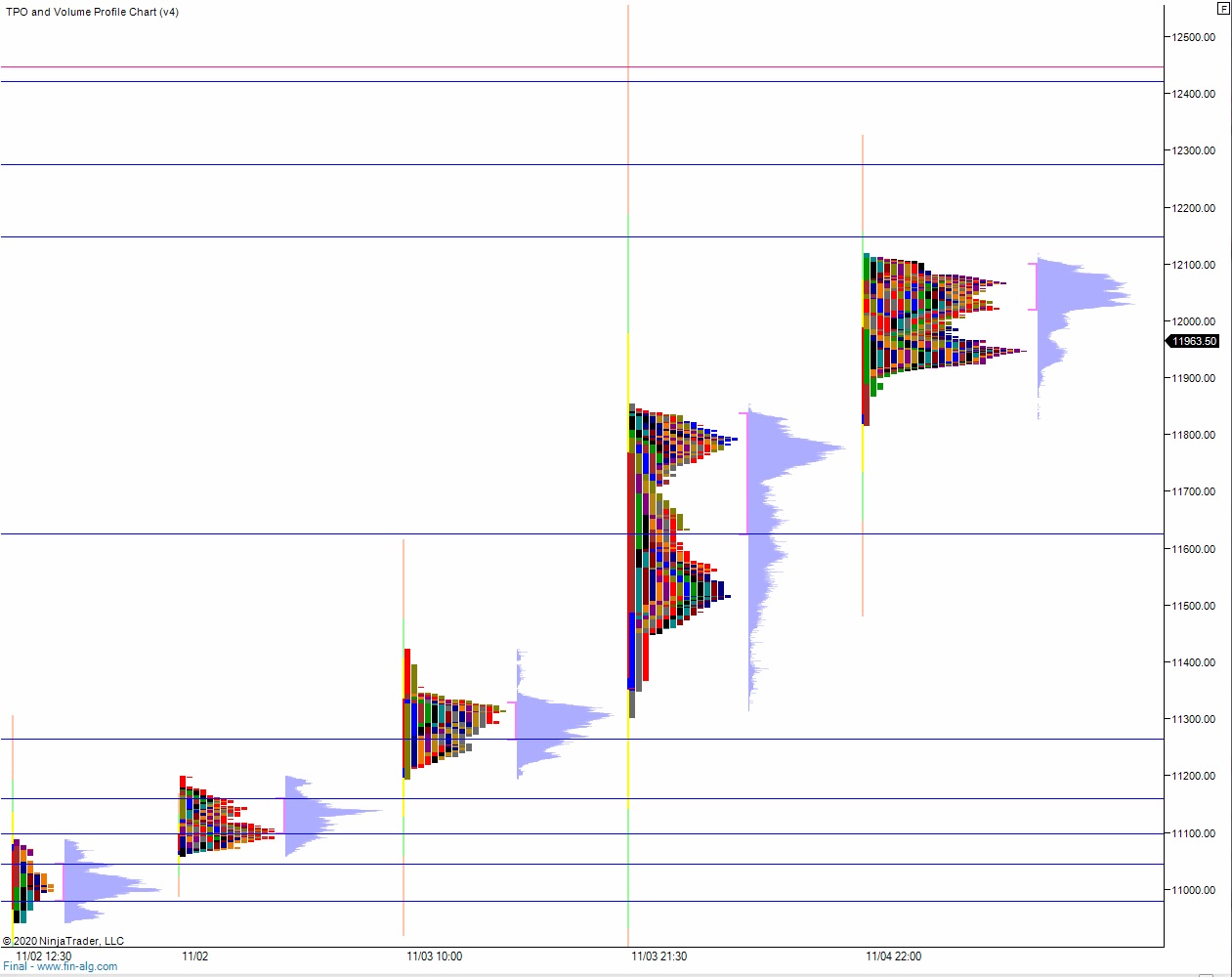

NASDAQ futures are coming into the final day of the first week of November gap down after an overnight session featuring extreme range and volume. Price worked lower overnight in a series of three rotations. The first lasted until about 8pm and did not take out Thursday low. The second took out the low by a bit. The third pressed a bit lower, nearly tagging the Wednesday high. At 8:30am non-farm payroll data came out better than expected. As we approach cash open price is hovering along the Thursday low.

There are no other economic events today. Investors are likely watching for more clarity on the final decision on the Presidential election.

Yesterday we printed a neutral extreme up. The day began with a pro gap up, trading up at levels unseen since October 14th. THe range was tight for the first few hours, with sellers making the first move out of initial balance. Buyers controlled the tape from about 12:45pm New York onward though, pressing through the range and going range extension up. After going neutral price worked back to the midpoint. Then we ramped back up and closed near the high during the closing settlement.

Neutral extreme up.

Heading into today my primary expectation is for buyers to work into the overnight inventory and reclaim the Thursday low 11,972.75 then continue higher, closing the gap up at 12,108.50. Look for sellers up at 12,147.50 and for two way trade to ensue.

Hypo 2 sellers reject a move back into Thursday low 11,972.75 setting up a move down through overnight low 11,868.25. Look for buyers down at 11,774.75 and for two way trade to ensue.

Hypo 3 stronger buyers tag 12,200 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: