NASDAQ futures are coming into Thursday pro gap up after an overnight session featuring elevated range and volume. Price worked higher overnight, rising to a new record high. At 8:30am housing permits/starts came out stronger than expected and jobless claims data slightly worse than expected. No real sign of sellers yet, and as we approach cash open, price is hovering up beyond any prior range.

Also on the economic calendar today we have 4- and 8-week T-bill auctions at 11:30am.

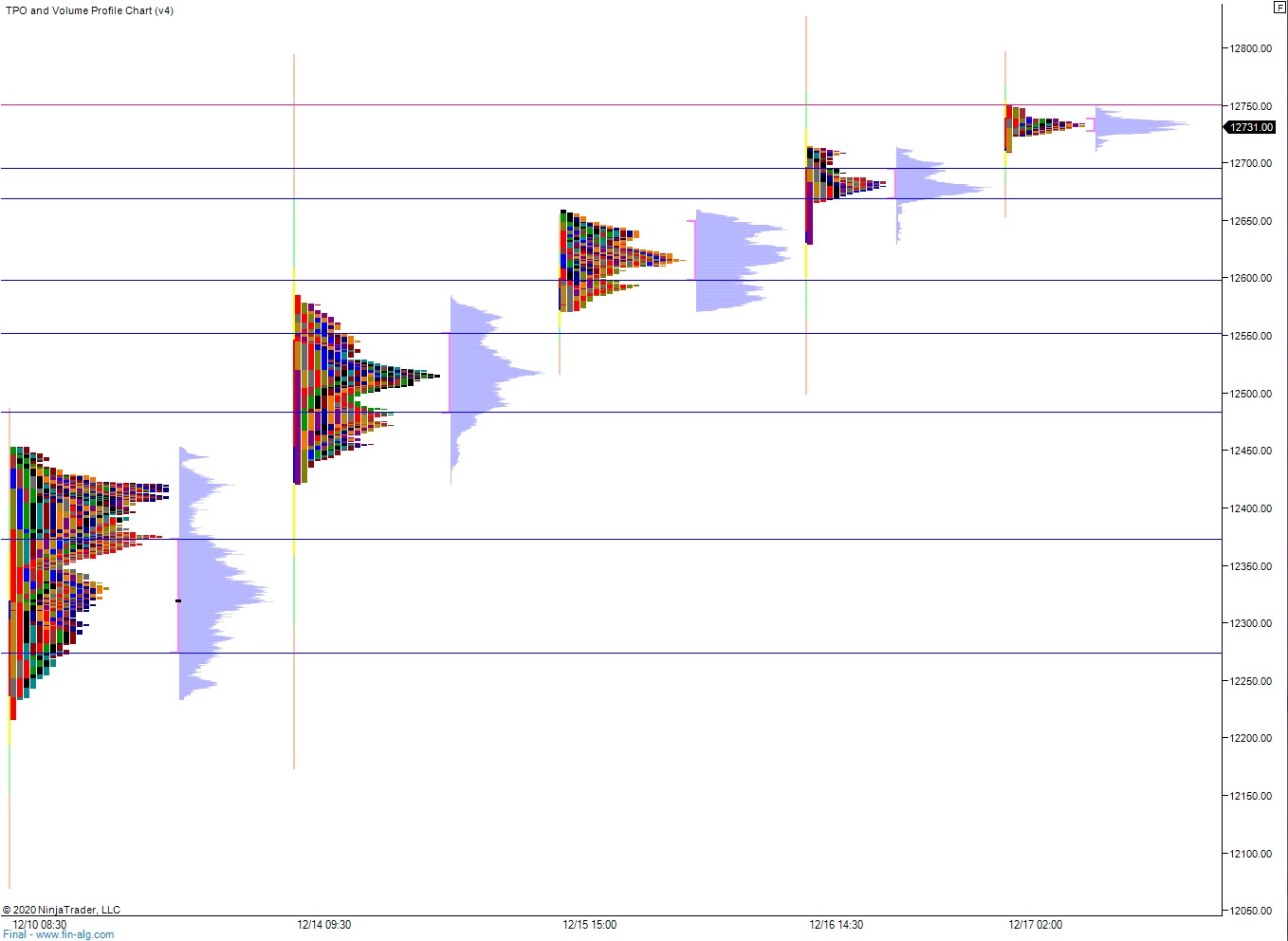

Yesterday we printed a double distribution trend up. The day began with a slight gap up beyond the Tuesday range. Sellers resolved the gap early on and tagged the Tuesday VPOC before the auction turned higher. The rest of the morning was spent steadily ascending higher. The FOMC announcement at 2pm introduced a bit of selling, just enough to tag the daily mid. Buyers held the mid and we rallied into the close, tagging 12,700 and then chopping into the bell.

Heading into today my primary expectation is for sellers to work into the overnight inventory and test back to the Wednesday high 12,704.75. Buyers reject a move back into the range setting up a run through overnight high 12,750 before two way trade ensues.

Hypo 2 gap-and-go up to 12,800. Stretch targets are 12,850 then 12,900.

Hypo 3 sellers work a full gap fill down to 12,675.50. Look for buyers down at 12,668.75 and for two way trade to ensue.

Levels:

Volume profiles, gaps and measured moves: