Nasdaq futures are trading lower overnight after a busy European session. Prices were sliding lower into a slew of Euro-Zone economic data which turned out to be inline-to-better than expected. Prices reversed higher shortly after but again sold off on a sour ADP number early in the USA morning. We have a busy economic calendar today. At 9:45 there are some PMI stats coming out and at 10am we have a Bank of Canada rate decision and ISM Non-manufacturing composite. We also have the Fed Beige Book at 2pm.

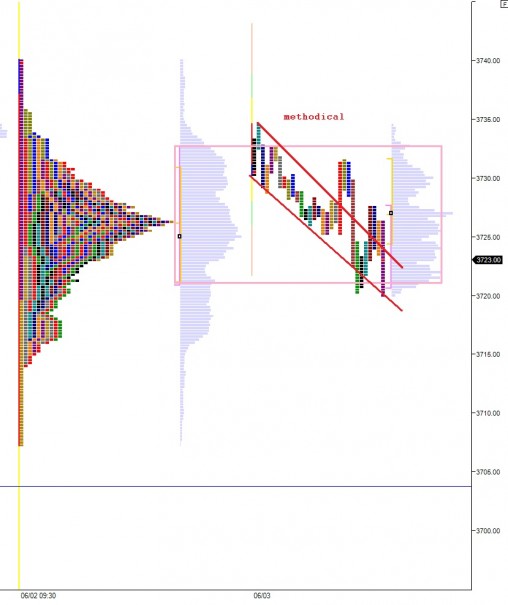

The steady selling overnight methodically auctioned the entire vale area of this large distribution forming on the 24-hour profile, have a look:

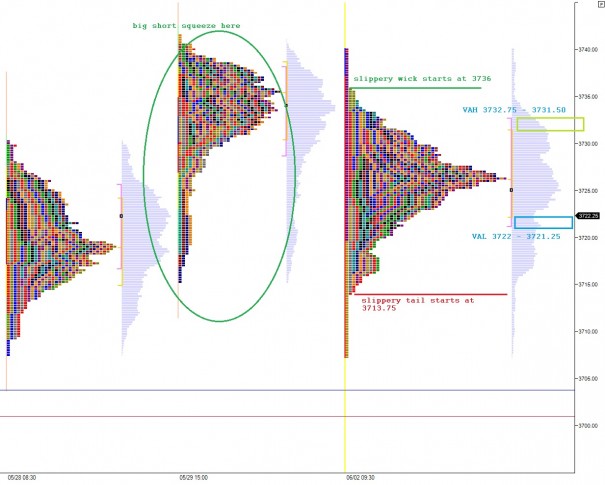

When I see this type of action, wholly emerged within my well established profile, I compress it into my existing profile. This does two things—it tells me the context has not yet changed and better defines the relevant price levels. With all the economic information being created 24-hours a day in our global economy, it makes sense to keep these 24 hour profiles in mind as we go about our trading day. Here is the merged profile, along with the profiles that exist behind it:

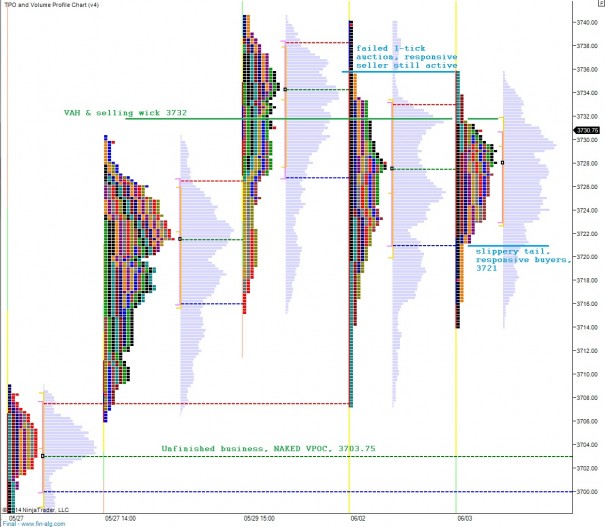

Turning our attention to the RTH market profile, you can see the compression taking place as the short term comes into balance. Yesterday we printed a SECOND normal day, with a close in the upper quadrant, which was also an INSIDE day. That is some serious compression, and the eventual move away from this value zone will likely have some power. I have marked up the profiles below:

Breaks from this type of serious compression can sometimes be FAKES…gut wrenching moves out of balance with equally gut wrenching reversals. I could see this happening to shorts here, only because we have the “unfinished business” of a naked VPOC at 3703.75. Should that level receive a hotplate reaction via responsive buying, then we very likely could launch back into our balance.

The selling is accelerating a bit as I complete my post. We are now priced to open very much on the low end of intermediate term balance. However, this balance is still in play until we see sustained trade below 3709. Sustained is the key, because as mentioned before, we have unfinished business, a naked VPOC at 3703.75. It should be an interesting session. Here is the intermediate term picture:

If you enjoy the content at iBankCoin, please follow us on Twitter

Scenario 1: sellers drive lower off open, down the zipper tail and test the naked VPOC at 3703.75 where we find responsive buying

Scenario 2: Test lower, find responsive buying at Tuesday O/S high and buying tail 3721.50, and rotate though YEST VAL 3723, and begin working a gap fill trade up to 3730.75

Scenario 3: test higher, find responsive sellers at VAL 3723, and rotate down through buying tail zipper to test low of the day 3714

straight up scenario 3 in play