Welcome to Opening Swing. This is the first of a series of analysis on the behavior of price during the first few minutes of trade, and the subsequent trade that follows. Initially our attention will be on NASDAQ futures because I think we will see more volatility in equity prices this year and I view index futures as a smart vehicle for playing this potential.

The opening swing is a high and low that is set by the initial auction right after the market opens. It is independent of time and is not the same as the opening range or initial balance. The opening swing is the high of the first push up and the low of the first push down or vice versa. It measures how far the Market On Open (MOO) orders take the auction right after the open.

The plan is to use less words and more charts, but if any of these charts begin showing a similar trading picture or tradable opportunity, my plan is to discuss it and hopefully solicit some input from some of the more seasoned traders hanging around these parts.

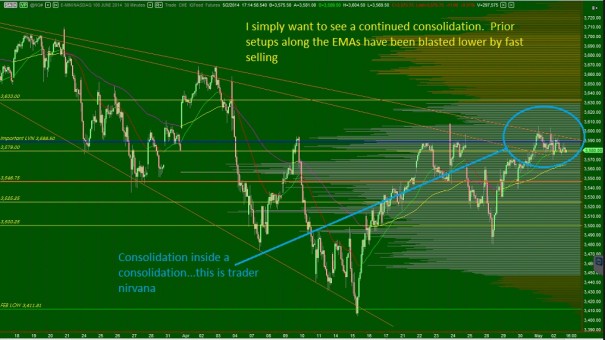

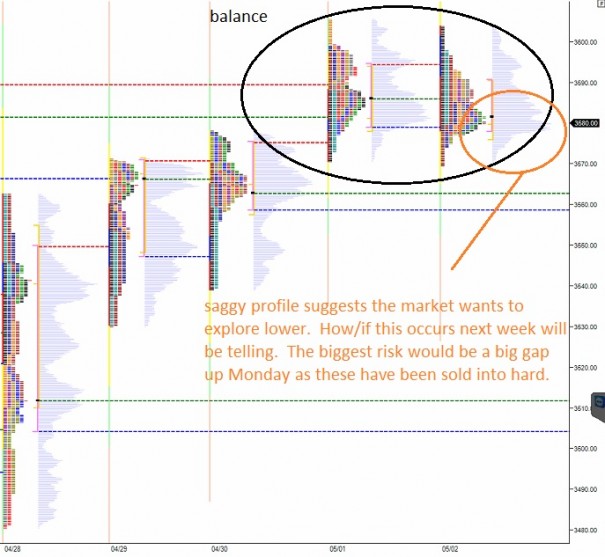

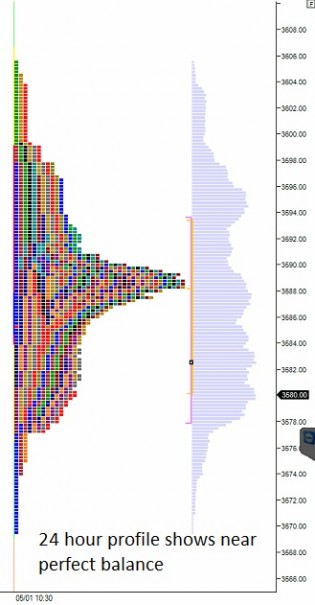

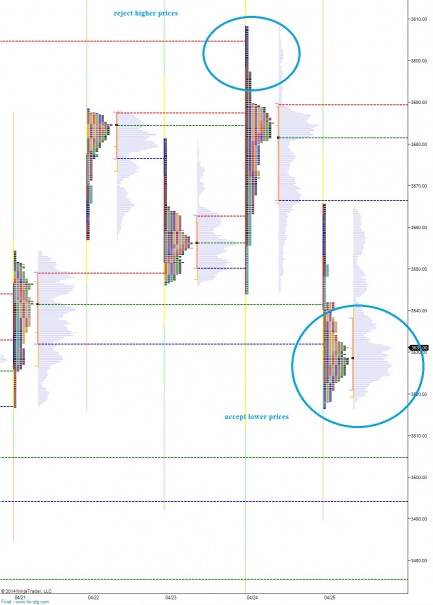

Without further adieu, let’s look at this week’s NASDAQ openings swings. They are presented in chronological order and free of any indicators, moving averages, etc. This is pure auction analysis. Keep in mind, the context analysis done every morning gives more insight into to these opening swings, and combined form the basis upon which we can consistently trade for profit. Therefore it would be of your benefit and mine to take each opening auction and compare it to my morning context report to form a solid understanding of the early auctions that take place. Again, don’t hesitate to use this forum to ask questions or suggest methods of trading this auction behavior:

NOTE: Most days I report the opening swing inside 12631. I like using 12631 not because I want to be exclusive from all the wonderful people I learn from and interact with on Twitter, but because the chart room has so many dynamic tools that I can use to review my messages. 12631 members can review my live opening swing calls (as I will be) to see how accurately I am calling the opening swing in real time.

Comments »