Don’t give me fake news wins memes. I’ve been ignoring this story because the media has been so apoplectic about nearly every god damned thing Trump did, I stopped viewing them as credible.

Now, whether Flynn did something wrong or simply fell on his sword to remove a major distraction for Trump is not really an important distinction. Let’s assume the globalist shills in the media are truly out to get Trump (duh), don’t you think this is going to embolden them to go after someone else next?

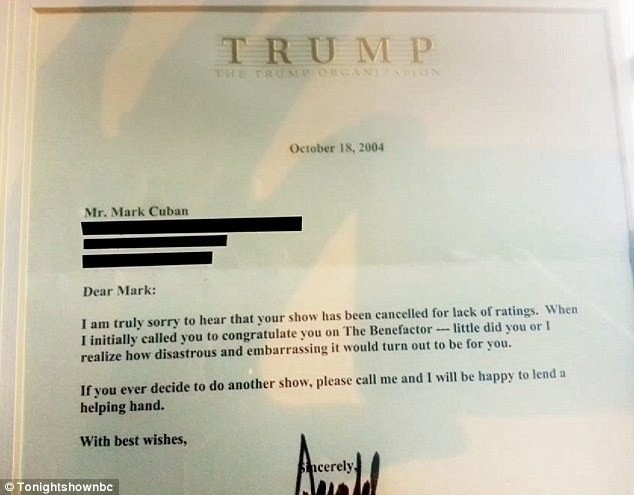

Trump is a master at PR, so it’ll be interesting to see how he spins this. After all, he’s the guy who got caught saying he’d grab her in the pussy and move on her like a bitch, and still get elected as President of these United Steaks.

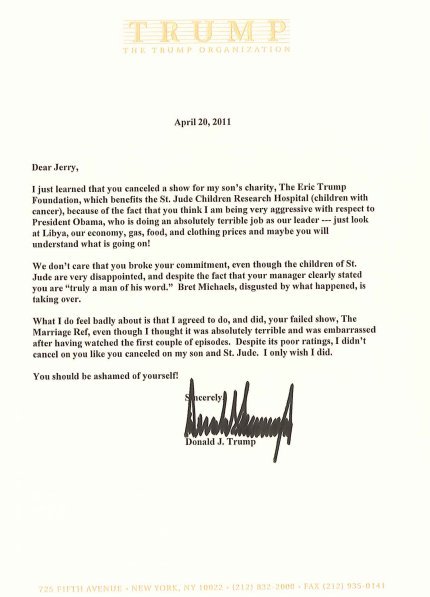

Here’s his resignation letter.

Source: CNN

Washington (CNN)Embattled White House national security adviser Michael Flynn resigned Monday night, two sources tell CNN.

His departure came just after reports surfaced the Justice Department warned the Trump administration last month that Flynn misled administration officials regarding his communications with the Russian ambassador to the United States and was potentially vulnerable to blackmail by the Russians.

The move comes less than a month into the job, making him one of the shortest-serving senior presidential advisers in modern history.

The sudden exit marks the most public display yet of disarray at the highest levels of the new administration, which has faced repeated questions over a slew of controversies and reports of infighting among senior aides during its first three weeks.

The shakeup now leaves Trump without one of his closest and longest-serving advisers. Flynn had counseled Trump on foreign policy and national security matters since early in the 2016 presidential race.

Flynn was not able to definitively refute a Washington Post story late last week that his conversations with Russian Ambassador Sergey Kislyak included communication about the sanctions. It is illegal for unauthorized private citizens to negotiate with foreign governments on behalf of the US.

The controversy intensified after the report put Pence and several senior White House advisers in an uncomfortable position, as they had denied in TV interviews weeks earlier that Flynn discussed sanctions with the ambassador. Some administration officials said Flynn must have misled Pence and others.

“The knives are out,” a White House official told CNN on Friday, noting that “there’s a lot of unhappiness about this.”

Many expressed concern at the idea that Flynn, a retired lieutenant general who headed the Defense Intelligence Agency, would discuss sanctions with a foreign official whose calls are regularly monitored by US intelligence and law enforcement agencies.

A US official confirmed to CNN on Friday that Flynn and Kislyak did speak about sanctions, among other matters, during a December call.

But after the call was made public, Pence told CBS News on January 15 that Flynn did not talk with Kislyak about the sanctions, which the Obama administration recently levied due to Russia’s alleged interference in the 2016 elections.

“They did not discuss anything having to do with the United States’ decision to expel diplomats or impose censure against Russia,” Pence told CBS News.

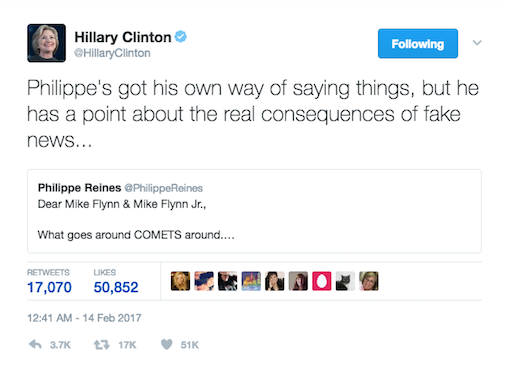

In summary, Trump defeated Hillary, which caused liberals to go apeshit over Russian hacking accusations, which caused Obama to levy sanctions, which caused Mike Flynn to allegedly have a discussion with Russia about this, errantly, before he was authorized to do so. Clearly, this was all semantics, but rules are rules.

In short, Obama laid the trap and Washpo executed it.

UPDATE: Popular alt right guy seems to think this is the work of Reince.

Comments »