42% of Ukraine’s exports are grain related. They are the “bread basket” of Europe. A few months ago Russia agreed to open a “grain corridor” to Turkey so Ukraine could export their grain. Due to a series of underwater drone attacks in the Black Sea, Russia has canceled the agreement and blames the Uk for facilitating the attack.

Full statement:

This development will undoubtedly cause inflation to rise in Europe, as the price of food rises due to lack of grain supply.

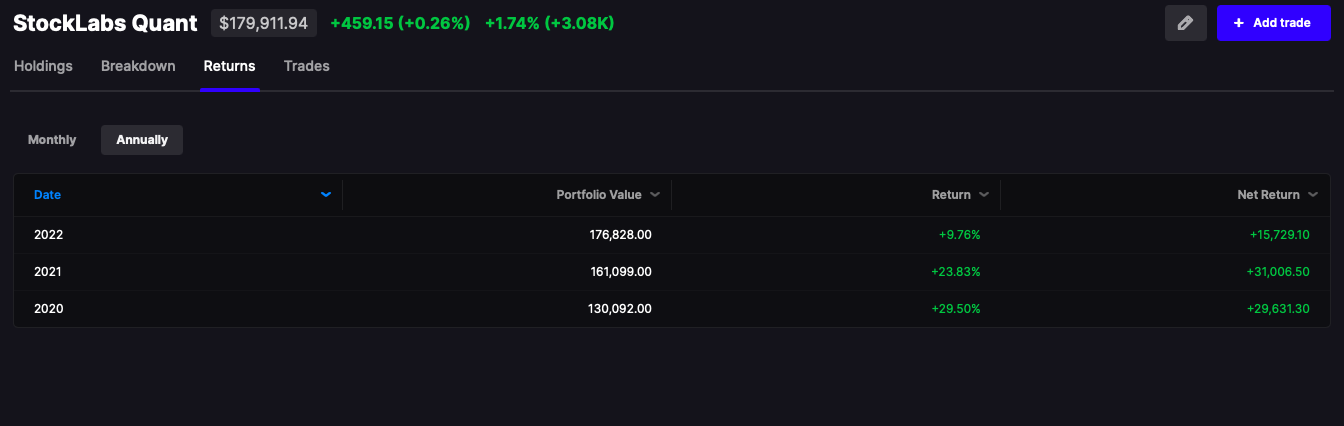

I’d also like to remind people of the returns for the NASDAQ over a number of time periods.

Do stocks deserve to be +42% from 2019 levels?

The NASDAQ is down 14% over the past 6 months. I’m in fact only up 3% over the same time frame. My bias has been to be short, but I’ve also hedged myself almost every day because of rallies like Friday. In October alone we’ve had 7 rallies of 2% or greater. Is that the behavior of a bear market? No. But we are in one, without a doubt.

We were up 12% in July and people thought the market bottomed. Then we sunk 15% from August through September and now we are up 5% for October. How confident are you that stocks will continue heading higher into peak shopping season? Will consumers steam out in droves to stockpile on the latest tech gadgets amidst this economic backdrop? Conversely, if you’re short stocks, how comfortable are you shorting into the hole with bell weather stocks down 50-80% YTD?

For all those disappointed that I’ve had muted returns the past 6 mos, fuck off. This has been a very hard market to navigate and my responsibility isn’t to be the organ grinder’s monkey but to preserve and methodically grow my 50% YTD returns. My breakouts usually happens in wild streaks and I always temper myself after achieving success. In 2021, my returns were +218%. But look at the monthly distribution.

I started 2021 at $150k, rose to $450k by May 1 and then traded around that level through year end, finishing at $492k.

In January of 2022, I dipped to $440k because I was wrong. That was my bottom and I busted loose in February, rising to $633k by April 1 and have methodically traded higher since then — closing Friday at $737k.

I can comfortably assume my returns are in the top quartile of all traders/money managers on the planet the past decade plus. If I’m so good and telling you this is a hard tape, this is a fucking hard tape.

Stop complaining.

Comments »