One of the primary jobs we have as traders is determining what type of environment we are trading in. What are the conditions? Are prices moving fast or are we chopping around? Our behavior can be adjusted accordingly. This means stepping back and examining the price and volume action from a less granular level—instead observing a multiple day auction.

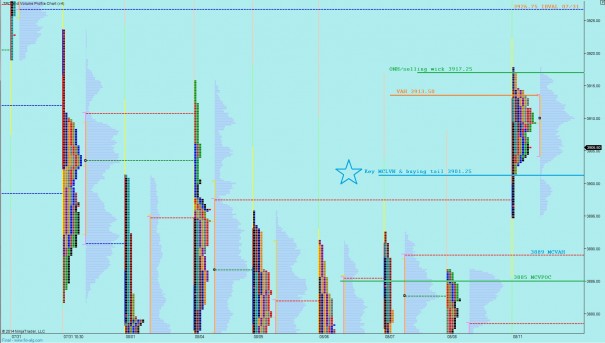

On my latest volume profile chart we can see multiple conditions all in one place. At a glance we can see the long term volume composite, the balance occurring on a shorter more intermediate term timeframe, and also see the daily auction. What jumps off the screen when I look at this chart is the balance formed during the last eight sessions. These eight sessions are significant because they are the auction as we wrapped up July and began August. A significant build of volume took place, we compressed on Friday before thrusting higher, and the thrust continued into Monday. We are now trading up at the edge of balance and that high volume core is acting like gravity. Between us and mean revision lower is a low volume node at 3901.25. The behavior around this price will be my early tell on whether we go back and fill the gap that started the week. Furthermore, how we behave around the high volume VPOC at 3885, a price vehemently defended by sellers last week, might indicate whether we have shifted into discovery mode, see below:

The overnight auction was quiet thus far, taking place inside yesterday’s range on low volume. The biggest rotation occurred around 7:15am, it was a downward rotation of 14 points. We have a Monthly Budget statement being released at 2pm and an otherwise quiet economic calendar until afterhours when Japan GPD data is set for release just before 8pm.

I have highlighted the short term levels I will be observing on the following market profile chart:

If you enjoy the content at iBankCoin, please follow us on Twitter

Primary Hypo – buyers push into premarket selling, test up to yesterday close 3905.50 and up to VPOC at 3910 before finding responsive selling. Buyers hold 3901.25 before setting up a move to VAH 3913.50

hypo 2 – sellers keep pushing off the open down through overnight low 3898.25 and push down to 3889 before finding responsive buying taking us up to test 3901.25 and if we push through then an overnight gap fill to 3905.50

hypo 3 – reject yesterday range at VAL 3904 and drive lower, back through MCVPOC at 3885 and push down through the other side of our micro composite to test if responsive buyers are still present.

There that seller is….that was a pretty sharp reversal off 3886

it was, I am expecting another rotation lower, to make sure we found a buyer, but if we get back into initial balance I will start to have more confidence in the long, IB LOW @ 3897.50

Nicely called

Raul, do you ever consider making another grab for a LED empire?

Funny you should say that, I queued up their charts today, not yet. I actually pursued this industry for a while outside of the markets and did not like what I saw.