After the close, $CLF announced a share offering of 50m shares to be used for the purposes of purchasing some of its senior notes — which as of tonight trades below par at around $95. This is precisely what a company on the mend is supposed to do — deleverage the balance sheet using the stock as the prime currency.

This is all very bullish — as it demonstrates a keen demand for the shares even at elevated levels.

Cliffs Natural Resources commences offering of 50 mln common shares or up to an aggregate of 57.5 mln Common Shares if the underwriter exercises its option (11.37 +1.85)

Co intends to use a portion of the net proceeds received from the Offering to fund the purchase of certain of its outstanding senior notes due March 2020, October 2020 and April 2021 pursuant to tender offers, including fees and expenses related to the tender offers. The Company intends to use the remaining net proceeds of this Offering for general corporate purposes, including the redemption of a portion of its outstanding senior secured notes and/or the repurchase of additional tender notes.

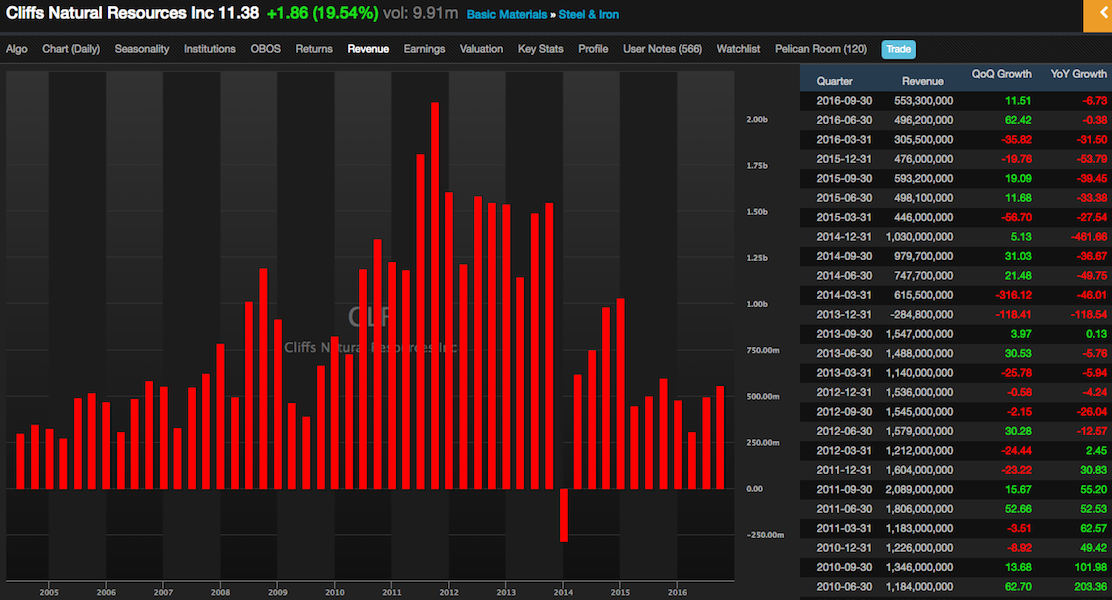

Bear in mind, this is a company in the midst of a major turn around. In spite of the recent surge, as you can see by the chart below, the stock is way off its highs — set back in 2011.

Note the earnings trends have been dreadful, but looking up.

And, have a look at the massive drawdown in revenues since the peak in 2011. If we are entering a new era of growth for the industry, those high end revenue numbers can be challenged again. Where do you think the share price will go if that were to happen?

The share offering is fodder, subterfuge, for the much bigger story. Take another look at the earnings that were reported this morning and understand that none of that reflected a prospective Trump fiscal stimulus boom.

CLF reported net earnings (attributable to Cliffs shareholders) of $79.1 million or 34 cents per share in the fourth quarter of 2016, versus net loss (attributable to Cliffs shareholders) of $60.3 million or 39 cents per share logged in the year-ago quarter.

Adjusted earnings (excluding one-time items) for the reported quarter came in at 41 cents per share, beating the Zacks Consensus Estimate of earnings of 25 cents.

Sales for the quarter came in at $754 million, surging 58.4% from $476 million in the prior-year quarter. Sales also beat the Zacks Consensus Estimate of $688.5 million.

Full-Year 2016

Cliffs recorded consolidated sales of $2.1 billion in 2016, up 5% from 2015. Net income attributable to the company’s shareholders in the year came in at $174 million or 87 cents per share, against a net loss of $788 million or $5.13 per share recorded in 2015.

This was a significant report, as it represented the 1st revenue growth quarter since Q3 of 2013 and just the second growth quarter since Q2 of 2012. The last time we saw growth likes this was in early 2010 — as the stock made its way from $20 to $90 over the next two years.

Buy all dips.

If you enjoy the content at iBankCoin, please follow us on Twitter

#enjoy xd

Got it!

I’ll sleep a little better.

Really cool earnings bar chart. I need to use my PPT more often.