Several Exodus users are competent and operate the system to extract actionable stocks. They also engage the macro timing algorithm like it is second nature. Other members, mostly noobs, need to be shown the basics.

That is why they sent me. I am the expert. Please do not envision me like a savant—naturally gifted in the fields of software, stocked markets, and statistical analysis. Running Exodus is not rocket science, though it was developed by a Space Alien Magician. It is simple to operate. Let’s go top down and find actionable stocks right now, shall we?

Step 1: Decide The Relevant Time Frame

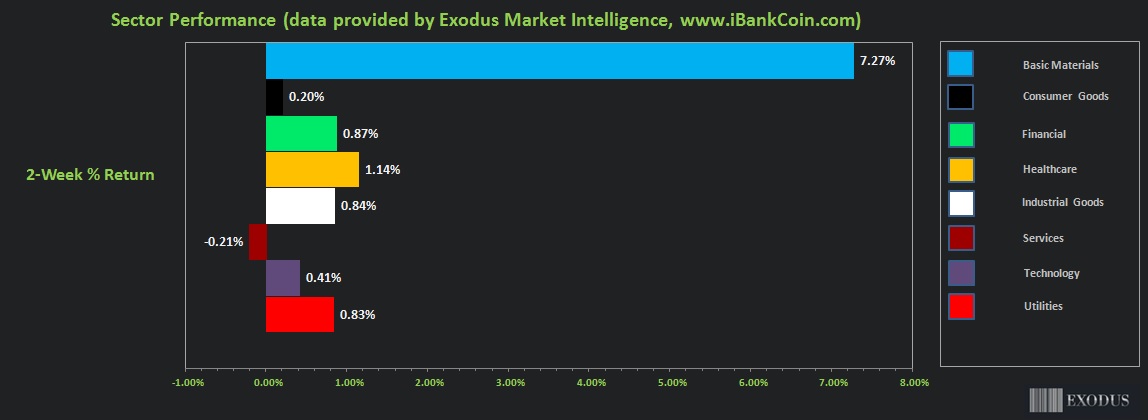

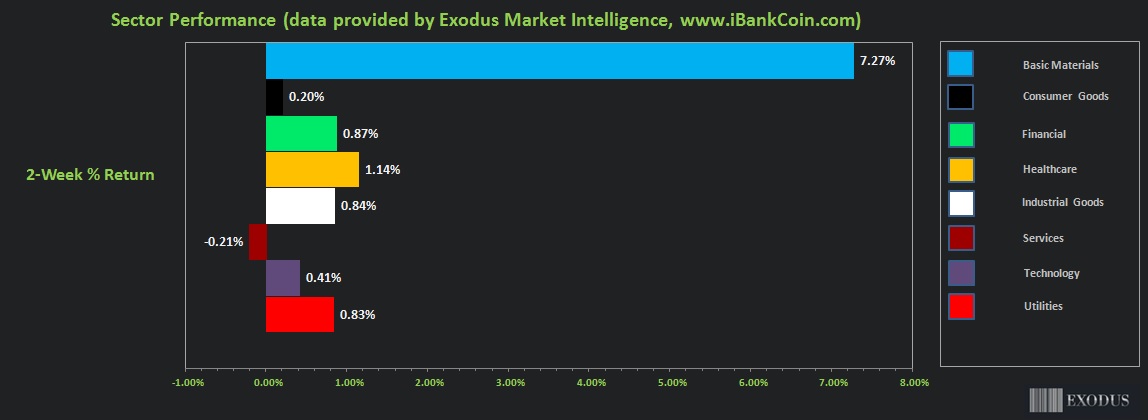

You need to think about how far into the past you want your data to go. I want to see which sectors are outperforming since the start of earnings season, which was about 2-weeks ago.

BEHOLD: 2-WEEK SECTOR PERFORMANCE (save all applause until the end)

Nothing really stands out, nothing except the haymaker Basic Materials landed square on the scrotum of bearshitters. Goodness, look at that thing. Now comes my bias, and this is the part where I tailor the results for my needs, and why you need to become self sufficient at this simple form of analysis. I do not want or need a Basic Materials stock in my portfolio. So I will instead dig into the second best performer, our good friend Healthcare.

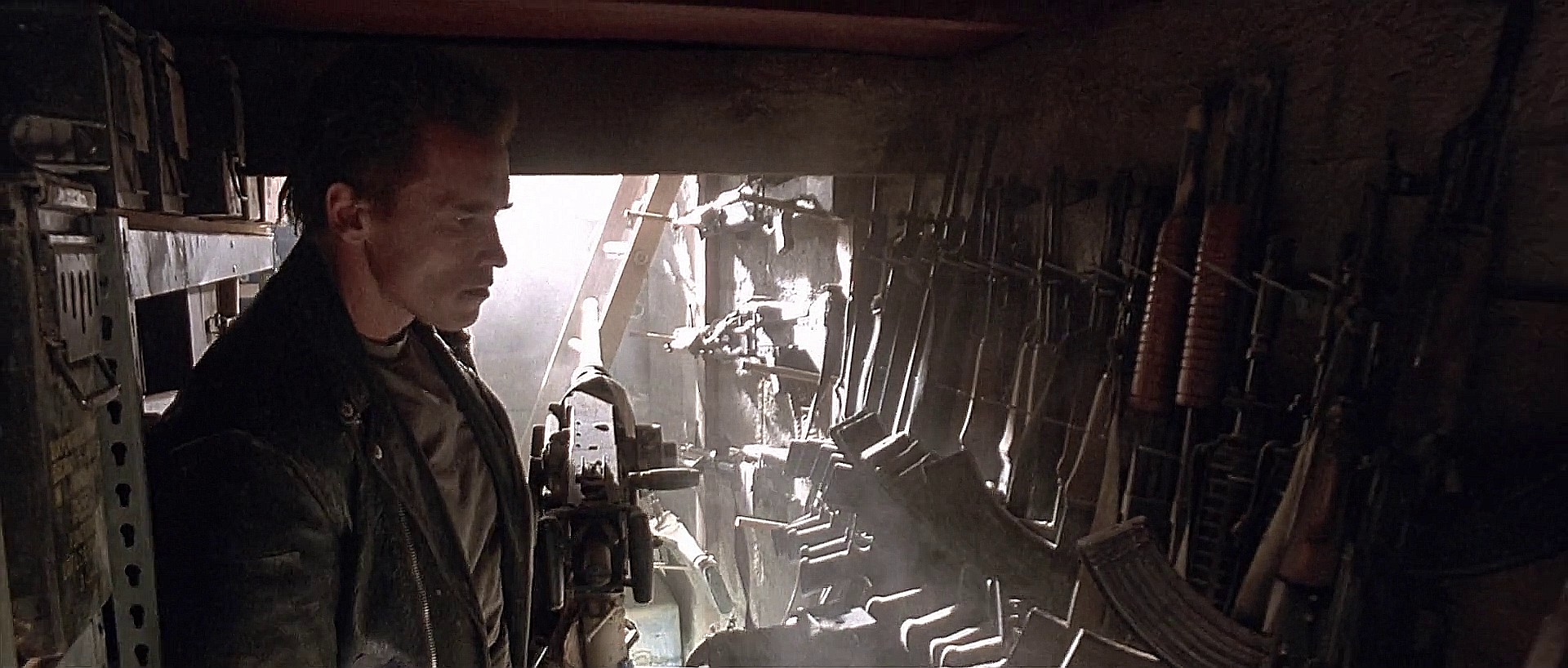

Step 2: Enter the Armory And Choose a Weapon

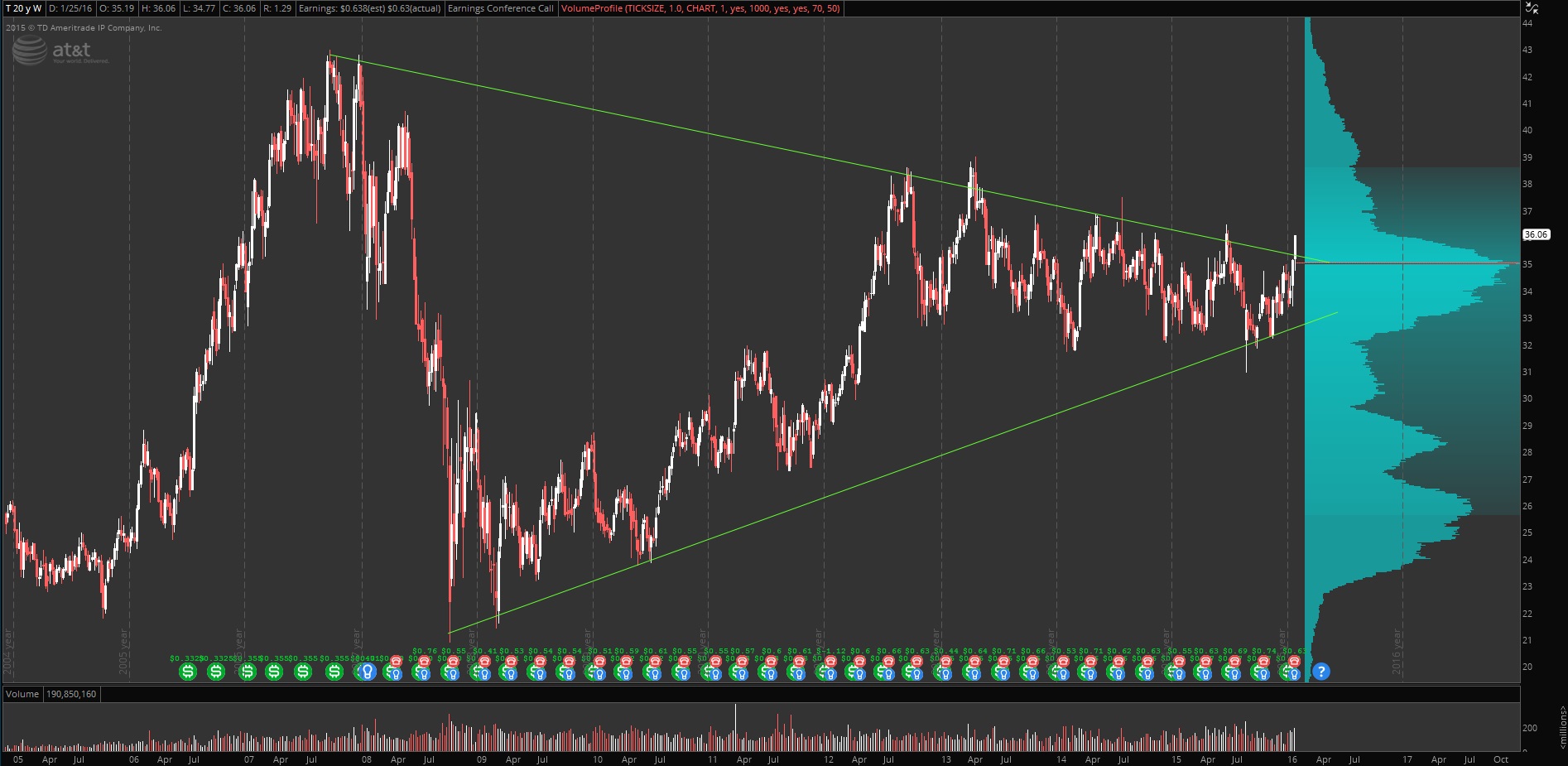

Armed with the sector intelligence we gathered above, we now head into The Grid. The Grid is the biggest page inside Exodus and is loaded with tools you can use to hone in on winners. The whole Sell in May thing has me cautious. Therefore I am picking the Free Cash Flow model portfolio as my weapon. It is loaded with fundamental filters by the Le Fly himself. Great screen when you want to find companies whose operations were sound over a trailing 12-month period, in hopes their operations will continue to funnel cash into the company, thus fending off any liquidity issues should credit start to tighten.

I refuse to write out all the steps I take to soup up the Free Cash Flow screen to find actionable stocks. If you are serious about using Exodus set up a 15-minute phone call with me by calling 800-863-7110, emailing [email protected], sending me a DM on Twitter @IndexModel, or ping me on SnapChat [VCali]. Exodus members can access the screen by clicking here.

However, for the unwashed, if you’ve stuck around with your hat out, bedraggled and smelling of cheese, waiting for PICKS, I have your picks.

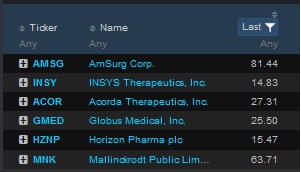

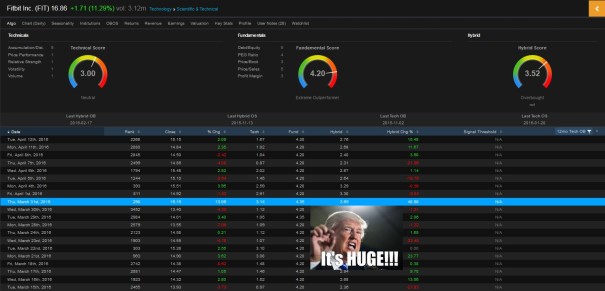

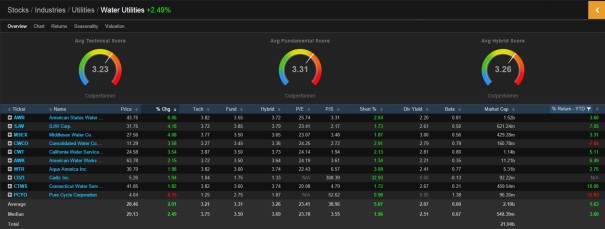

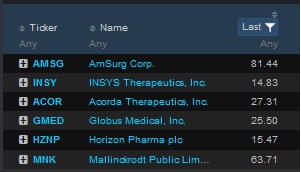

BEHOLD: THE STOCKS GENERATED BY Exodus MARKET INTELLIGENCE

From the list I like GMED the best, then MNK ::takes bow, basks in applause::

Comments »