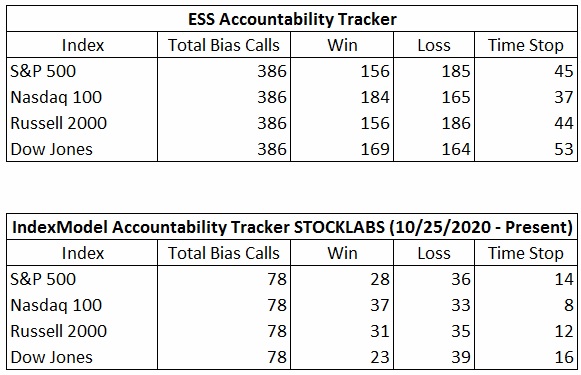

Bias Book Performance [11/17/2014-Present]:

Down channels and other migrations

Markets fluctuate between two states—balance and discovery. Discovery is an explosive directional move and can last for months. In theory, the longer the compression leading up to a break in balance, the more order flow energy to push the discovery phase.

Market are most often in balance.

Every week this newsletter uses auction theory to monitor three instruments, the Nasdaq Transportation Index, PHLX Semiconductor Index and ethereum. Readers are encouraged to apply these techniques to all markets.

Transports accelerated to the downside last week, and the downward channel remains in place. Discovery down.

See below:

Semiconductors could be in the process of accepting a new range here, which lines up with the 2021 lows. Had to say, but maybe this index is accepting value around here, a few tiers off all-time highs but still a long way up.

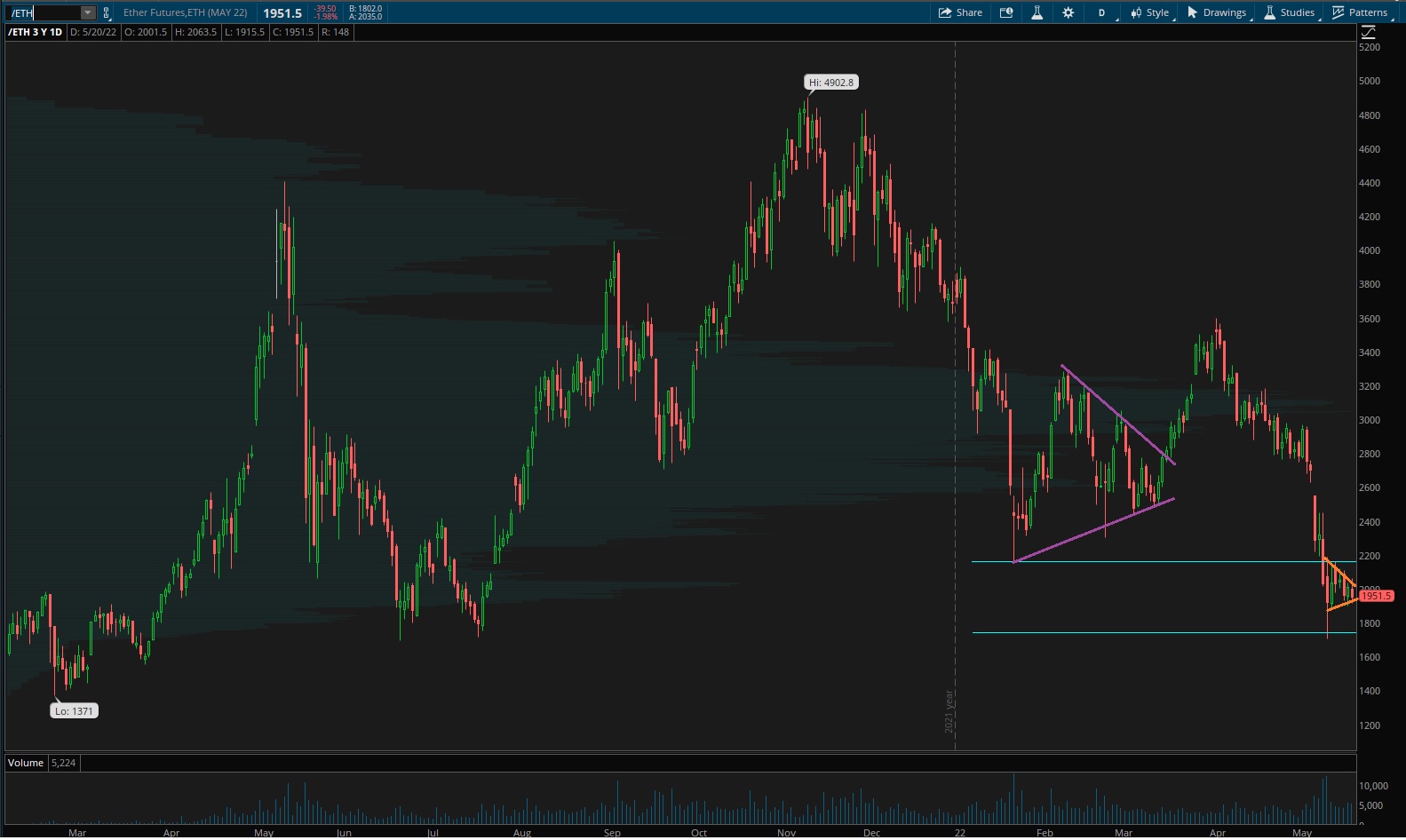

Ether is quite messy. We can see a recent attempt at balance here, which sort of resembles a bear flag. These type of obvious technical patterns rarely resolve the way technical analysis books say they will. But we could see an attempt down-and-away from the flag. How that is received will tell a story.

V. INDEX MODEL

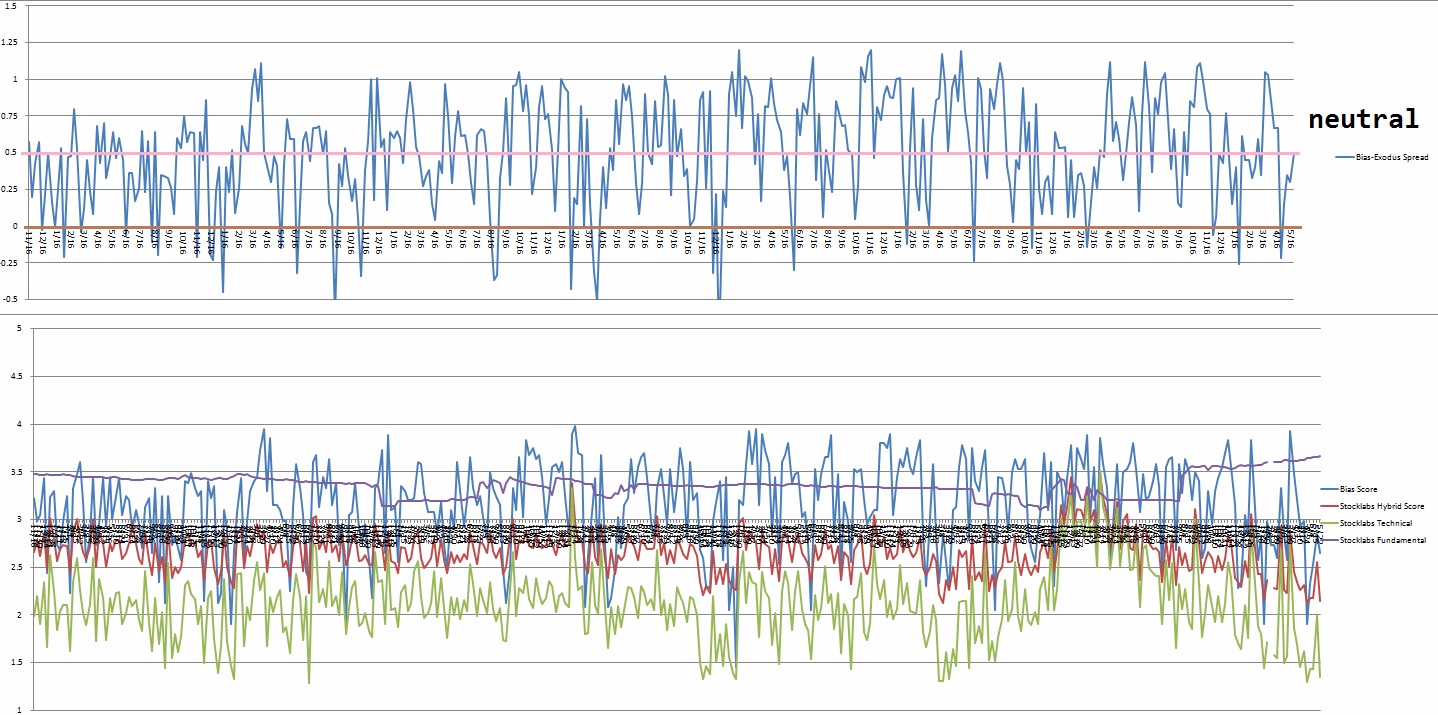

Bias model is neutral for a fourth consecutive week after going Bunker Buster four weeks back after three consecutive rose colored sunglasses bearish signals after two consecutive weeks of extreme RCS bullishness.

We’ve had three Bunker Busters in recent history, four weeks ago, seventeen reports back and a third twenty-five reports back. The Bunker Buster before these recent three was sixty-three weeks ago.

Here is the current spread:

VI. 12-month Technical Oversold

On Monday, May 9th Stocklabs signaled hybrid oversold on the 12-month algo. This is a 10-day bullish cycle that runs through Monday, May 23rd end-of-day. Here is the performance of each major index so far:

VII. QUOTE OF THE WEEK:

“And why should we feel anger at the world? As if the world would notice.” – Euripides

Trade simple, willing to accept the news and noise

If you enjoy the content at iBankCoin, please follow us on Twitter

Nice. But $40K for a kitchen … a fag kitchen at that … sheesh … and even now it’s no doubt more. I WAS thinking of it …

kitchen rennos can really spiral out of control because once you’re in it you want to do it right so you don’t have to do it again

then it looks all badass and the appliances suddenly look ghetto so you gotta replace them

but I mean, it can be bootstrapped and done more modestly