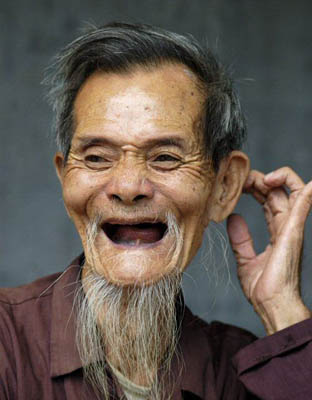

My grandfather was the proudest man I’ve ever known. He was comfortable with who he was, wore his Italian culture on his sleeve, and voiced his opinions often in his classically loud baritone way. A small business owner, dealing with furniture, a stand up comedian during World War 2, and a fantastic story teller in his later years: that was my grandfather.

Christmas in our quaint two bedroom apartment in Brooklyn started immediately after Thanksgiving. He’d plaster his cheesy, one dimensional, paper decorations all over the apartment, in every room, even the bathroom. The front door was covered with Santa Claus’ greetings and the 6th story window was framed with large colored bulbs. He made a small chimney out of cardboard and wrapped it in faux brick paper, for the effect of course. Then he’d stick an oversized blow up doll of Santa Claus in it and declared the Christmas season had begun.

These were magical times for me. The whole idea of Santa Claus traveling to my house to deliver gifts was beyond amazing. He’d tell me stories of the time he actually saw Santa Claus, live and in person, when my mother was a child. This only fueled my imagination with endless possibilities.

In his spare time, he was either painting in his closet or baking. Italians express themselves through food. My grandmother was the traditional Italian cook. She never did anything differently, always the same, reliable, Italian fare. My grandfather, being the artist he was born to be, would make fantastic messes in my grandmother’s kitchen, which would lead to dramatic flare ups and eventual evictions for Grandpa Fly from the kitchen.

But every Christmas he did it right. He’d take out his Mother’s 19th century, hand written, recipe of struffolis out from his little tin box and get to work. For those who aren’t familiar, they are small balls of dough, infused with anisette, and deep fried in glorious oil. After they were fried, he’d lather them with honey and candied sprinkles. Sometimes he’d sneak me a shot of anisette when my grandmother wasn’t looking.

He’s also made us zeppoles, which is essentially deep fried dough with tonnes of powdered sugar on them. For a kid who loved sweets, this was my favorite time of year.

We’d buy a real tree down the block, lug it home on foot; and then he’d saw off the end and stick it in a tree stand. He always said the trunk of the tree needed to be cut so that it’d last longer. I have no idea whether this was true or not. All I do remember was the force he’d administer to saw that damned trunk apart. The decorations were something out of the 1920’s. My grandmother would literally string popcorn together and wrap it around the tree. Throughout the month of December, Christmas music would be playing, from real vinyl records, never from the radio. Sinatra was never played in his house, since he hated him. I think he knew one of Sinatra’s cousins and had a personal beef against him. Back then, Italians in the tri-state area all seemed to know one another. If you were in politics or owned a business, you vacationed in the same places and went to the same nightclubs.

Christmas eve was for the kids. My grandparents would wake at 5:30 am to a boiling pot of black coffee. He’d start his “gravy” with braciole, sausages and meatballs. The spread was kid-friendly: sweets, home made anti-pasta, linguini with sauce and meats, baked macaroni with cheese, lots of bread, roasted sausages, peppers, onions with potatoes, and of course lasagna. My sister and I would run around like wild animals, playing hide and seek, then open our presents at night. When we woke up the next day, like magic, Santa Claus’ presents had arrived and we were smitten with joy.

Christmas day was a traditional Italian holiday, one that pushed the annoying kids aside and celebrated the birth of Christ. Coincidentally, my Grandmother’s birthday was Christmas Day too (Happy birthday Grandma!), so it was a really big deal in my house.

Seafood of all kinds was made. He favored mussels, clams and shrimp. I hated all of that stuff, so I usually ate leftovers from the night prior. But I remember how happy they all were, dancing and celebrating over plates of their favorite food and glasses brimming with wine.

You only realize how special things are when they’re gone.

Cheers to the past and to making new memories.

Merry Christmas.

NOTE: My grandparents would play this song every Christmas and every Christmas remind me that my Uncle would always cry when he heard it. To this day, I have no idea why he’d cry.

Comments »