NASDAQ futures are higher than last Friday’s close after several hours of Globex trading. Yesterday the futures continued to trade while its underlying components were closed. Both range and volume metrics are skewed [but elevated] due to the holiday. Price managed to push up above last week’s high before printing a slight failed auction and settling into two way trade. As we approach cash open sellers are becoming more active. At 8:30am, Empire Manufacturing data came out well below expectations. The initial reaction is selling.

Also on the economic docket today we have NAHB Housing Market Index at 10am, 3- and 6-month T-Bill auctions at 11:30am, and Long-term TICK Flows at 4pm.

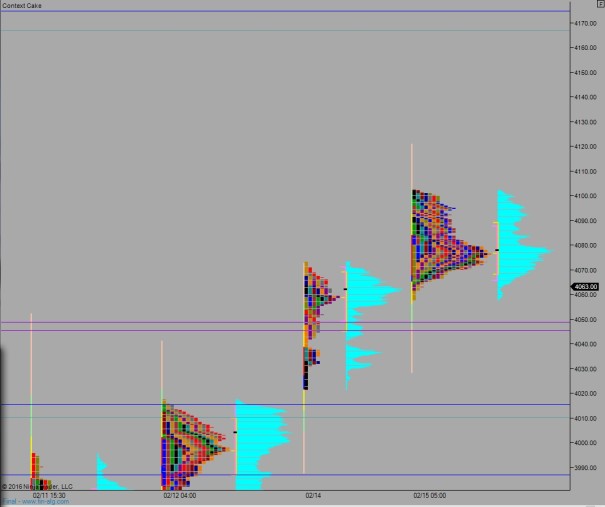

Last week the market came into balance after a weak Monday. The rest of the week was spent balancing out. On Friday buyers started showing signs of becoming initiative.

Heading into today my primary expectation is for sellers to push into the overnight [President’s Day] inventory and trade down to 4045.25. Responsive buyers may show up here but look for selling to continue down to 4015.25 before two way trade ensues.

Hypo 2 buyers defend north of 4050 and set up a move to target overnight high 4102.50. Look for responsive sellers around 4109.50 and two way trade ensues.

Hypo 3 full gap fill down to 4006.25. Look for responsive buyers down near 3987.25.

Levels:

Volume profiles, gaps, and measured levels:

If you enjoy the content at iBankCoin, please follow us on Twitter

Good stuff, thanks Raul.

Agreed. Thanks Raul.

hypo 2 pretty bang on. Traded 4050 on Snapchat earlier if anyone wants to check it out VCALI is the name over there.

I had to delete my snap chat. Too many pointless snaps from friends & not enuff risque material from my lady friends

big props for hypo 2