This is my second of twelve purchases, over a 12 month horizon, of $HABT.

Comments »OIL TO SAVE THE DAY?

We are getting a fierce and ferocious bounce in oil related names. The stocks that have been the very bane to society might serve as its savior today. With 5-15% gains running strong now, there is a better than average chance it lifts the entire market higher today.

Keep on the look out for penis slicing reversals.

Comments »Good Morning: Great Calamity Awaits You

Last night I took to the Twitter to let the world know we’d be down 200+ today. The childish games with the futures markets has to end and many, many people should be imprisoned and/or executed because of it. Also, last night we got to see the Chinese market down more than 5%. This morning, the ass lovers from Greece have added turmoil to their daily repertoire, sending their utterly retarded exchange down 11%.

Adding insult to injury, CONN missed earnings by several football fields and will likely detonate C-4 explosives onto one of my smaller positions, HGG.

Nothing is going right this December–because the end of the bull market is here. This is happening NOW, in real time, and I missed it.

The breath taking drop in crude, coupled with a Fed Chief whose dimwitted and old as shit, makes for a very precarious situation near Dow 18,000.

Great declines await you my dear friends, as investors get washed out and their brains exploded by chards of metal. As you know, I am all but fully invested, maybe no more than 10% in cash. My year, and possibly my entire career, has been tossed into the flaming barrel of garbage for the history books to figure out at a later date. As a citizen of the United States, specifically hailing from the Northeast corridor where this great nation was founded, I fully intend to behave in a manner that is becoming of a gentlemen, withstanding outrageous losses whilst sipping on fine brandy, reading the morning newspaper.

Will I sell everything today?

That is the $24,000 question. I have a mind to do it, you know. At the end of the day, I am now beyond acceptance. I am in a new phase called “driving automobile made from dynamite sticks into a fucking wall that happens to be on fire.”

Do not join me in this ride, for I prefer to go it alone.

Comments »For the Holiday’s, I Bring to You: BLOGGING BONANZA!

I was going over the all-time traffic leaders on iBankCoin the other day, in which I lead the pack by a mere 11 million. And an idea struck me: why not get the old crew, sans those who excommunicated me and discarded iBC to the trash heap for the sake of ‘business’, for one week to talk to the reader class? I am still on good terms with all of the former tabbed bloggers, so I reached out to them and this is who I got so far.

Breakfast Taco (old school FOWS, MVIS days)

Danny aka SpyderCrusher

Woodshedder

Jakegint

The Chart Addict

Henry Fool

Rhino

Mr. Bilderberg

RAG

BEAS

The Devil

Chuck Bennett

The Analyst Bomber

Greenwriter

Scott Bleier

UPDATE: Gunners

Am I missing anyone?

The festivities will begin on the week of December 22nd and it will be something to BEHOLD.

THIS IS JUST A MINOR BLIP

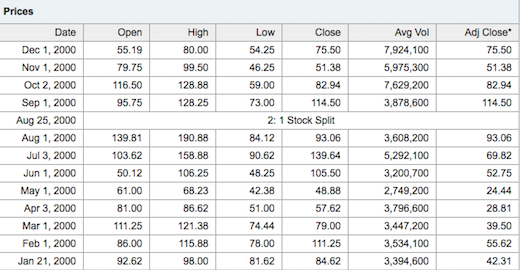

3 month returns from some of your favorite sectors.

Listen to me: If any of you talk shit today, I am flying out to your city to pummel your eyebrows off your head. Comments, such as “stop whining bra. Be a man” will result in you being placed on my kill list. This isn’t a game. I am not idly tossing around ideas for a newsletter. I AM BEING FUCKING DISMANTLED, in real time, using real money.

Now the CNBC will have you believe the market is doing just fine. Have a look at the image above.

I didn’t sell today–because I don’t sell into holes. You can sell into the hole and preserve your pittance. Seeing oil stocks down 75% over the past 3 months has me thinking “this may be overdone.” But that’s not even my problem. I have to deal with the Dante’s Inferno of owning GPRO, YELP, BALT and others.

I lost 3% today and I hate this life more than anything else in the world. I eagerly await the apocalypse and look forward to starting a new career as hired assasin.

Comments »Serious Question: Who’s Buying Oil Down Here?

Following some staggering 1 month declines to the tune of 50%, is anyone taking the plunge into oil here or around these prices? If so, what are your favorite ways to lose money in oil?

I am flabbergasted by the pin less hand grenade action in SLCA, EMES, HCLP and FMSA.

Comments »A December Forged in Hell

Although the market is flat today, there is widespread panic amidst a number of sectors, especially oil. Drillers, as a collective, are down a staggering 8% today alone. The month of December, usually marked with subtle moves and feelings of euphoria, has been nothing less than hellish for momentum players.

Here are some of the standouts, MTD.

(mkt cap bigger than $1bill)

BITA -21%

YY -15%

CTRP -16%

MBT -18%

CLF -17%

FMSA -25%

EMES -21%

BBEP -32%

YNDX -20%

TWTR -12%

GPRO -13%

ANET -18%

BIG -20%

JCP -22%

TSLA -11%

TNH -27%

EXPR -15%

On the bright side, the NASDAQ is slightly lower for the month, off just by 0.5%. Technicals have held up great, despite the collapse in oil. The last two times the NASDAQ fell in December was in 2011 and 2012, off by less than 1%–just like now. In January of 2012 and 2013, the NASDAQ rose by 8.43% and 2.67%, respectively. The market looks like shit now. But don’t count out a strong reflect rally in January. Until then, try to endure hell best you can.

Comments »A Brave New World After Oil

I am not going to try to find a bottom in crude. For all of you who are buying on the way down, I wish you luck. This isn’t like a stock that just missed earnings. Oil isn’t going to V-shape up. The major integrated oil companies are going to slash their capex budgets and the small players will be crushed because of it. Having said that, I am certain there is a violent upside bounce to be had somewhere. For me, I don’t feel like playing that game.

GPRO is trading sharply lower this morning, which is par for the course. It has morphed into a sickly stock, a regular Tiny Tim. Just a few weeks ago, it was a rock solid porn star, crushing the feeble skulls of those who bet against it. Now, geez, it’s just a paradiddle, easily crushed under the weight of weak sellers.

Instead of lamenting on my losers, which gets boring, let’s talk about the sea change that is taking place in fast food. MCD reported abysmal numbers this morning, which is a testament to how much America hates them. MCD, BKW, YUM and WEN are all on the way out, paving a path for new players like BWLD, CMG, HABT and PNRA.

To offer an analogy, HABT/Shake Shack and others of that ilk (high quality hamburger restaurant) are to MCD/BKW what Apple was to Compaq 10 years ago. MCD dominates the hamburger genre, but has lost its way. America is becoming a more health conscious society. You can easily see it in our consumption of soda vs water and cigarette use stats. The ascendency of WFM vs the bedraggled microbes at Pathmark and other ridiculous supermarkets is only the tip of the iceberg of what is coming.

Naturally, with any major shift in society, the move is incremental. Old schoolers will cling onto the past, bidding up MCD on any semblance of positive news. They will scoff at companies like HABT and Shake Shack as being ‘hyped’ or ‘overvalued’, point to lock up periods as a reason to hate the company–all noise. The bigger picture is market share shift and who will be the winners 5 years from now.

Comments »DOW 18,000

Let’s all take a moment to be thankful for the Dow Jones Industrial Average, as it approaches the historic number of 18,000. Never mind the fact that Visa made up 30% of the move higher, from 17,000 to 18,000, or that a myriad of high growth industries have been fucking pummeled into dust. Let’s simply ignore all of that and jerk off to the wonders of Dow 18,000.

One more thing before I go (extra Columbo), have a look at some of the returns of choice industries over these past 3, wonderful, months.

Oil and Drilling Exploration -44%

Alternative Energy -32%

Silver -29%

Gold -27%

Copper -23%

Steel & Iron -21%

Solar -17%

3-D Printing -15%

Broadcasting- Radio -15%

Foreign Utilities -14%

Construction -14%

Metal Fabrication -14%

Wireless Comm -14%

Toys and Games -13.5%

Chinese Burritos -13.5%

Chemicals -13.5%

Department Stores -13.3%

Oil and Gas Pipelines -12.5%

LED -12.2%

Security and Protection -12.2%

Internet Information -9.5%

Railroads -9%

Visa +23%

Hip, hip, fucking, hooray!

Comments »A Brief History of the Dot Com Party and Subsequent Calamity that Ensued

Generally speaking, when large and mini bubbles in the market pop, the maximum downside resides in the 70% range. We’ve recently seen this play out in May of 2014 with a wide array of tech stocks. We are seeing it unfold now in oil and have seen it play out many, many times in the history of stocks, from dot coms in 2001 to banks in 2008.

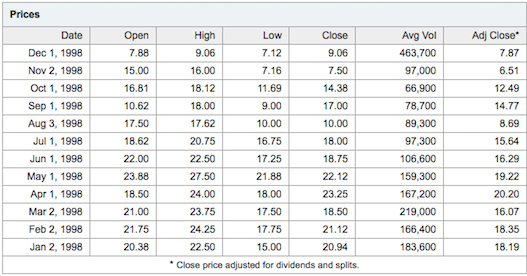

The Option Addict texted me an interesting stat this morning, alluding to the last time oil and stocks diverged like this, which was back in 1998. It’s funny that he should mention 1998, since it was the first and only time I thought about leaving the business. Times were so tough for me then, I thought nothing could salvage my young and miserable career as a stocked broker. I recall owning a lot of stock in a company called Gulf Island Fabrication, just before the collapse of oil prices.

Back then, INTC, MSFT and DELL were the darlings of Wall Street; everyone was buying them, GTW (Gateway computers) too. Being a contrarian, I didn’t want to buy tech, so I opted for oil.

BIG MISTAKE.

Oil went down to drill bits and GIFI descended with it.

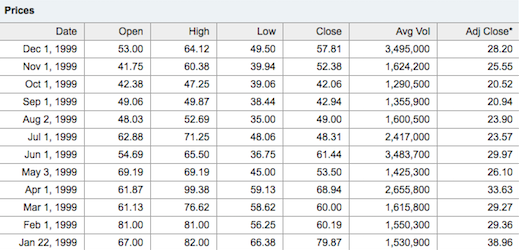

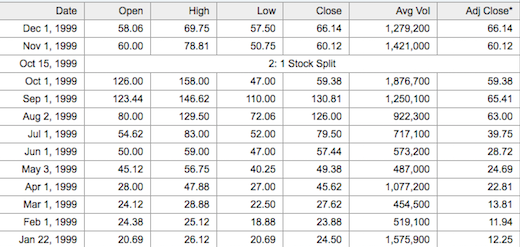

Take a look at the pin action.

I recall blowing out of GIFI around $15, just before the collapse. I then began a fanatical campaign of buying UNDERPERFORMING dot com stocks. I used to spend hours and hours researching prospective internet companies on the bloomberg terminal. I shared these ideas with my friends and co-workers , who scoffed at me and said “MSFT will own everything”. Hardly anyone even knew about these stocks, like Earthlink, Mindspring, CMGI etc. I was an early adopter. What people know about the dot com era is that people made money. What they don’t know about the dot com era is lots of people lost money.

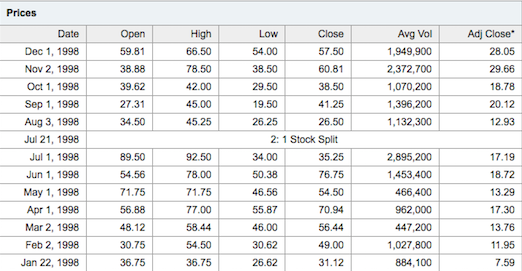

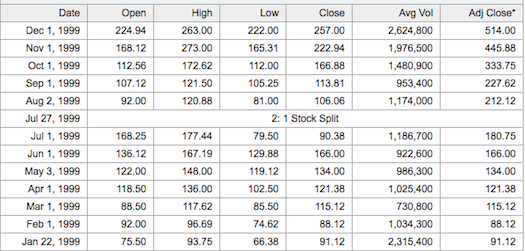

So in 1998, in the midst of a market meltdown, young Le Fly started to buy dot coms in earnest. My buying power was minuscule, but to me, back then, it was an enormous sum of money. One of the stocks I was buying was ELNK. Have a look at the pin action.

Working with the timeline I am laying out here, I sold out from GIFI around May-June and then I started buying ELNK, BYND, CMGI and others from June on. At first, it was dicey. As you can see by the drop in August, I was hating life to the maximum then, hanging around the office, all depressed and shit, playing Tetris. But then things started to pick up; things started to get real colorful (extra Randy Savage). By November of 1998, I was making a fucking fortune.

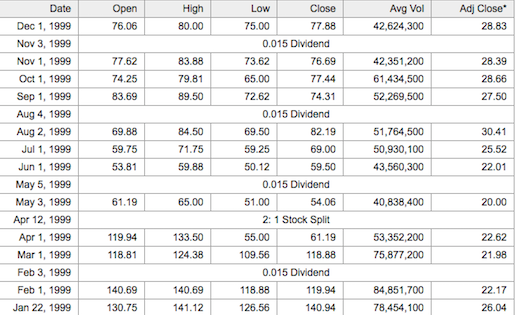

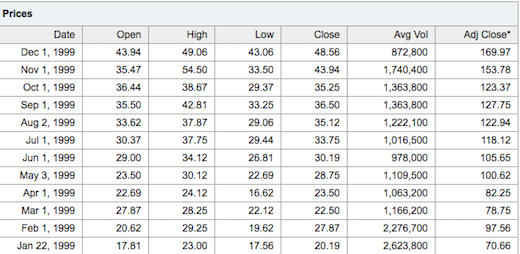

As 1999 rolled in, the old school tech names were dead money. I know this is hard to believe, since the NASDAQ was up 100% that year; but they were.

Here is the trading action for INTC that year.

Not impressive. During 1999, all of the assholes who were shitting on me in 1998 were now my cold callers. My production shot through the roof and they couldn’t catch up, mainly because they had no idea where the money was going. I knew it because I had done the homework.

We started buying networking stocks, B2B names and selling out of 2nd tier names like ELNK, who began to underperform, horribly.

Now if you were long ELNK or INTC in 1999, you felt like shit, especially when stocks like JDSU and CIEN were popping off.

JDSU

CIEN

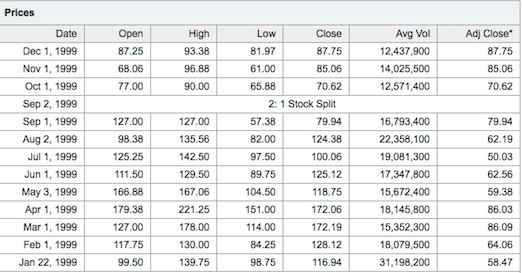

Why was this happening? The market in its infinite wisdom concluded the internet was old hat, despite just being invented. Stocks like AMZN, who went from $5 to $30 in 1998, were now acting like old man stocks in 1999. Here was the mediocre performance of AMZN in 1999.

The theory was that the internet was growing. People had computers. Now we needed to speed up the networks, in order to make it work. So, like the railroads in the late 1800’s, America went on a frenzy to build out fiber optic networks. Companies like JDSU and CIEN were at the epicenter of this craze and their shares ran like wild dogs higher. This, of course, was a classic mistake, which led to over-capacity, which led to the eventual collapse of the industry.

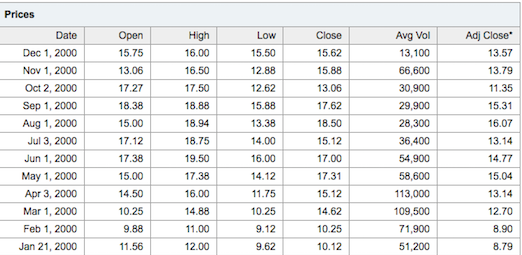

In 2000, the party came to an abrupt halt. However, there were stocks that outperformed, like EXTR.

I remember a friend of mine riding that stock from nothing to its peak and right back down. So many people thought these networkers would outperform forever.

Another one of my favorite names was HLIT, another networker. This stock ran from $12 to over $130 in a year–then right back down in 2000.

HLIT 1999

HLIT 2000

The party was more or less over. Actually, the party was 100% over and I was inheriting 100 new clients from fired brokers per week, by the spring of 2001.

So what have we learned today, children?

1. When bubbles pop, the downside is your worst nightmare. They do not come back.

2. Pay attention to where the money is flowing, else end up a cold caller for an asshole broker.

3. Book profits.

4. Before you can book profits, you have to know where to find the waves.

In conclusion, I don’t know for sure if the oil bubble has popped or not. What I see with my eyes is an industry being taken to the woodshed by Wall Street on a daily basis. Perhaps it’s time to buy up the social media or other web 2.0 stocks now, considering oil is done? Or, maybe this is 2000 and everything is going to drop?

Actually, that’s not how it worked back then. See, while everyone was getting blown to smithereens in HLIT back then, people started to make a mint again in my old friend GIFI.

GIFI, circa 2000

Things work in cycles, people. 2008-2009 was an outlier event, one that saw both oil and stocks collapse in tandem. You and I both know this isn’t happening now. I don’t think we are going to see oil and the rest of the market trade down together. As a matter of fact, if oil continues lower, I believe it will pave the way for extreme upside in a number of high growth industries. Then after those stocks have run their course, you can start buying oil again and dance on the graves of all of those who overstayed their welcome at the party.

Comments »