Over the weekend a delightful research paper was released by David Reifschneider, who is the deputy director of the division of research and statistics at the Board of Governors of the Federal Reserve System. In it, he cites the low levels of interest rates and indulged himself to imagine what an economic downturn might look like in the post QE era.

The results were less than awe-inspiring.

The degree of economic downturn used in the study were the base case, standard, run of the mill scenario: negative shockwaves reverberating throughout America–sending unemployment up by a mere 5%.

“Simulations of the FRB/US model of a severe recession suggest that large-scale asset purchases and forward guidance about the future path of the federal funds rate should be able to provide enough additional accommodation to fully compensate for a more limited to cut short-term interest rates in most, but probably not all, circumstances,” Reifschneider writes.

Moreover, Reifschneider factored in a psychotic $4 trillion QE programme, plopped atop the current $4.5t Fed balance sheet and could only jimmy rig the unemployment rate by 0.2%. And this is assuming the Fed funds rates would be at 2-3%, a far cry from the current rates of 0.5%.

“In the simulation, QE and forward guidance take 10 year yields down 225 basis points to 300 basis points depending on the starting point for Fed funds and whether you do $2 trillion or $4 trillion for QE,” he says. “But that is not going to work very well if, by design, Fed funds and 10 year yields can’t go below zero. And if expected rates are already low then forward guidance does not have much room” to stimulate the economy. In effect, Fed officials would have to “keep a straight face while saying they we will keep rates at zero … forever.”

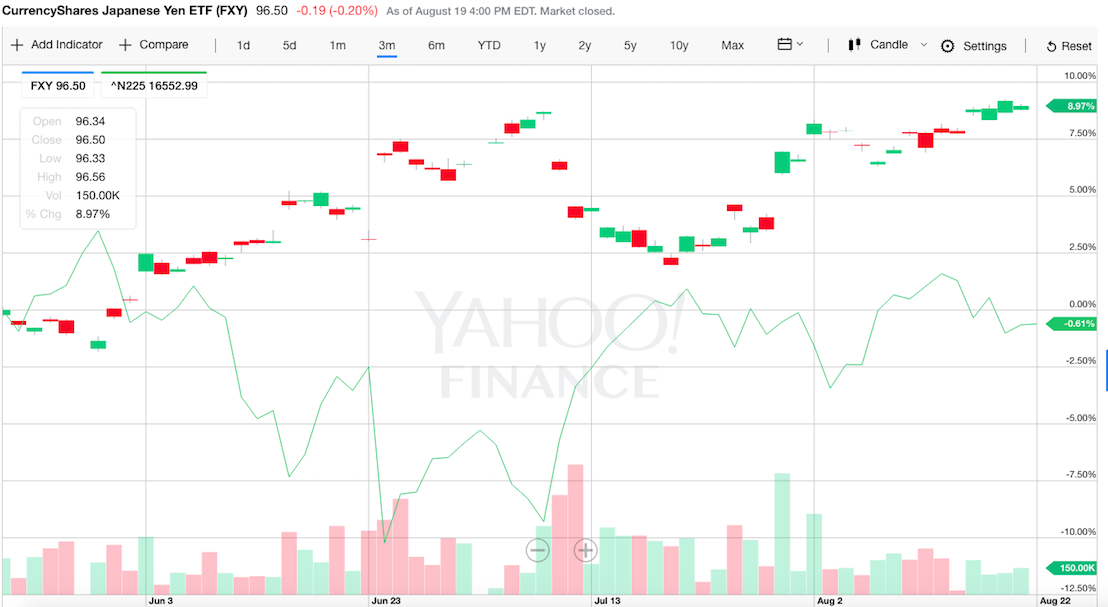

In other words, QE for life–like I’ve been saying. And, even with QE for life, we’re still doomed. However, I am sure stock prices will do just fine under these conditions, with the Fed intervening with an enormous $4t QE warchest.

Rigged.

Comments »