Friday is upon us and after 4 days of upward price movement traders are wondering if Friday will see some selling. The overnight session was quiet and balanced ahead of the 8:30am NFP data. After a strong set of numbers and revisions prices went higher-lower-higher on third reaction analysis. Range and volume managed to maintain a normal 1st sigma range and volume. Fed Plosser was speaking this morning, saying the FOMC is at a point where they are nearly forced to raise rates soon.

Coming up today we have Fed’s Lockhard speaking at 12:45pm and Consumer Credit stats at 3pm.

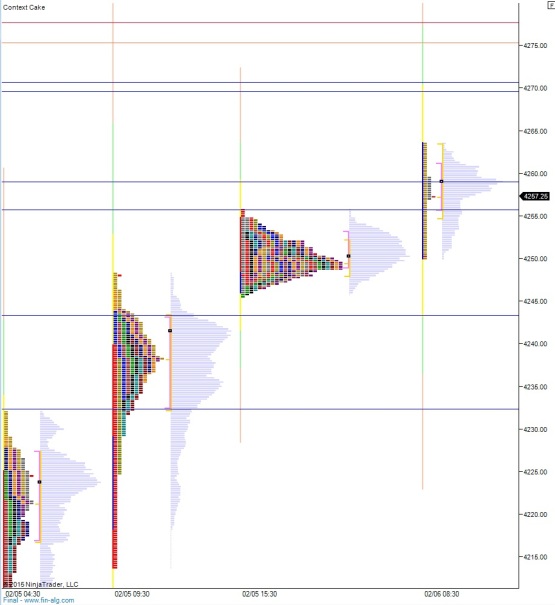

Yesterday we printed a normal variation-type day. Price was gap up to start the session and sellers pushed us down through Wednesday’s volume pocket to the mCLVN at 4214.50 where responsive buyers stepped in and took us up through Wednesday’s high. Sellers were unable to complete a full gap fill down to 4204.25 thus it remains open to the downside.

The normal variation resembled a P-shaped short squeeze before making a second leg higher in the afternoon shifting the shape almost into a double distribution trend. The action put us up into the range of 1/26. The full gap fill up to 4269.25 is still open. There is also an interesting LVN at 4260.75.

The auction tends to become a bit rough after 3-4 days of unidirectional movement. Therefore early on I am expecting sellers to push into the overnight inventory to close the gap to 4249.25. From there we may see responsive buyers initially but they cannot take us up through 4260.75 and we see another leg lower to take out overnight low 4245.50 and target the MCHVN at 4233.25. Stretch target is a Wednesday gap fill down to 4204.25.

Hypo 2 is buyers gap-and go to take out overnight high 4263.50 and close the gap up at 4269.25. Responsive sellers struggle to re-enter Thursday’s range ~4253.75 and we continue higher to target the MCHVN at 4285.25.

Hypo 3 is 2-way chop with slight buyer edge with range between 4240.50 and 4270.

These levels are highlighted below:

And here are the market profile levels and structures I am working with today:

And here are the market profile levels and structures I am working with today:

If you enjoy the content at iBankCoin, please follow us on Twitter

sup.

getting my gorby on

gray jay

This short Friday thing is still working.