The median return for the housing sector is +6% this year. Over the past two years, however, the sector is down by 8.8%, in spite of record low interest rates and record high stock prices.

Today Toll Brothers came out with better than expected results and truly lauded the state of the residential market in their call.

Contracts grew in every region; virtually every metric improved Y/Y. TOL saw sequential improvement throughout Q3 and August reservations were up 23%.

- Repurchased ~3.7 mln shares at $26.33/share ($97 mln), representing ~2% of outstanding shares. Will opportunistically buy back stock

- Still bought $459 mln in land, mostly in California; now has 48K lots owned/optioned

- Margin reduction a result of some higher margin City Living property deliveries being pushed out into FY17.

- Not seeing any softness in luxury home market.

- No change in appetite from foreign buyers (low to mid-single digit mix)

- High end of NYC market is fine. Remains bullish in California, well positioned. Ivy Zellman said co is ‘kililng it.

- California, Vegas, No. Virginia, NJ/PA, Seattle, Dallas, Raleigh all strong; both coasts going well.

As a result, shares of many homebuilder stocks are rising.

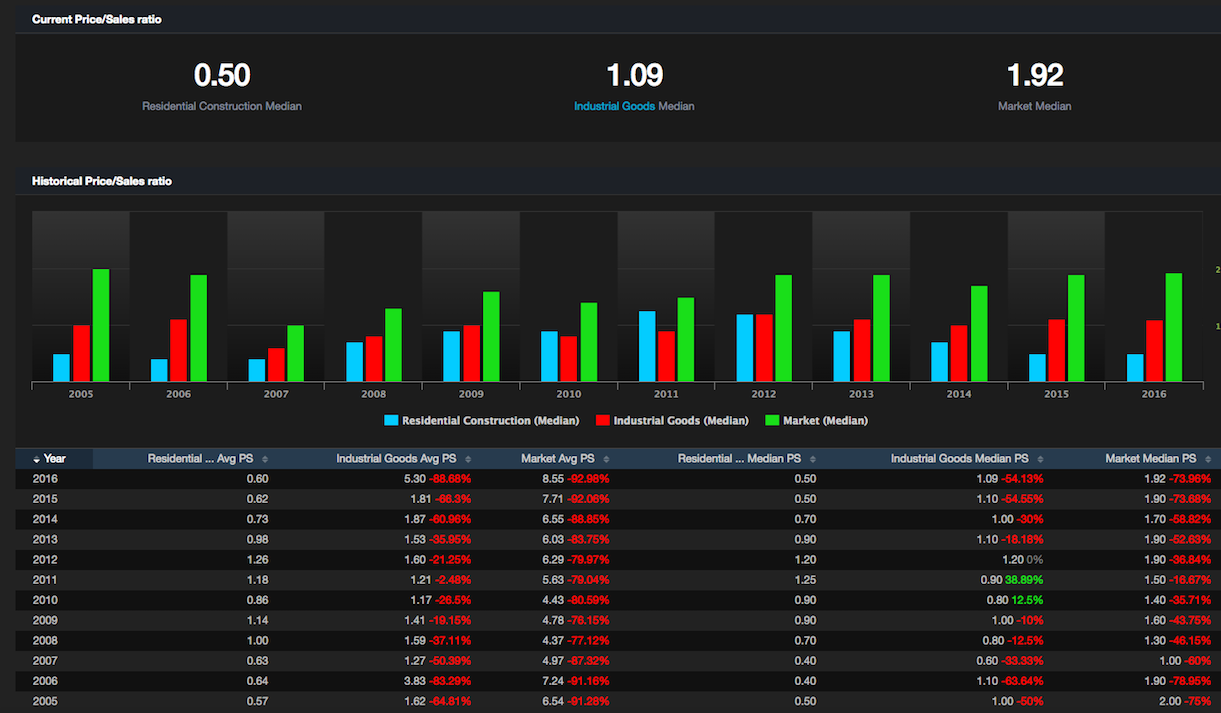

According to Exodus, valuations for the sector haven’t been this attractive since 2007.

But that was a different story back then, wasn’t it? Homies were crushing numbers and trading like internet stocks, because of the housing bubble. Aside from the luxury market, there isn’t a bubble in real estate anymore. If your home is priced in the $300k-$999k range, values haven’t moved in years.

Having established those points, this is an intriguing sector to be long, if you believe the economy will improve and the Fed might hike rates over the next 12 months. Typically, the specter of higher rates coerces people into buying, in order to lock in rates.

Home ownership is at 50 years lows, as the younger class of vagabonds rent inside of filthy and disgusting urban centers. But there’s always a counter-balance and I am sure some of these punk kids, once properly employed, will venture out into the suburbs for a cleaner and better life. They’ll buy a home, and a few fucking dogs, and live happily ever after.

Seasonally speaking, September is the worst time to own the sector, which means it might be a good time to buy dips.

While everyone seems to be focused on the caprices of Amazon and Exxon shareholder behavior, there is a whole sector of economically sensitive stocks out there–trading at historically low valuations, that are now moving to the upside.

Comments »