Bloomberg is out with a fictional piece this evening — asserting that creditors are selling treasuries because of Trump.

(adjusts microphone)

WRONG!

Anyone mildly versed in capital markets knows that when Trump was elected President on 11/8/16, equity markets took off — which also caused a rout in the bond market. The reason for this is because investors viewed Trump as a weapon of inflation — someone who’d cut taxes, regulations and spur a massive fiscal stimulus budget. In no way was the sell off in bonds a revolt by foreign governments because they were afraid of Trump. Think of the markets like you would a see-saw: stocks up, bonds down and vice versa.

It’s also worth mentioning that our so called ‘creditors’ are small time holders of treasuries, in comparison to our own Federal Reserve — who own upwards of $2t in U.S. debt.

As per the BBG retard level thinking piece.

In the age of Trump, America’s biggest foreign creditors are suddenly having second thoughts about financing the U.S. government.

In Japan, the largest holder of Treasuries, investors culled their stakes in December by the most in almost four years, the Ministry of Finance’s most recent figures show. What’s striking is the selling has persisted at a time when going abroad has rarely been so attractive. And it’s not just the Japanese. Across the world, foreigners are pulling back from U.S. debt like never before.

Classic care-trolling. The U.S. can borrow as much as it likes. The author of the article is either completely ignorant on matters of finance or purposefully malicious with his editorial slant.

From Tokyo to Beijing and London, the consensus is clear: few overseas investors want to step into the $13.9 trillion U.S. Treasury market right now. Whether it’s the prospect of bigger deficits and more inflation under President Donald Trump or higher interest rates from the Federal Reserve, the world’s safest debt market seems less of a sure thing — particularly after the upswing in yields since November. And then there is Trump’s penchant for saber rattling, which has made staying home that much easier.

Nobody is saying that foreigners will abandon Treasuries altogether. After all, they still hold $5.94 trillion, or roughly 43 percent of the U.S. government debt market. (Though that’s down from 56 percent in 2008.) A significant drawdown can harm major holders like Japan and China as much as it does the U.S.

It’s down from 56% because the god damned Federal Reserve has been buying it all. This is a prime example of intentionally misleading the reader.

Nevertheless, any consistent drop-off in foreign demand could have lasting consequences on America’s ability to finance itself cheaply, particularly in light of Trump’s ambitious plans to boost infrastructure spending, cut taxes and put “America First.” The president has singled out Japan and China, the two biggest overseas creditors, as well as Germany, for devaluing their currencies to gain an unfair advantage in trade.

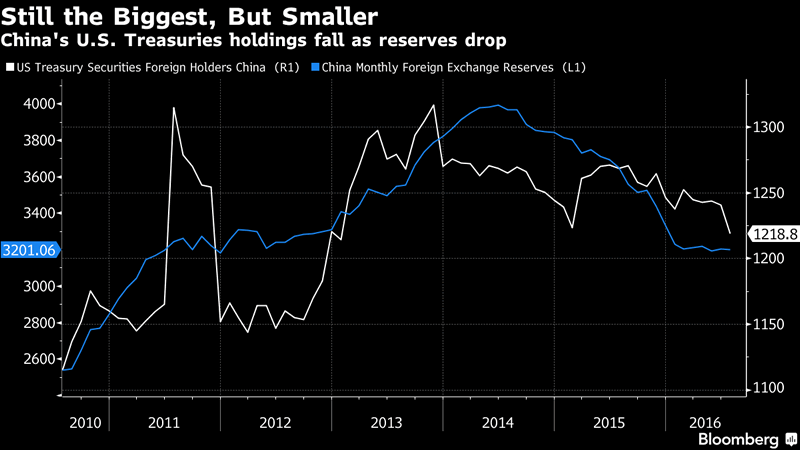

In December, Japanese investors reduced their investments in U.S. debt by 2.39 trillion yen ($21.3 billion) after a smaller pullback in November. While only a fraction of Japan’s $1.1 trillion of holdings, they were first the back-to-back declines since the start of 2014. China, which owns just over $1 trillion of Treasuries, has been selling since May. Its holdings are at a seven-year low.

Notice how the other glosses over the fact that the former largest holder of U.S. debt, China, has been culling its treasury holdings for 7 years — all of which done under the Obama regime? The Chinese have been selling for quite some time, as their economy slows and their currency drops to 8 year lows — all due to a larger and more serious matter regarding capital flight.

And investors like Kunibe can ill-afford more losses. Last quarter, Japanese investors who hedged all their dollar exposure in Treasuries suffered a 4.7 percent loss — the biggest in at least three decades, data from Bank of America showed. The same thing happened in Europe, where record currency-hedged losses also stung euro-based buyers.

“It was a deer in the headlights moment,” said Zoltan Pozsar, a research analyst at Credit Suisse.

Combined with the unpredictability of Trump’s tweet storms, interest-rate increases in the U.S. could further sap overseas demand. Mark Dowding, who helps oversees about $50 billion as co-head of investment-grade debt at BlueBay Asset Management in London, says the firm has already moved to insulate itself from further losses due to higher rates.

What’s more, central bankers in Japan and Europe are still experimenting with monetary policies that may benefit bond investors locally.

Right now, it’s just “much easier to stay home than go abroad,” said Shyam Rajan, Bank of America’s head of U.S. rates strategy.

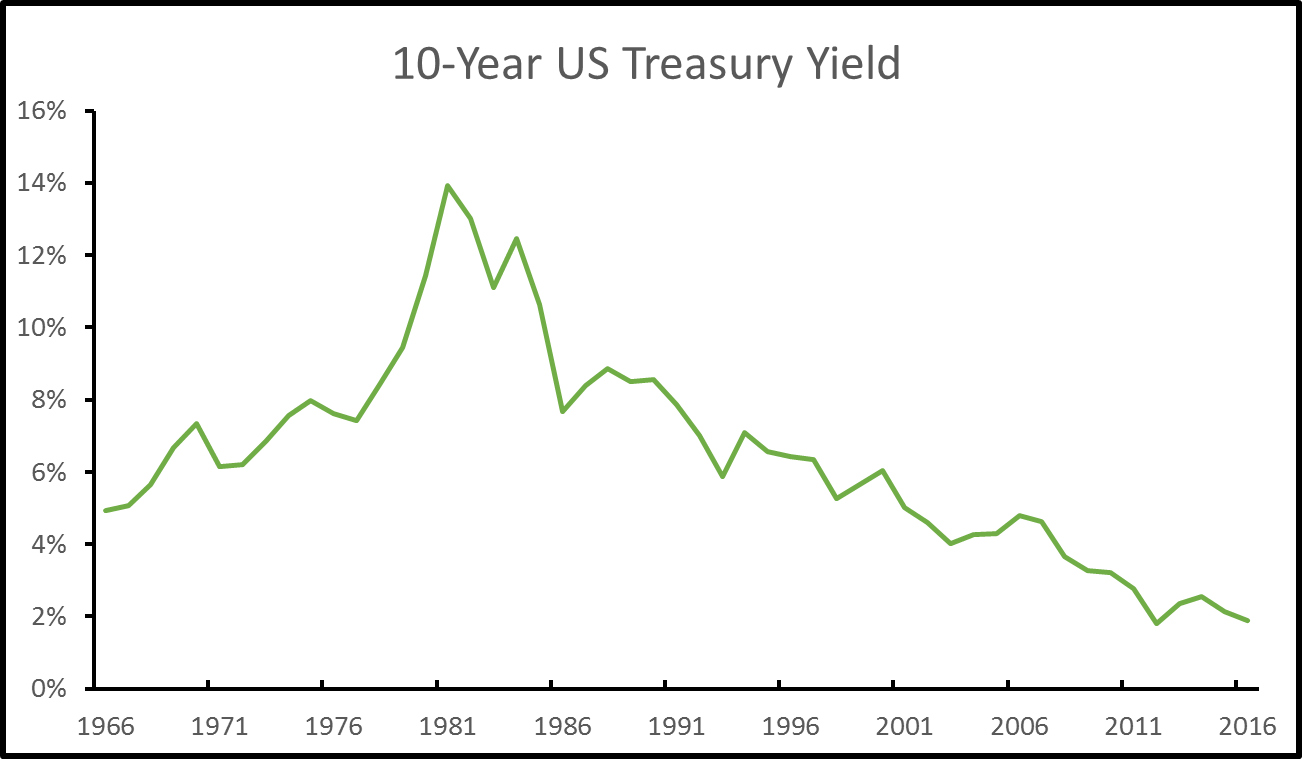

What in the actual fuck are they talking about? Rates are near ALL-TIME record lows. America is the primary market for debt issuance — the envy of the world and they make it seem like we’re struggling to raise capital to fund our over bloated and ridiculous surplus spending.

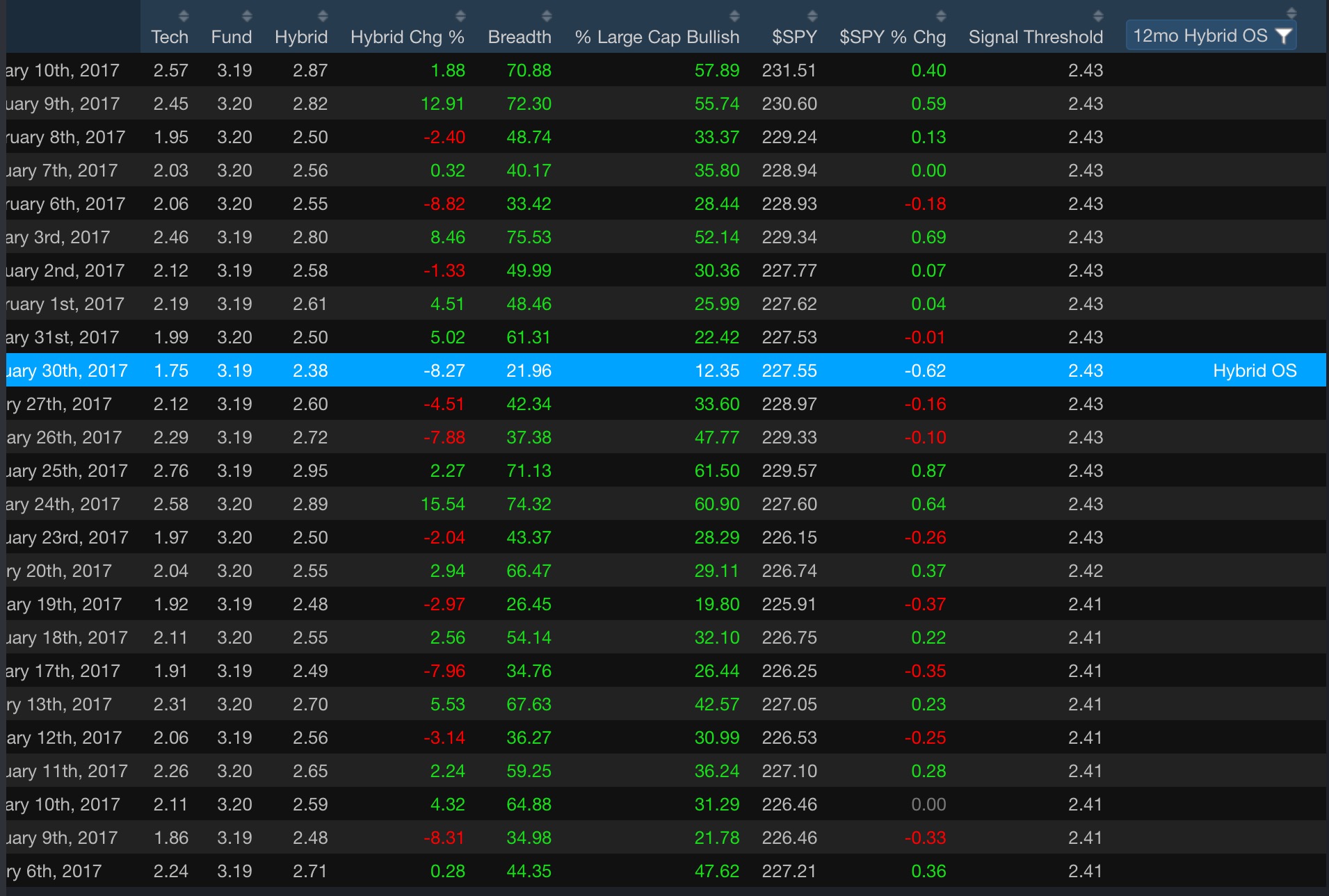

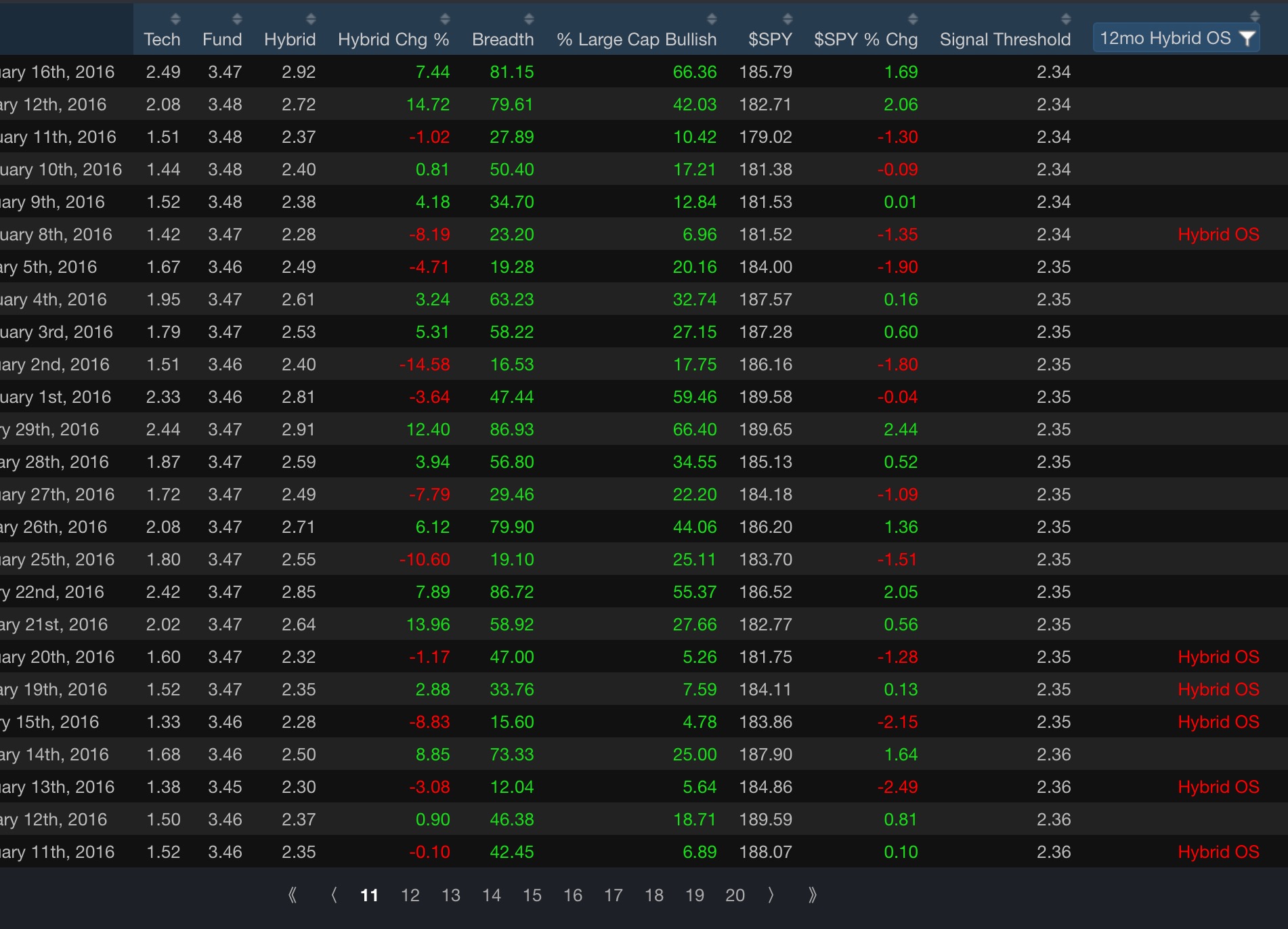

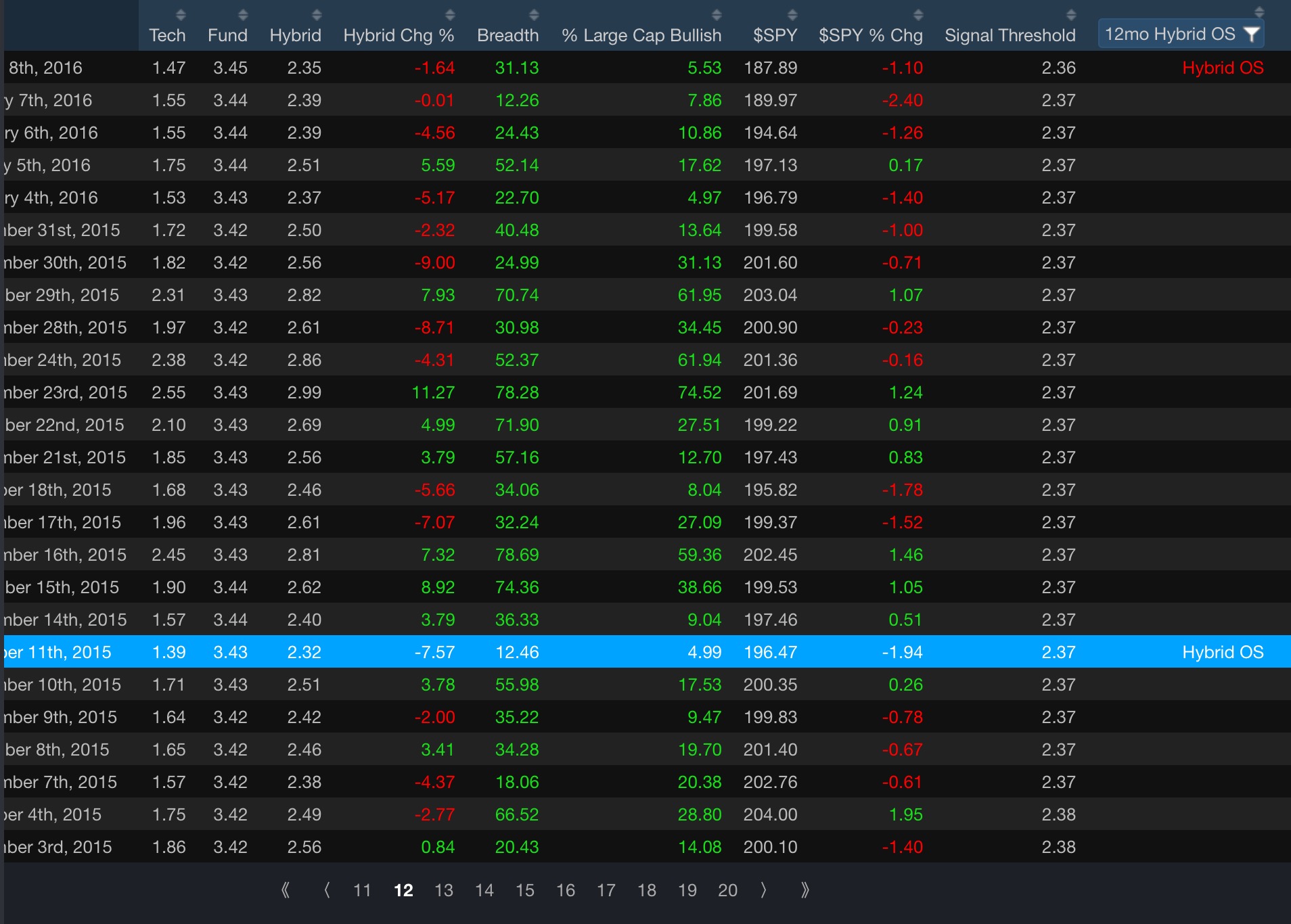

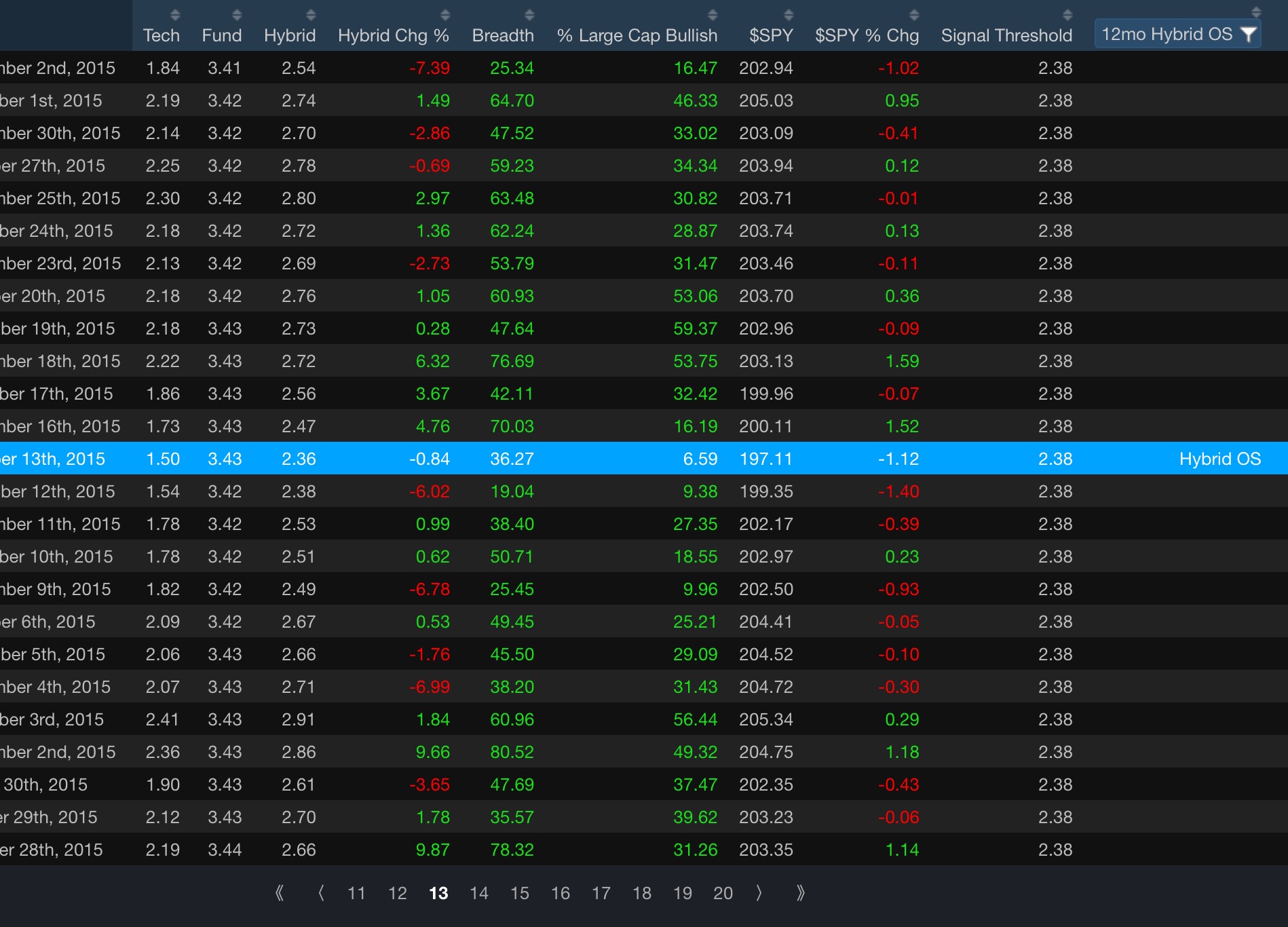

Here are the top holders of U.S. debt.

In other words, our own Federal Reserve owns more US debt than both Japan and China combined — at $2.4t. Why wasn’t that noted in this absurd article cobbled together, lazily, by a Brian Chappatta?

Bonds topped in the summer of 2016. Naturally, asset allocators responded in kind to record prices and sold some to fund whatever projects they deemed more important to their national interests. The worrisome tone about the Japanese central bank selling treasuries — due to Trump — isn’t credible and is without merit, especially when considering Japan is beset with the largest debt/gdp burden of any developed nation in the world — at 230%.

Plus, let’s not forget that the BOJ is currently undergoing a gargantuan perversion of finance — purchasing their own debt and equity ETFs to the tune of $700+ billion per annum. Additionally, the BOJ is the largest owner of equity ETFs in the country — purely and blatantly manipulating every single aspect of their control economy. To chalk up the BOJ’s nonsensical and unconventional monetary actions to Trump winning the election is both stupid and unnecessarily divisive. Then again, it’s Bloomberg, so we should come to expect this sordid brand of yellow journalism.

Comments »