Nasdsaq futures are trading a touch lower overnight in a balanced session of trade. We are quiet on the economic from this morning. The Chicago Fed National Activity index came out at 8:30am a bit below forecast but the response was low in the Nasdaq. Looming in the minds of many participants are the rising tensions across the Atlantic, where the Israelites are waging battle in Gaza and finger pointing over the Malaysian airline crash continues.

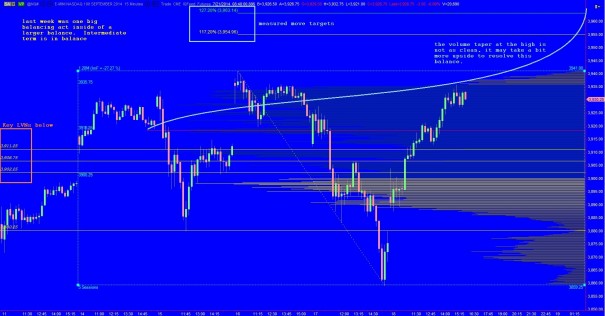

The balance I have been tracking on the intermediate term has grown to encompass the entire month of July. Thus I present the intermediate term balance below in the context of 2014:

The weekly chart shows the long term timeframe where responsive buying formed two tails recently, suggesting an excess low was presented to participants—prices perceived as discounts. This activity requires a significant amount of energy, thus we will need to see buyers muster up additional strength if they are to build upon their response. Also note the still-open 14 year gap above:

Last week our five sessions aggressively formed a bit of balance. This balance is taking place within the balance of the month, to overall form a solid, thick, state of balance on the intermediate term. The intermediate term timeframe was very active last week, thus I am consolidating my eye to 5 days to view the intermediate term timeframe:

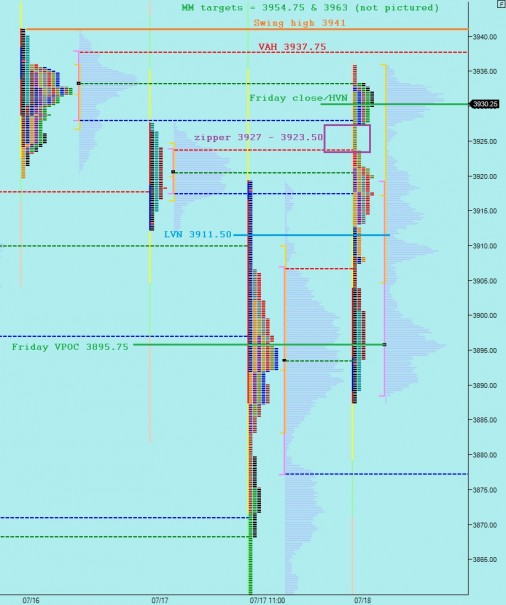

Finally, I have presented the relevant prices levels I will be watching today on the following market profile chart:

If you enjoy the content at iBankCoin, please follow us on Twitter

Hypo 1 – push up through the zipper (3923.50 – 3927) and up into the overnight gap to 3930.25. Push a bit through the high volume region before finding responsive selling back down to test the LVN at 3911.50 before balancing out around 3920

Hypo 2 – test lower to LVN at 3911.50 find responsive buying which pushes up through the zipper (3923.50 – 3927) and up into Friday’s close/HVN 3930.25. Balance out before making another push higher up to VAH 3937.75 and balance out near this VAH.

Hypo 3 – drive higher off the open, through the zipper, through the HVN at Friday’s close, and take out swing high 3941. Target measured moves up to 3954.75 and 3963

Hypo 4 – aggressive selling drive through LVN at 3911.50 and back to Friday’s VPOC at 3895.75, murky trade gives way to additional selling through the thin volume spanning 3885 – 3875

Elon’s placement on the forbes list appears to fluctuate on a daily basis as TSLA and SCTY make moves like this.

He def has some big variable income sources