Last week and the weekend were really something. Around Tuesday I kept saying that I, “struck the blarney stone,” which makes no sense. One kisses the blarney stone, and upon kissing it is mystically endowed with eloquence and persuasiveness.

In my brain I think I was making a Moses reference, when he was supposed to talk the rock into giving his people water but he bashed it with a stick instead and it gave water righty-o but then he had to roam the desert for like idk 20 years. But I was instilling it with some Irish luck, because I pushed my agenda on some fine folks and they responded kindly and my projects finally caught some traction. Around Tuesday.

Anyhow, then doge went bananas and sort of sent me for a spin after making quite the impression on my net worth. Suddenly, the doge I hold is catching up to the fiat american value of my dear TSLA position.

But in reality nothing has changed. I still wear 18 dollar Unionbay joggers every day with beat up vibram barefoot shoes that look like rags but make my old hips feel okay, and at night I either eat giant plates of sauteed vegetable or Del Taco drive thru all whist drinking cheap hooch.

I am reading The White Album by Joan Didion right now and it is the finest non-fiction I’ve read since the pandemic began. I want to share an exerpt from the chapter titled In Hollywood because it resonated with my speculative work and odd mentality of late:

“The place makes everyone a gambler. Its spirit is speedy, obsessive, immaterial. The action itself is the art form, and is described in aesthetic terms: “A very imaginative deal,” they say, or, “He write the most creative deals in business.” There is in Hollywood, as in all cultures in which gambling is the central activity, a lowered sexual energy, an inability to devote more than token attention to the preoccupations of the society outside. The action is everything, more consuming than sex, more immediate than politics; more important always than the acquisition of money, which is never, for the gambler, the true point of the exercise.”

I talk on the telephone to an agent, who tells me that he has on his desk a check made out to a client for $1,275,000, the client’s share of first profits on a picture now in release. Last week, in someone’s office, I was shown another such check, this one made out for $4,850,000. Every year there are a few such checks around town. An agent will speak of such a check as being, “on my desk,” or “on Guy McElwaine’s desk,” as if the exact physical location lent the piece of paper its credibility. One year they might be the Midnight Cowboy and Butch Cassidy checks, another year the Love Story and Godfather checks.

In a curious way these checks are not “real,” not real money in the sense that a check for a thousand dollars can be real money; no one “needs” $4,850,000, nor is it really disposable income. It is instead the unexpected payoff on a dice rolled a year or two before, and its reality is altered not only by the time lapse but by the fact that no one ever counted on the payoff. A four-million-dollar windfall has the aspect only of Monopoly money, but the actual pieces of paper which bear such figures have, in the community, a totemic significance. They are totems of the action…”

I think I need to get outside more man. I need to regain a pure sense of why I take to the speculative markets, day-and-day, methodically extracting fiat american dollars from the global financial complex. I know I’ve reiterated my purpose here a hundred times (land, cement, greenhouses, solar, etc) but I need to feel it viscerally, down in my plumbs for real. All this mouse click money has me a bit out of touch. I deserve to be successful and consistent. I work hard. I just want to make sure I remember the purpose.

Raul Santos, April 18th 2021

And now the 334th edition of Strategy Session. Enjoy:

Stocklabs Strategy Session: 04/19/21 – 04/23/21

I. Executive Summary

Raul’s bias score 3.80, medium bull*. Sideways drift, perhaps with slight upward bias. Then look for Intel earnings Thursday after-market-close to put direction into the tape heading into the weekend.

*IndexModel flagged extreme Rose Colored Sunglasses bullish bias, see Sections III and IV.

II. RECAP OF THE ACTION

Choppy Monday. Rally Tuesday. Afternoon sellers Wedneday. Strong rally into the weekend. NASDAQ lagged a bit.

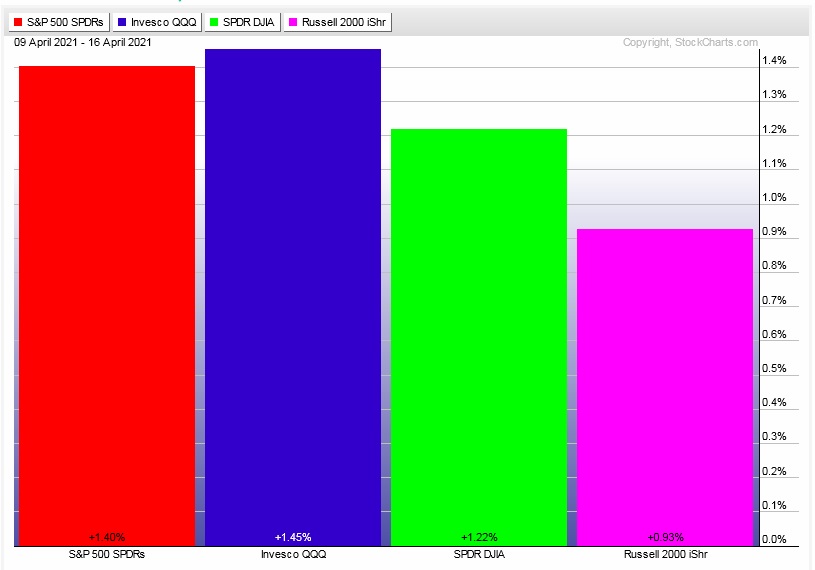

The last week performance of each major index is shown below:

Rotational Report:

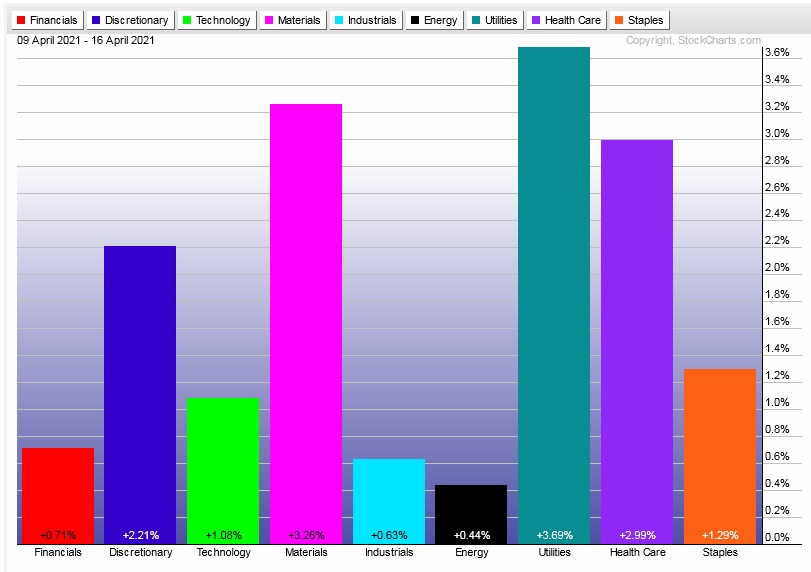

After two solid weeks of sector rotations, with quality tech and discretionary leadership, the lowest quality sectors (utilities, staples, healthcare) were out front last week. Discretionary did manage to flank them.

neutral.

For the week, the performance of each sector can be seen below:

Concentrated Money Flows:

Six weeks back we had major buy flows. Three weeks back we saw follow through on them. Then we had two big money flow pushes to the buy side. Two weeks back was balanced.

Last week skewed slightly negative.

Median return last week was over +75 basis points and volume delta over the last 30 days remains quite negative (-41%).

No word yet on having 1-week volume delta added to the screener.

Money flows are neutral.

Here are this week’s results:

III. Stocklabs ACADEMY

Extreme Rose Colored Sunglasses

When IndexModel logs a bias spread greater than +1 that tends to be a bullish signal. The beginning of the week has 50/50 odds directionally, but the later we go into the week the more the bullish statistics kick in.

Note: The next two sections are auction theory.

What is The Market Trying To Do?

Week ended searching for sellers.

IV. THE WEEK AHEAD

What is The Market Likely To Do from Here?

Weekly forecast:

Sideways drift, perhaps with slight upward bias. Then look for Intel earnings Thursday after-market-close to put direction into the tape heading into the weekend.

Bias Book:

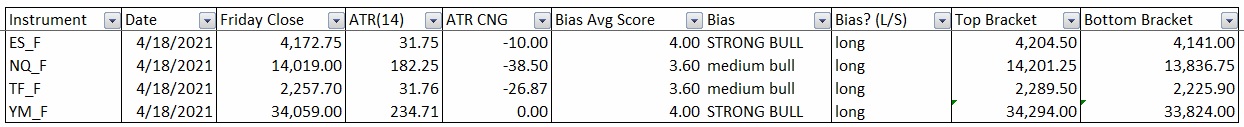

Here are the bias trades and price levels for this week:

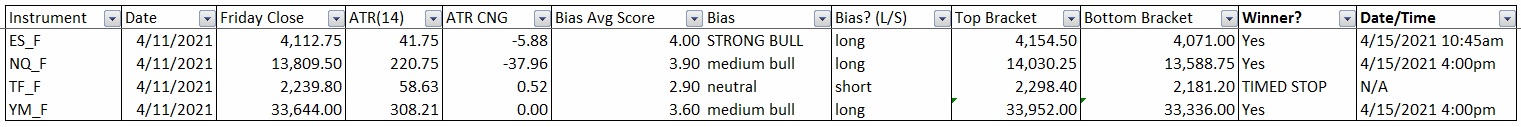

Here are last week’s bias trade results:

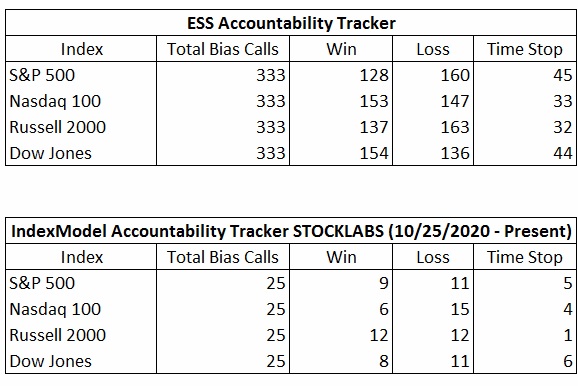

Bias Book Performance [11/17/2014-Present]:

Semiconductors still flag along the highs, likelihood of more discovery up increases

Markets fluctuate between two states—balance and discovery. Discovery is an explosive directional move and can last for months. In theory, the longer the compression leading up to a break, the more order flow energy to push the discovery phase.

We are monitoring two instruments, the Nasdaq Transportation Index and the PHLX Semiconductor Index.

Transports are maybe coming into balance. Long term discovery up remains in tact.

See below:

Semiconductors still flagging along the highs. The longer they can hold these highs the more bullish it becomes. This industry group is becoming the highlight of policy lately, and is therefore subject to elevated geopolitical risk going forward.

See below:

V. INDEX MODEL

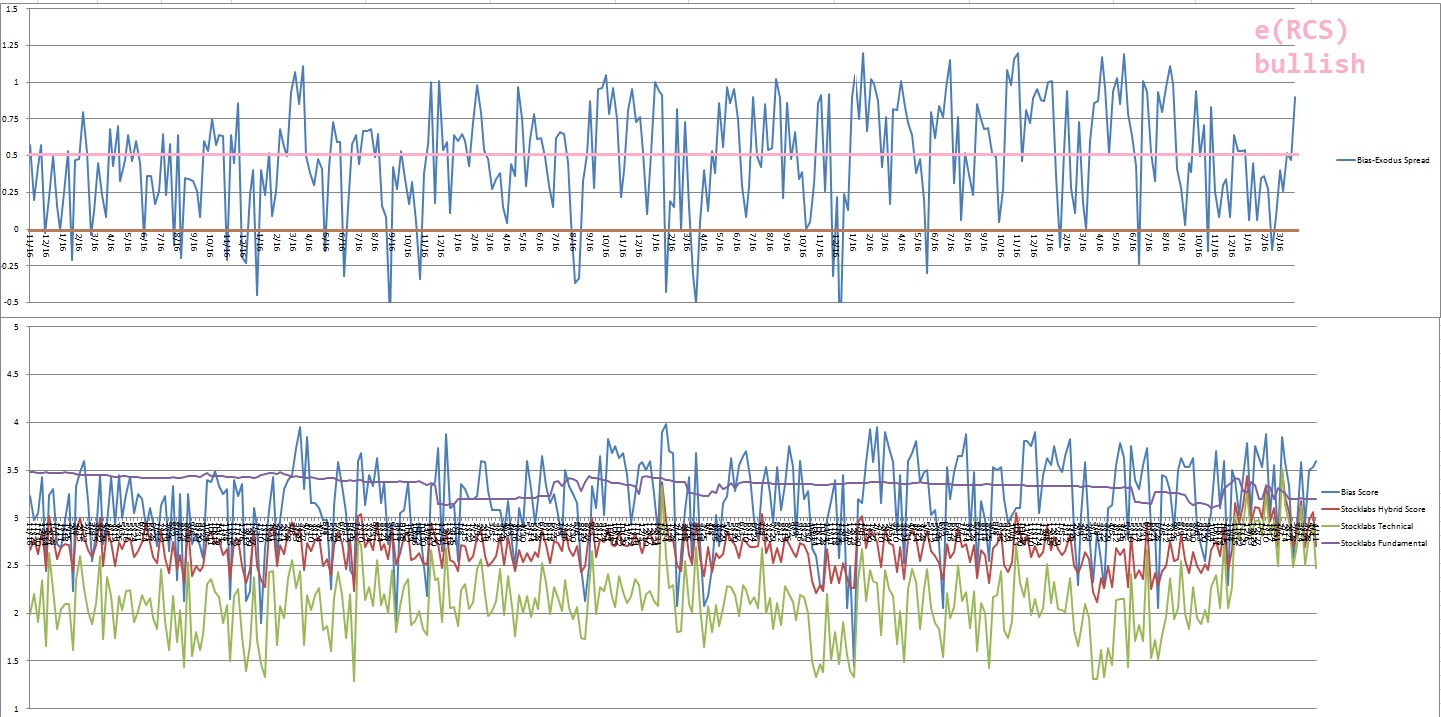

Bias model is flagging extreme rose colored sunglasses for a second consecutive week after being neutral Two weeks back and having flagged extreme Rose Colored Sunglasses three weeks back after being neutral four weeks before that after signaling Bunker Buster seven weeks ago after being neutral for the thirteen weeks prior to that.

Extreme Rose Colored Sunglasses calls for a calm sideways drift, perhaps with a slight upward bias. With a bias spread over +1 we expect buyers to pressure the tape higher late into the week.

Here is the current spread:

VI. QUOTE OF THE WEEK:

“If you quit once it becomes a habit. Never quit.” Michael Jordan

Trade simple, dedication

If you enjoy the content at iBankCoin, please follow us on Twitter

Thanks for posting the WSS, Raul.

you’re welco