NASDAQ futures are coming into Thursday with a slight gap up after an overnight session featuring elevated range on extreme volume. Price marked time overnight, balancing along the lower half of Wednesday’s range. At 8:30am initial/continuing jobless claims data came out mixed, slightly worse than expected. As we approach cash open, price is hovering below Wednesday’s midpoint.

Also on the economic calendar today we have ISM non-manufacturing/services composite PMI along with durable goods/factory orders at 10am followed by 4- and 8-week T-bill auctions at 11:30am.

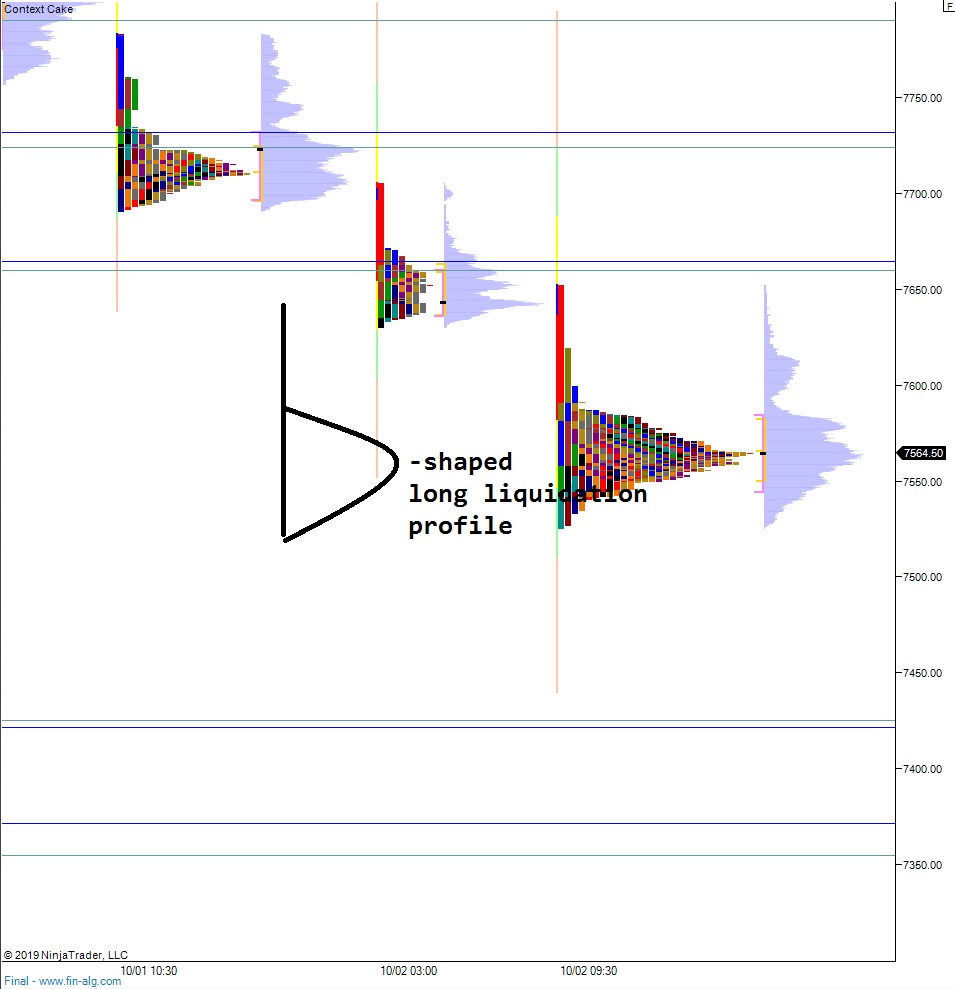

Yesterday we printed a double distribution trend down. The day began with a gap down putting the market out of balance from the past few weeks. Sellers drove lower off the open, trading down to 7600 before catching a bounce. The selling campaign continued lower, trading down into prices unseen since late-August before a rotation up to the daily midpoint occurred. Sellers defended the mid and worked price back near the lows into the close.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 7546.50. From here we continue lower, down through overnight low 7540.75. This sets up a test below Wednesday’s low 7525.50. Look for buyers down at 7500 and two way trade to ensue.

Hypo 2 stronger sellers liquidate down to 7424.75 before two way trade ensues.

Hypo 3 buyers work up through overnight high 7587.75 and tag the 7600 century mark before two way trade ensues.

Hypo 4 stronger buyers work price up to 7659.25 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: