Yahoo is being valued at negative $1 billion, after its BABA and Yahoo Japan spinoffs. German 30 yr yields are under 1% and shorter duration sovereign yields are negative in most western democracies. Our 10yr yield is under 1.7% and TLT is at new highs.

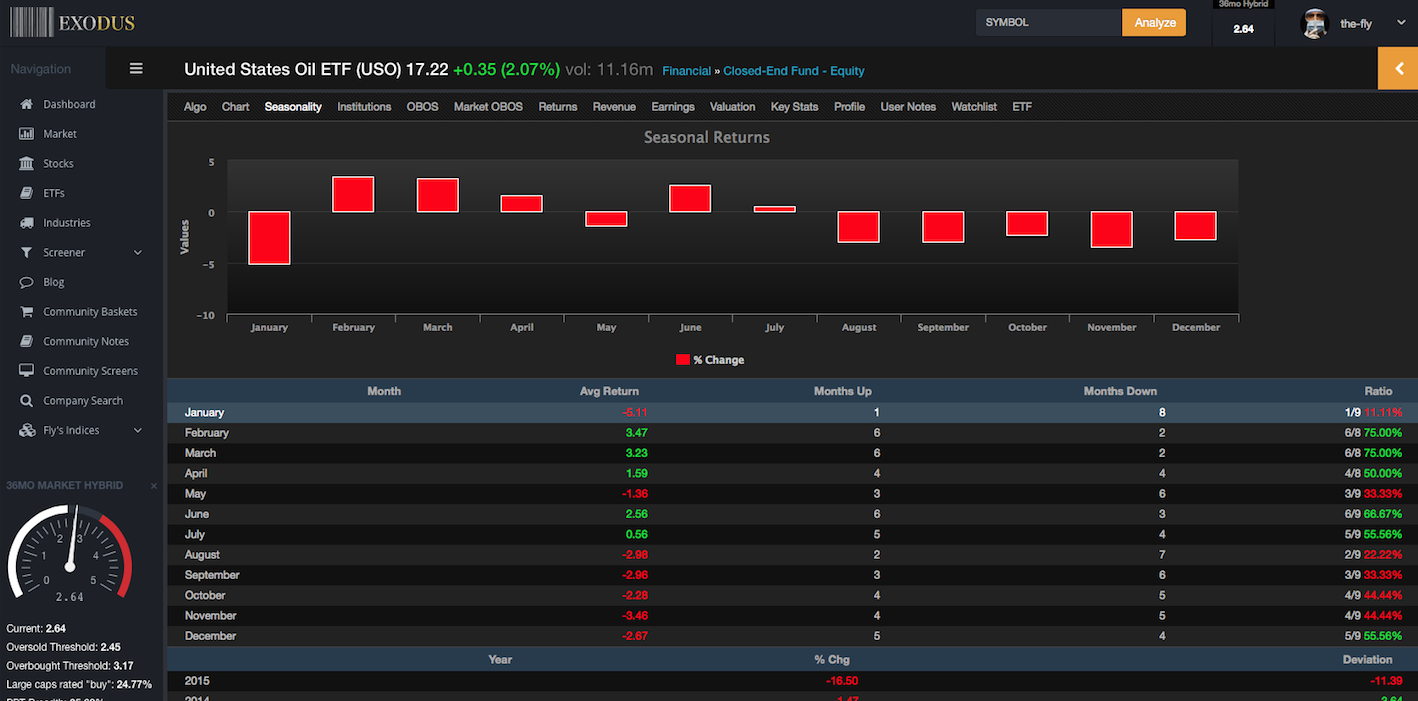

Oil is cratering and the Dry Bulk Index is at its lowest point since 1986.

The entire commodity sector is in shambles and if it weren’t for US GDP numbers suggesting the economy can grow at 3%+, one would say we are trapped inside of a vicious deflationary cycle, one that stands to absolutely destroy equity prices.

Or, maybe we’re all fucking cowards and have COMPLETELY LOST OUR FUCKING MINDS, by giving governments our money for 10 years at NEGATIVE yields. This is unbelievable to me, frankly, how so many smart people can be so fucking stupid. There isn’t a credit crisis or an event that should cause you to stow away money into the coffers of Swiss central banks, locking in negative rate of returns.

Why not buy AAPL or SHAK instead?

One thing is for certain: we are in a new paradigm and the old rules do not apply. Adjust or die.

Comments »