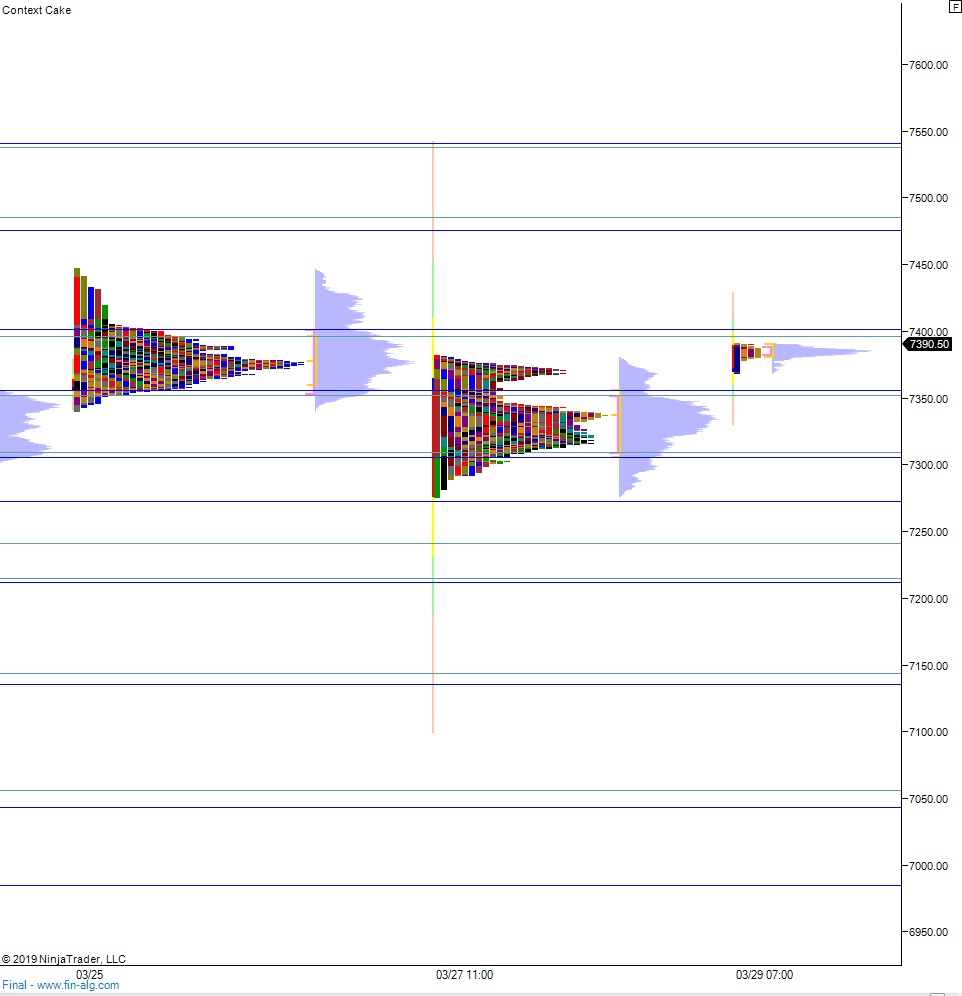

NASDAQ futures are coming into Friday gap up after an overnight session featuring extreme volume on normal range. Price worked higher overnight, balancing for several hours near the Thursday high before breaking away from the balance around 7am New York. At 8:30am PCE core came out below expectations.

Also on the economic calendar today we have new home sales at 10am and University of Michigan’s final March reading of sentiment.

Yesterday we printed normal variation down. The day began with a slight gap up. Sellers resolved the overnight gap and then we worked higher, eventually stalling out before the first hour of trade completed and well below the Wednesday high. Sellers then pressed us range extension down but the selling dried up well ahead of the Wednesday low. Price eventually worked back above the daily midpoint and closed as we started to rally up-and-away from it.

Normal variation down. Inside day.

Heading into today my primary expectation is for buyers to take out overnight high 7390.75. Look for a tag of the naked VPOC at 7415 before two way trade ensues.

Hypo 2 stronger buyers trade us up to 7460.25 before two way trade ensues.

Hypo 3 sellers work into the overnight inventory and close the gap down to 7352.50. Sellers continue lower, down through overnight low 7349.75. Look for buyers down at 7309.25 and two way trade to ensue.

Levels:

Volume profiles, gaps, and measured moves: