NASDAQ futures are heading into Tuesday gap up after an overnight session featuring a strong upward rotation. The buying started around 1am and lasted until 6–pushing price up near the ‘Red Monday’ gap, the big gap down to start 2016 back on 01/04. Range is elevated on normal volume, and at 8:30am both Housing Starts and Building Permits data came in way below expectations.

Also on the economic docket today we have a 4-week T-Bill auction at 11:30am. Also, both Intel [INTC] and Yahoo [YHOO] report earnings after the bell.

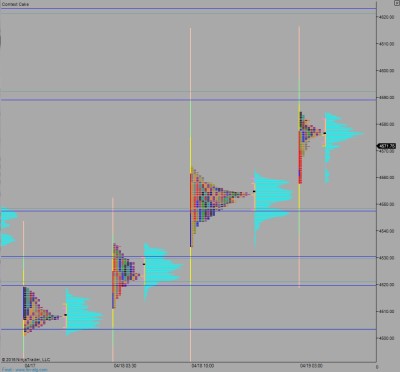

Yesterday we printed a normal variation up. After starting the day with a strong drive up the market went into balance and two way trade ensued along the swing high. At the end of the session, during settlement period, their was a seller’s push back down to the daily mid.

Heading into today my primary expectation is for buyers to take out overnight high 4584.50 and target the red Monday gap up at 4591.50. Look for responsive sellers above at 4596 then two way trade ensues.

Hypo 2 sellers work into the overnight inventory and close the gap down to 4546.25. Look for responsive buyers right near these levels and two way trade ensues.

Hypo 3 strong selling closes overnight gap down to 4546.25 then targets overnight low 4544.25. Look for sellers to continue probing lower, down to 4530.50 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: