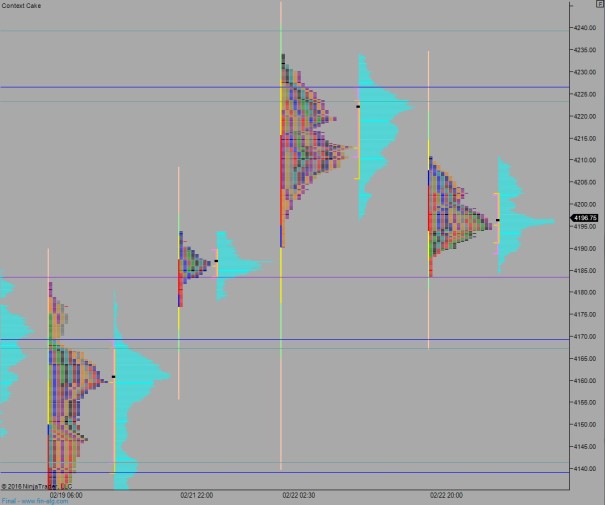

NASDAQ futures are priced to open gap down after an overnight session featuring normal range and volume–the first statistically normal Globex session this year. Price pushed lower for most of the session but came into balance ahead of the weekend gap.

The economic calendar is busy today, with several retail stores reporting earnings. We also have Consumer Confidence and Existing Home Sales at 10am, a 4-week T-Bill auction at 11:30am, and a 2-Year Note auction at 1pm.

Yesterday we printed a normal variation up. Price opened gap up and buyers worked into the market early on. Most of the session was spent auctioning higher on balance trade until sellers stepped in during settlement period.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 4213. From here look for buyers to continue working higher to 4223.25 before two way trade ensues.

Hypo 2 sellers push down through overnight low 4183.50 on the open and target 4169.25. Buyers are seen here but ultimately overrun as sellers continue lower to close the weekend gap fill down to 4161 before two way trade ensues.

Hypo 3 liquidation takes hold. After filling the weekend gap down to 4161 selling accelerates. Stretch target is 4141.50.

Hypo 4 bulls close overnight gap up to 4213 and sustain trade above 4223.25 setting up a secondary leg to target 4239.25.

Levels:

Volume profiles, gaps, and measured moves: