NASDAQ futures are coming into Wednesday gap up after an overnight session featuring extreme volume on only an elevated range. Price was balanced overnight, briefly probing beyond the Tuesday cash high in calm, two-way trade. This morning both Bank of America and Goldman Sachs reported better-than-expected earnings, and while neither of these stocks are NASDAQ components, a bid entered the market shortly after the announcements.

Also on the economic calendar today we have crude oil inventories at 10:30am followed by Fed Beige Book at 2pm.

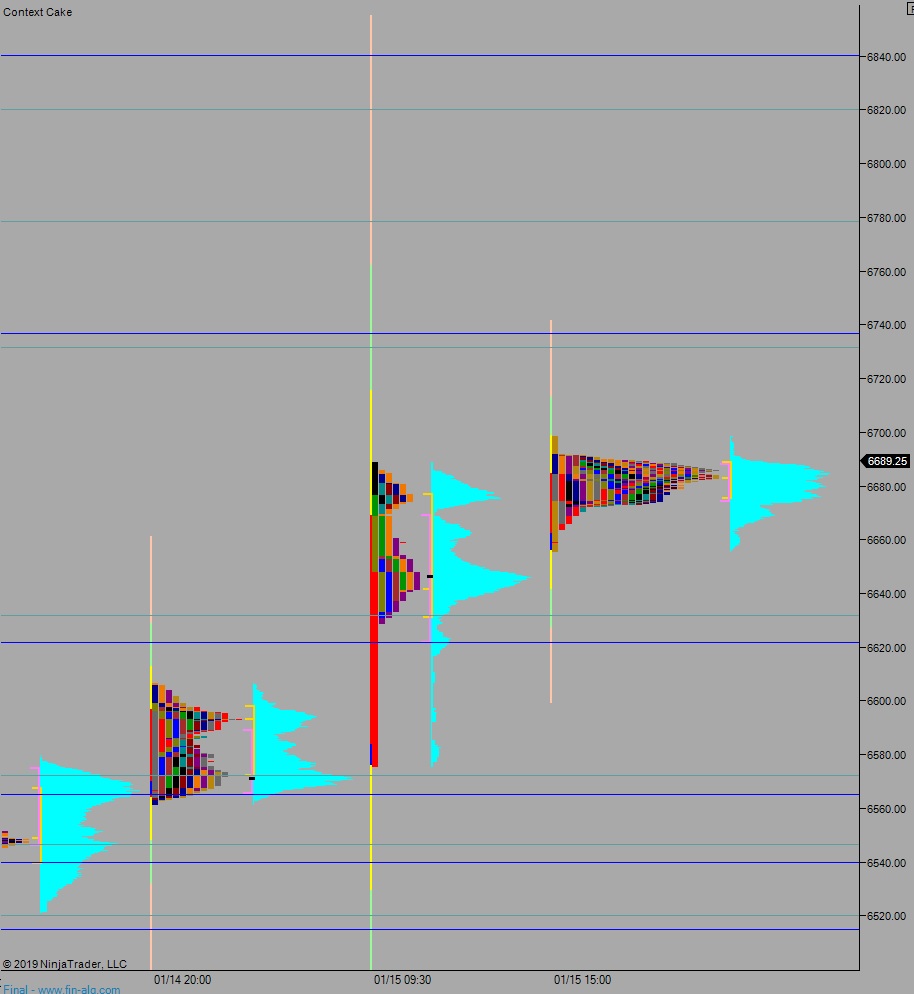

Yesterday we printed a double distribution trend up. The day began with a gap up and drive higher. The drive took out both open gaps above [from Monday and last Friday] and sustained trade above it. This set up a move to target the psychological 6666 level. Sellers took a shot around 2:30pm that took price right back to the daily midpoint. Buyers defended. We ended the day near session high.

Double distribution trend up.

Heading into today my primary expectation is for buyers to gap-and-go higher, trading up to 6731.50 before two way trade ensues.

Hypo 2 stronger buyers sustain trade above 6731.50 setting up a move to target the open gap up at 6772.50 before two way trade ensues.

Hypo 3 sellers work into the overnight inventory and close the gap down to 6674.75. Sellers continue lower, down through overnight low 6664. Price pins at 6666 as two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: