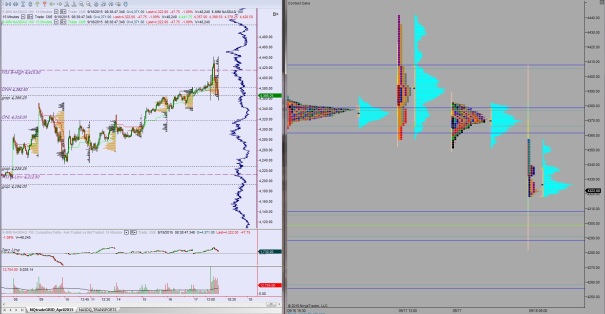

Nasdaq futures are pushing lower heading into September OPEX day, a quad witching day. The session was balanced mostly until about 6am when a wave of selling pushed through. Price managed to push down through Wednesday’s range and most of Tuesday’s range to put the index back to unchanged on the week. Volume is elevated but not extreme while range is in extreme territory.

On the economic calendar, we have Leading Indicators at 10am, Household Change in Net Worth at 12pm, and the Baker Hughes Rig Count at 1pm.

Yesterday we printed a neutral extreme down session. The morning started out gap down and price slowly drifted higher ahead of the FOMC rate decision. 3rd reaction analysis yielded the buy signal and soon after price was pushing up. Just beyond the weekly ATR band sellers stepped in. We then traversed the entire daily range to close near the low.

Heading into today, my primary expectation is for buyers to work into the overnight inventory. Look for a move up to 4361.25 before sellers come in and two way trade ensues.

Hypo 2 sellers push off the open, take out overnight low 4318. Look for responsive buyers down at 4308 otherwise sellers move to target 4299 then two way trade ensues.

Hypo 3 sellers push hard, down through 4288, setting up a liquidation down to 4258.25.

Hypo 4 full gap fill trade up to 4366.25.

Levels:

If you enjoy the content at iBankCoin, please follow us on Twitter

Hypo 2 completed already, pre market, didn’t take long