The header photo for this Sunday, December 16th blog entry comes courtesy of The New York Times SundayStyles front page, which I poached from a Howard Lindzon Stocktweet. It depicts two tiny cartoon humans moments away from being kookslammed by a giant black and white wave with a red crest. Here is the cover again, for emphasis:

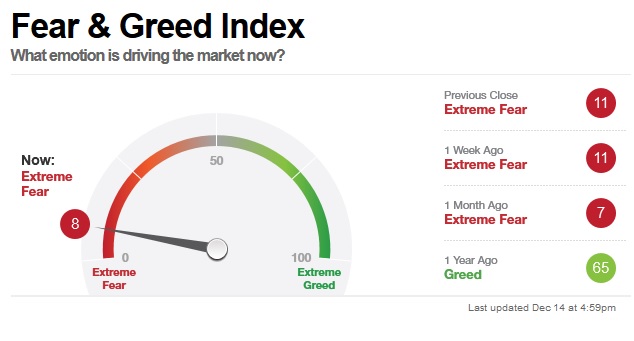

This is the type of sentiment that gives me bullish conviction. CNN’s Fear & Greed index shows a similar sentiment and the prevailing tone amongst my carefully curated Twitter feed is that the world is fucked and so is everyone else on it. Bitcoin wealth is all-but-gone and on paper some people look a heck-of-a-lot less wealthy then they did this time last year.

But I do not base my decisions of the capricious sentiment of the herd, or the newspapers, or even the politicians. Or the raucous behavior of Frenchmen, or the patriarchal shake-ups in Arabia. I base my decisions on the will of my robots. They are my guide. I am their steward.

But I do not base my decisions of the capricious sentiment of the herd, or the newspapers, or even the politicians. Or the raucous behavior of Frenchmen, or the patriarchal shake-ups in Arabia. I base my decisions on the will of my robots. They are my guide. I am their steward.

What are the robots saying? Last week they said ‘acceleration to the downside then a tradeable low’. Last week Monday we accelerated to the downside, and except for on the Russell, this resulted in a tradeable low. Now my IndexModel is back to neutral, while Exodus has a bullish cycle lasting until the end of the half day Christmas eve. The robots are bullish. Therefore I am too.

This is a good week coming up. There is an FOMC rate decision Wednesday afternoon. It is a live meeting. There is a press conference scheduled afterwards and the gambling halls in Chicago are placing 76.6% odds of a 25 basis point lift in rates. Only 76%. They usually have more conviction one way or another. So the hike is not guaranteed, despite being the heavily favored bet. We like uncertainty.

We also like distractions. Holidays are distracting. I fielded over three hours of phone calls this weekend with relatives, some crying, some belligerent, all because of the holidays. Bringing everyone together can be challenging. Not being able to satisfy the desires of everyone can be discouraging. And people are just sort of brainwashed by the consumer cycle foisted upon Americans by the forces of capitalism. These are rife conditions for a balanced mind to capture opportunities. This is a good week coming up.

Whether or not rates lift this Wednesday is important, but investors will also be looking closely to see if the Fed is dialing back their intentions to continue lifting rates through 2019. The 2:30pm press conference will be scrutinized for slight changes in verbiage and tone. Overall, Wednesday afternoon will serve as a useful guidepost on the week. The third reaction after the decision/conference will likely dictate direction for the rest of the week.

And listen, while I do my finest work inside the NAS100 futures, I am less concerned with the intermediate-term direction of the indices and more interested to see how individual stocks that I like are behaving. Tesla, for example. All this fear and crash sentiment but my favorite stock (and largest position) is a few dollars away from record highs. Twitter has been fierce. I love solar into 2019. Sangamo. Goldman. These are the areas that I expect to see move higher over the coming weeks and months. That is where my concern lies. The indices could chop and even head lower, but if individual stocks decouple, this continues to be a healthy bull market.

So there you have it. The theme going into year-end has been persistence. I think adding kindness to that theme has been helpful for me. Persistence and kindness. Especially kindness for your fellow traders. 2018 has been shaky. By no means has it been as extreme as 2008 or even 2014 when indices didn’t bother to reflect the huge destruction of market cap happening almost everywhere outside of the FANG stocks, but 2018 has been a test of grit. Resist the urge to pile onto someone who holds positions that oppose yours.

I am bullish heading into OPEX. I am bullish heading into this crappy calendar-timed Christmas. I am bullish into this extremely negative sentiment.

Hopefully I’ve made myself clear and mahalo for reading along.

– RAUL SANTOS, December 16th, 2018

If you enjoy the content at iBankCoin, please follow us on Twitter

I always have a skepticism for those that claim absolute objectivity (“will of the robots”), because this objectivity is often very subjective in basis. For example, at the core of almost every stock pricing model is history and the assumption that the future will go down exactly like the past, with disregard for basic economic factors such as demographics. If things were that simple, you may as well go with the masses’ buy-and-hold strategy, whic is undefeated in the US stock market – historically. Not to mention the choice of the pricing model is not up to the robots, either, but to the programmer/analyst.

Also, I do not understand your TSLA conviction. Is this based on technicals (recent stock charts) or long-term fundamentals? If the latter, what kind of car sales do you envision and when (2019? 2025)? Inquiring minds want to know.

Tesla conviction is based on something illogical that is pervasive across all demographics and regions—faith. Only I worship a billionaire by the name of Elon Musk. He is my living idol. My dead idol is Nikola Tesla.

Also, I love buy-and-hold.

Finally, I simply rank 5 very objective broad index observations from 1-to-5 and then subtract that average from the overall hybrid exodus score. I score things like 3 day trend and volume as objectively as possible, albeit manually. I eyeball these patterns and rank them. The average itself generates a bias 0-2 strong bear, 2.1-2.7 medium bear, 2.8-3.2 neutral, 3.3-3.9 medium bull, 4-5 strong bull. The hybrid score – the average behaves more like an osillator and anyone whose worked with osillators knows their inherent limitations (mainly to due with staying at the extremes for prolonged period, sending ‘bad’ signals, during price discovery phases). Drawdown periods are part of any systematic approach I’ve come up with. I do my best to avoid them by adding in context, but context can be murky and biased even when codified. I don’t disagree with you, just sharing more of my thoughts on objectivity.

On TSLA: I’m guessing that you are probably ~32 years in age: old enough to have traded the housing crash, but too young to expereince the overly-optimistic, “new paradigm,” price-doesn’t-matter-for-good-companies, Dot Com boom-bust.

You are obviously intelligent, so I’d advise you to perfrom a “bottoms-up” valuation of TSLA **stock**. Since you are providing a free helpful service, I will return the favor: here is the BEST place to start when pricing car companies:

http://www.goodcarbadcar.net/category/sales-by-brand/tesla-sales/

Keeping in mind that TSLA has a strong finacial incentive to *temporarily* boost production before the Jan 1 rebate cut, I’d expect their temporary production lines to be shut down after that.

2018 Q4 sales + volumes should be strong, but 2019 Q1 (reported in April) will likely be disappointing. Either way, come up with a 2020 production figure that you are happy with.

Net profit per ca can only go down if volume is to increase ($35k + $50k model 3 introduction, no rebates). So optimistically, they will be lucky to net $7k per car., probably me like $5k.

My *high-end ceiling* estimate for 2020:

300k cars *$7k = $2B in Net income

(note this also ignores all kinds of other costs)

I closed my TSLA short today because I realized the timing was off (and taking advantage of the mornign drop), but will open it agressively after Q1 earnings are released, regardless of the results.

Hope your strategy works out, but I also hope that you know the lesson from LTCM.

https://en.wikipedia.org/wiki/Long-Term_Capital_Management

thank you

But why did I close my TSLA shorts! Too much incertainty, plus it was already profitable.

I had such a good (high) entry point and it is down 9% since I posted, in less than 2 full trading days. I should have esagblished a calendar spread or something. May not be too late.

ROFL