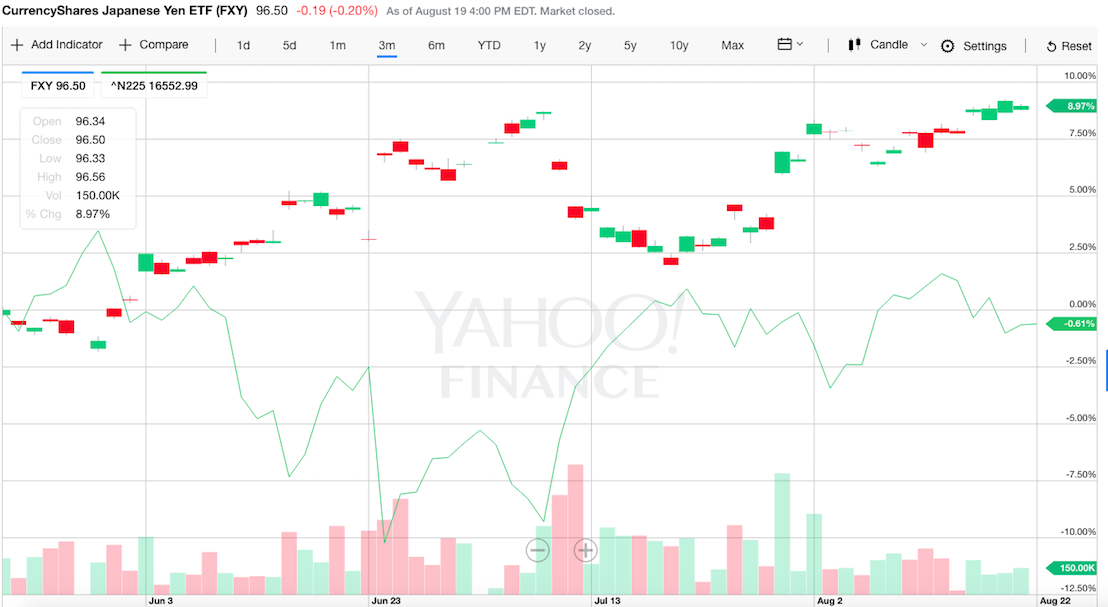

Apparently, no one is afraid of a strengthening yen anymore. The good folks at the BOJ have done a splendid job cornering their stock market, via QE fueled ETF purchases in the open market, jacking up share prices of companies that should be indelibly fucked. With the yen rising against the dollar, Japanese exporters and yen carry trade players are placed inside of a jam-box with no place to go but down. Nevertheless, the NIKKEI has been drifting along just fine this summer, as the central bank robber barons apply their science to the markets.

“There is some skepticism that they are going to mount an even stronger defense against yen appreciation,” Todd Elmer, Citigroup’s head of G-10 foreign-exchange strategy for Asia ex-Japan, said in an interview in Singapore on Friday. “International authorities aren’t going to be seeing any signs that a stronger yen is destabilizing other markets. If anything, since the spring, there does seem to be some degree of agreement among international authorities that a somewhat weaker dollar is a better outcome for global markets.”

MOAR

A weak dollar has “been associated with stronger asset prices, less volatility, and I don’t think that pattern is going to change anytime soon,” Elmer said.

The yen will probably reach 95 before the Bank of Japan meets on Sept. 21 unless investors are convinced the authorities will move beyond the policy steps that have been unveiled so far, he said.

The BOJ last month disappointed investors by leaving two key policy tools — bond purchases and negative interest rates — unchanged. That sentiment was compounded after details of a 28 trillion yen ($278 billion) fiscal spending package released on Aug. 2 failed to ignite optimism that Japanese Prime Minister Shinzo Abe can boost growth.

“To me the path of least resistance is lower for dollar-yen,” Elmer said. “There’s not a great deal of fear in the market for intervention.”

Typically, when the yen rises, the NIKKEI falls. Not recently.

Year to date, the yen is higher by 20% v the dollar and the NIKKEI is down 12.25%

If you enjoy the content at iBankCoin, please follow us on Twitter