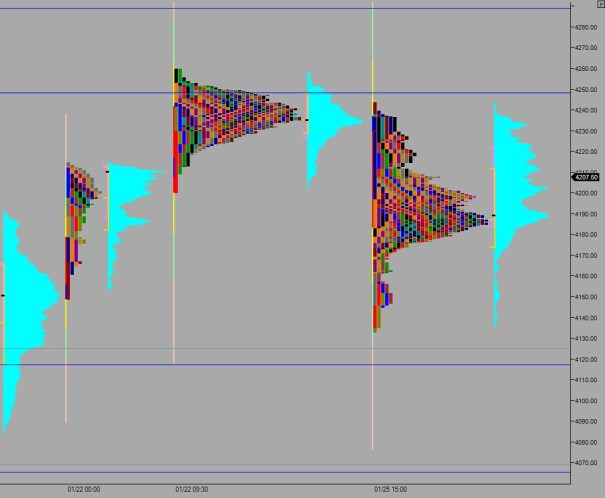

NASDAQ futures are priced to come into Wednesday gap down after an overnight session featuring extreme range on elevated volume. The session’s price action was balanced overall and price was contained within yesterday’s range while traversing most of it. At 7am MBA Mortgage Applications came in slightly below expectations. The initial reaction was buying.

The economic calendar is busy today. The biggest event comes at 2pm when we hear the FOMC Rate Decision. This is the highest impact event for the marketplace. We also have New Home Sales at 10am, crude oil inventory at 10:30am, a 2-Year Floating Rate Note auction at 11:30am, and a 5-Year Note auction at 1pm.

Yesterday we printed a normal variation up. The morning gap up was faded and filled. A push back down into last Thursday range (01/21) was rejected by responsive sellers who spent the rest of the session working higher. Price stalled out at the Monday VPOC around 4236 and closed just below the level. After the bell, Apple earnings caused a bit of volatility.

Heading into today my primary expectation is for buyers to press into the overnight inventory but struggle to close the gap up at 4226.75. Instead sellers stall out around 4222 and two way trade ensuses, taking out neither overnight high or low until we hear the afternoon FOMC rate decision.

Hypo 2 buyers push a full gap fill up to 4226.75 and sustain trade above it. Initiative buyers come in ahead of the FOMC rate call and work price up through overnight high 4237.25. Look for price to continue higher to target 4247.50 before finding responsive sellers and two-way trade ensues.

Hypo 3 sellers push off the open and work down to 4183.75 before tight, two-way trade takes hold ahead of the FOMC rate decision.

Hypo 4 sellers accelerate down through 4183.75 and sustain trade below it to set up a leg lower to take out overnight low 4177.50. Look for responsive buyers just below the level and two way trade to ensue ahead of the Fed.

Watch for the third price reaction after the FOMC rate decision to provide market direction into the end of the week.

Levels:

Lol. Best day of the month, only in the Fury sense.

Love these morning reads Raul. In reference to your last sentence, can you explain what the third price reaction means and how one would spot that? Thanks in advance for the response.

I watch the renko chart and attempt to see the first 3 reactions. It takes anywhere from 5-20 minutes.