NASDAQ futures are coming into Wednesday with a slight gap down after an overnight session featuring elevated volume on normal range. Price held balance in the upper half of Tuesday’s range overnight. As we approach cash open, price is hovering near Tuesday’s high print, which is back at the “scene of the crime” the price level we sold off from Sunday evening once futures opened for trade and we able to react to the Iranian/Persian drone attack on Saudi Arabian oil equipment.

On the economic calendar today we have crude oil inventories at 10:30am. These numbers may garner more attention today, given the geopolitical backdrop this week for oil.

PLENTY OF OIL!

— Donald J. Trump (@realDonaldTrump) September 15, 2019

Also on the economic calendar today we have an FOMC rate decision at 2pm followed by a press conference from Federal Reserve chairman Jay Powell. Fed fund futures on the CME are currently pricing a 61.2% chance of a rate cut. This is a live meeting, and the commentary afterwards is likely to offer clues into the Fed’s thinking.

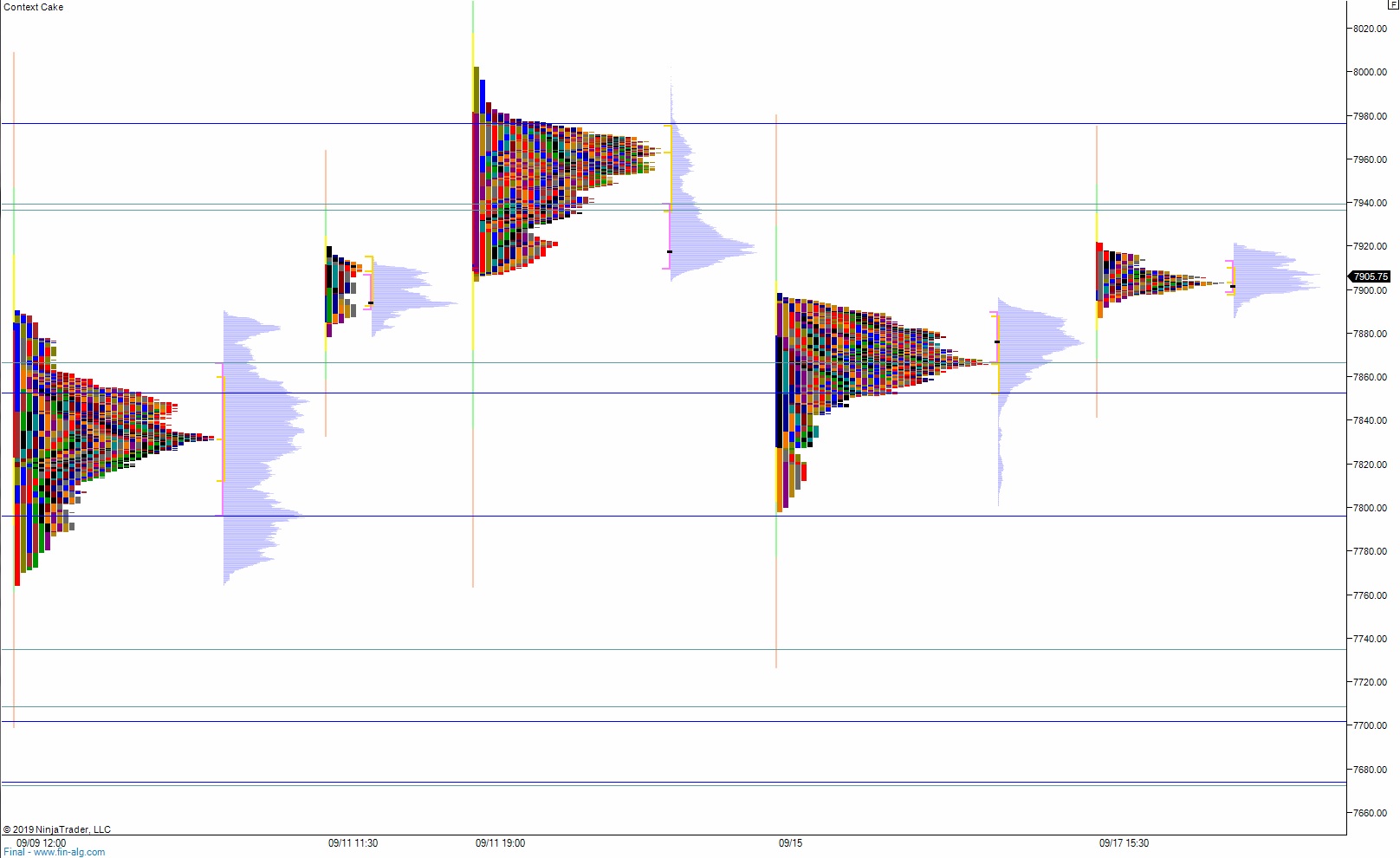

Yesterday the NASDAQ printed a normal variation up. The day began flat and we chopped sideways for most of the session until about 3:30pm when we ramped higher into the bell, going range extension up and pressing price back to the scene of the crime from Sunday night. We ended the day near session high.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 7914.25. From here we continue higher, up through overnight high 7921.50. Look for sellers up at 7936.50. Then look for the third reaction after the FOMC rate decision to dictate direction into end-of-day.

Hypo 2 stronger buyers trade up to 7976.25 before settling into two-way chop. Then look for the third reaction after the FOMC rate decision to dictate direction into end-of-day.

Hypo 3 sellers press down through overnight low 7887.25 setting up a move to target 7866.50 before two way trade ensues. Then look for the third reaction after the FOMC rate decision to dictate direction into end-of-day.

Levels:

Volume profiles, gaps, and measured moves: