Observing the long wick-like characteristic of our current developing value I surmised a move lower would not surprise me. However, I did not cover any swing longs because a move lower may or may not change anything about market conditions. The key factor in this case is velocity and location.

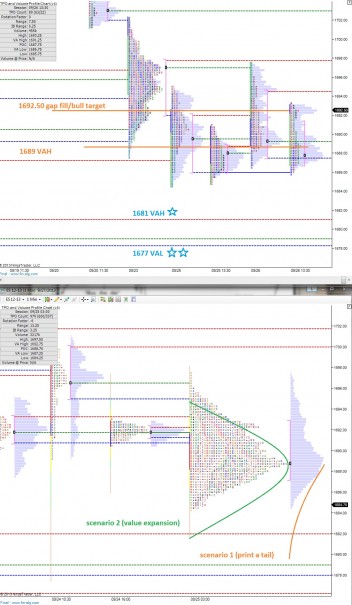

We have a gap below, dating back to 9/11 and these market voids tend to get filled. We are only a point away from the upper boundary of the gap fill but it is more important to focus on the value area that developed just below this gap. In this case, it was formed over two days, from 9/11 – 9/12 and it has very good reference points.

1681 is our first level of support, the value area high. The price level also coincides with a very effective Fibonacci extension. The value area low is at 1677 which aligns well with another Fibonacci extension. Therefore again, I see weakness as a buying opportunity.

However, I do not want to see us spending too much time below 1681 which would signal the market is accepting the lower value. Instead I am looking for the sharp-type of rejections we have been seeing from the sellers every time we attempt to explore higher—I want to see the choppiness cut both ways if you will.

The market rotated quite a bit overnight, printing over an eleven handle range. Indecision is certainly high as we roll into month end. I give the sellers an edge early on unless the bulls can recapture and sustain trade above 1689 which is yesterday’s VPOC.

I’ve noted key levels on the following market profile charts:

If you enjoy the content at iBankCoin, please follow us on Twitter

I love your work.

I very much appreciate your work too good sir, thank you

Damn Raul3, OA just passed you his Philly blunt.

BST, iBC is FTW only RVLT comrade