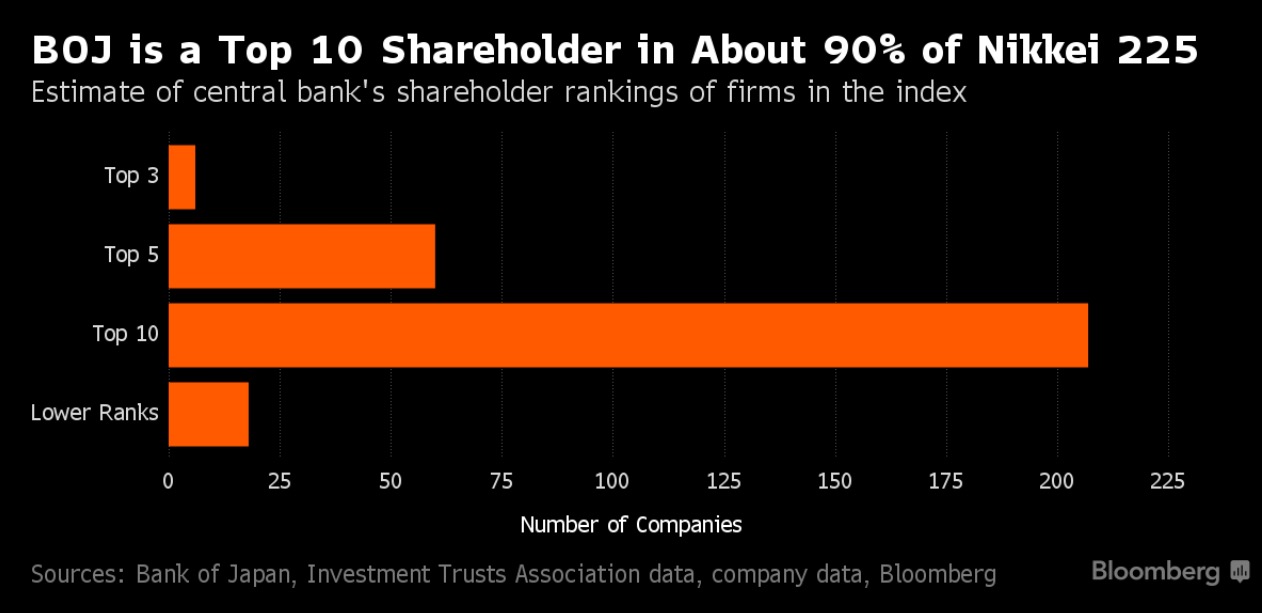

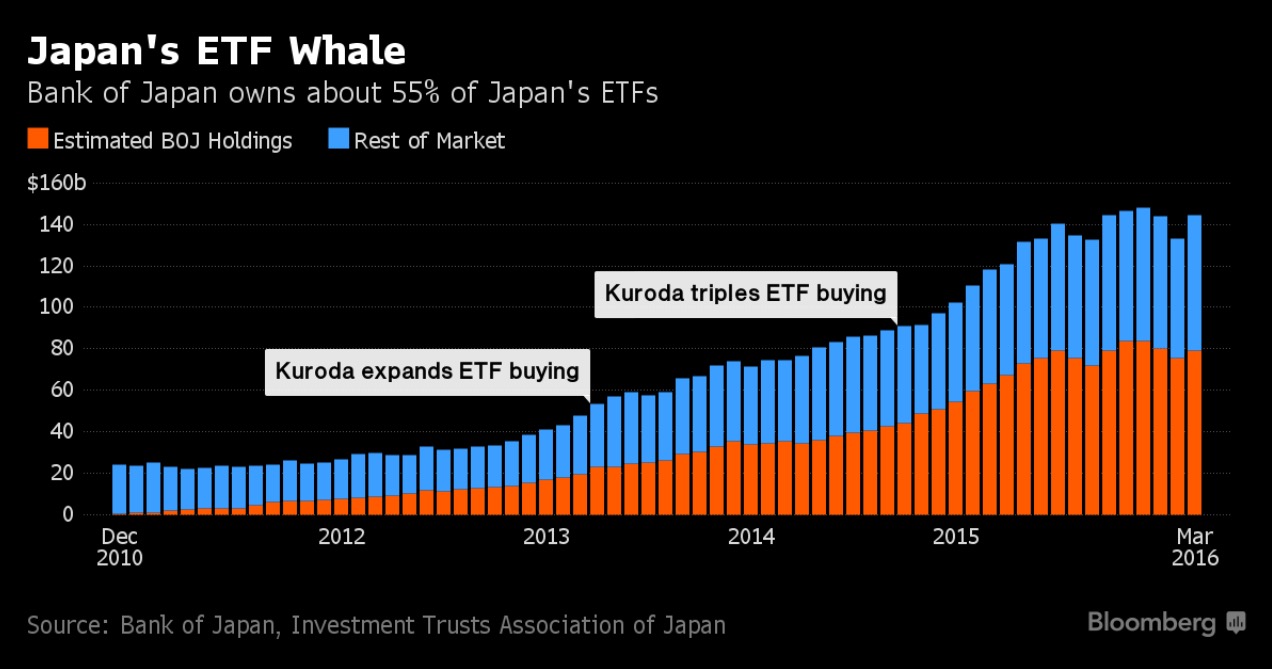

Due to Abenomics and Japan’s QE program that includes the explicit purchase of ETFs, the Bank of Japan now owns nearly 2% of all Japanese stocks and is #2 in net holdings next to Japanese pension funds.

This is manipulation of a wanton varietal.

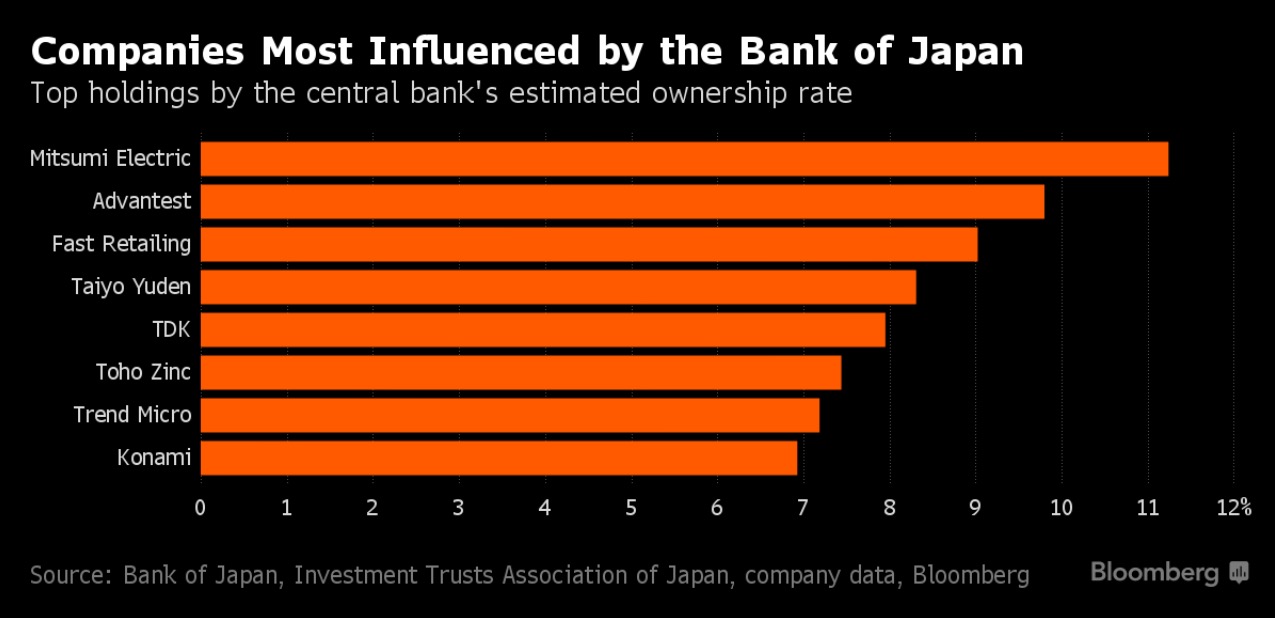

To critics already wary of the central bank’s outsized impact on the Japanese bond market, the BOJ’s growing influence in stocks risks distorting valuations and undermining efforts to improve corporate governance. Proponents, meanwhile, say the purchases provide a much-needed boost to investor confidence. With the Nikkei 225 down 7.7 percent this year and inflation well below official targets, a majority of analysts surveyed by Bloomberg predict the BOJ will boost its ETF buying — a move that could come as soon as Thursday.

“For those who want shares to go up at any cost, it’s absolutely fantastic that the BOJ is buying so much,” said Shingo Ide, chief equity strategist at NLI Research Institute in Tokyo. “But this is clearly distorting the sanity of the stock market.”

How does this end? Does the BOJ, eventually, own 10,15 or 20% of all Japanese stocks? Every time you take note of the NIKKEI gapping higher, just know, it’s a facade.

If you enjoy the content at iBankCoin, please follow us on Twitter

There is one, and only one, solution for the Japanese (and everybody else): TAKE THE PAIN, NOW. It is either that or have all your limbs amputated without anesthetic at some time in the future…guaranteed.

What does this imply though? Common stock can be held forever and central banks aren’t subject to margin calls. Also, will the BOJ start to change the corporate culture in companies where it has a big % of the company. It just seems, right now, that the BOJ is doing a little “nationalization” in order to lower volatility.

thoughtful rumination but it is ultimately just elevating values during&into deteriorating circumstances. which. only leads to bigger balloon bursting in the end

They can’t possibly sell at the bottom, can they?

I close my eyes and I ponder Japan throughout history and the Japanese diaspora .

The Japanese market will fly when they stop rigging it. Funny how the tape works.

The permabear vindication has Begun:

– Facade

– Manipulation

– Distorted Valuation

Hey bulls how do you think those stock markets are moving.

Technology in 2014 2015 a little different from 1928?

Think 19000 Nikkei indicates a strong Japan?

Think things are being somewhat

fabricated for

you?

Just by watching NK futures you can infer that they’re buying everyday between 7pm & 730pm