Nasdaq futures spiked Sunday evening right around the time China Manufacturing PMI came out unexpectedly strong. The move did not stick for long however, when it came time for the France and Germany to release their net PMI data, and it was softer than expected, the Nasdaq gave up the entire spike and more. Interestingly enough the initial spike up to 3807.25 was powerful enough to exceed all prior swing highs on the September contract. Rarely are swing highs and lows made outside of regular trading hours, thus we have a fresh piece of bullish context to start the week. Keep in mind, this is context, not a timing tool. The vulnerability of our overnight high by no means states it will break today or even this week, only that a piece of contextual caveat exists to our analysis.

The Unites States is due out with the Flash PMI at 9:45am and given the market’s sensitivity to PMI during the globex session, it may make for an interesting opening trade. We also have existing home sales on the docket at 10am and a few T-bill auctions at 11:30am.

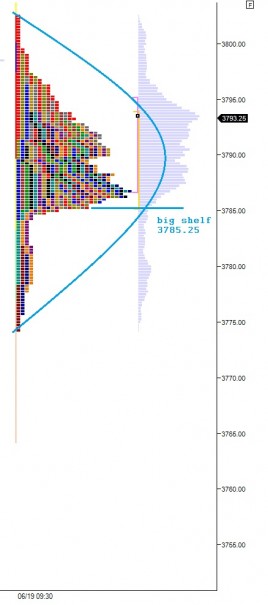

Turning our attention to the market profile, we can see all the dynamic action taking place post The Fed rally has resulted in a most peculiar market profile print. Note the globex market profile, which encompasses the price action aforementioned above. There is a huge shelf at 3785.25. We are likely to spill over this level, which may result in some liquidation. However, if sellers cannot push us over the natural demand cliff, that would be very telling as well, see below:

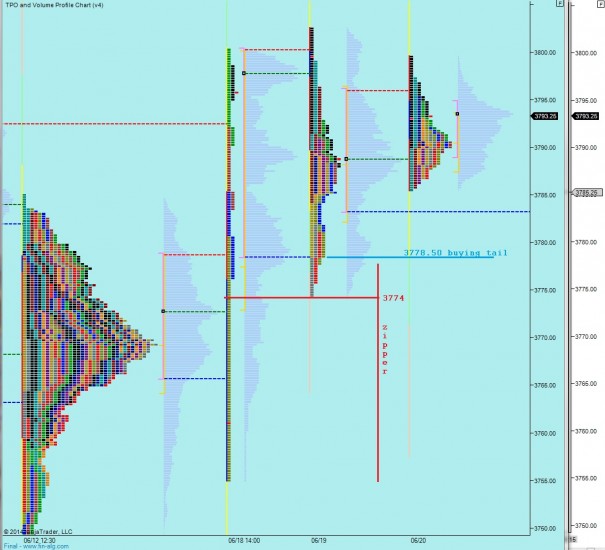

Again viewing market profile, but this time using only the action from regular trading hours, you can see 3785.25 is one tick below Friday’s low. Therefore, we should be keen to any price action below Friday’s low and whether it brings more selling into the marketplace. I have noted key support levels below this zone where we can gauge sentiment:

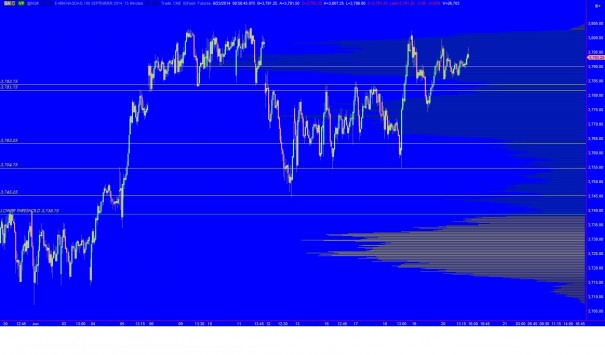

The intermediate term has been grinding along in balance. We have a volume pocket separating our current price action from the prior bracket-range, and the VPOC has shifted up to this upper distribution suggesting accepted prices. The question becomes, have we simply sucked new money in at the highs to trap, or will we continue higher putting all of those newly initiated positions in the green?

Finally let’s refresh the weekly composite chart. It is hard to argue against the buyers here, they have made a steady push higher after losing the very logarithmic trend higher at the end of March and then balancing. There could still be a case made for bracket trade to continue, but sellers will need to show up soon and defend swing highs, see below:

If you enjoy the content at iBankCoin, please follow us on Twitter

Hypo 1: test lower and find responsive buy just below Friday VPOC 3790, attempt to rotate higher through VAH 3795 and if successful take out Friday high 3799.50

Hypo 2: test lower and take out VAL 3787.50, rotate down and over shelf at 3785.25 to ultimately test buying tail at 3778.50

Hypo 3: drive lower into zipper at 3774 which leads to a liquidation day down

Hypo 4: test higher, take out selling wick at 3796.75 and target overnight high at 3807.25