*Note: this morning’s trading report references the December ’18 NAS100 futures contract (NQZ18). I will be trading the December contract despite most action ‘rolling forward’ to the March ’19 contract.

NASDAQ futures are coming into Friday gap down after an overnight session featuring extreme range and volume. Price worked lower overnight starting around 8pm and continued lower until two-ticking the Tuesday cash low. After that a responsive bid stepped in and we came into balance. As we approach cash open price is hovering near the overnight low, inside the lower quadrant of Tuesady’s range. At 8:30am Advance Retail Sales data came out above expectations.

Also on the economic calendar today we have Manufacturing Production at 9:15am, Manufacturing/Service PMI at 9:45am, and Business Inventories at 10am.

Yesterday we printed a normal variation down. The day began with a gap up and two way auction. Buyers attempted higher early on but stalled out before they could take out the Wednesday high. Responsive sellers worked the overnight gap fill before we spent the rest of the session chopping inside of Wednesday’s range, forming a weak low along the way.

Heading into today my primary expectation is for buyers to work into the overnight inventory and attempt to reclaim Thursday’s low 6749.25. Sellers reject a move back into Thursday low, setting up a move to take out overnight low 6650.75. Look for buyers down at 6606 and two way trade to ensue.

Hypo 2 stronger sellers gap-and-go lower, trading down through overnight low 6650.75 early on and tagging 6600. Trade is sustained below 6600 setting up a move to target the open gap down at 6530.50 before two way trade ensues.

Hypo 3 stronger buyers work a full gap fill up to 6748.75 then continue higher through overnight high 6760.75. Look for sellers up at 6800 and two way trade to ensue.

Levels:

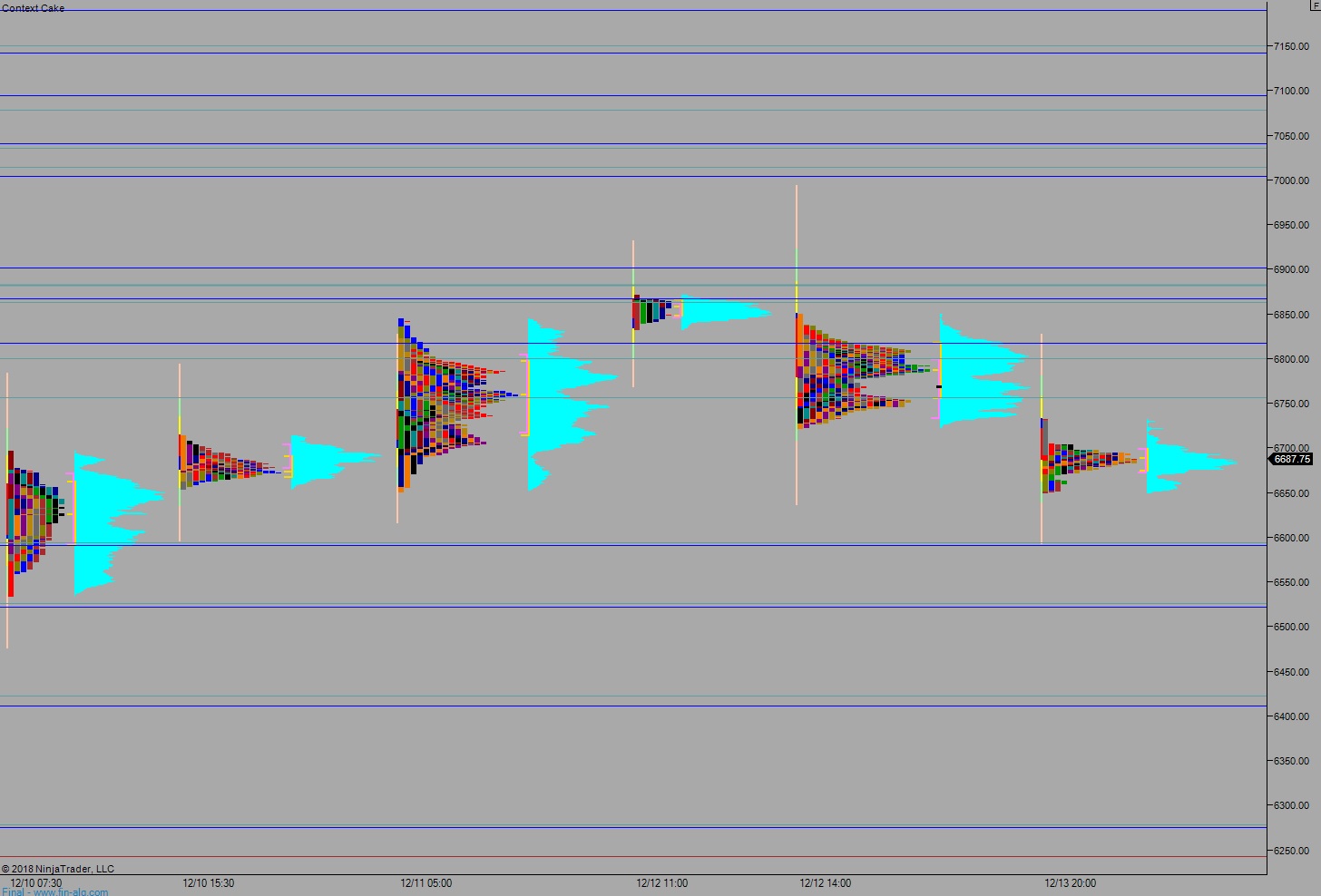

Volume profiles, gaps, and measured moves: