I have been keeping an eye on you clamheads from over 10,000 feet and all of you have completely lost your minds.

Christmas cultivates greed and jealousy. Like when your friend mails you a professionally made card from his new house, with the hot wife and strong chinned baby. On Instagram you find out your douche ex-roommate Chad bought the white Range Rover like some hipster cocaine dealer. Meanwhile you are finally set free from 50 hours of corporate drudgery. With your newfound free time you try trading stocks, not good. ATRs are blown out and momentum is hyper concentrated into solar. Defeated, you take to your computer and turn into one of those crazy internet people.

The internet is your haven. Online you shovel feces on strangers without repercussion. In real life you run into gnarly gents like me–dangerously handsome fellows who can dismember you with words and muscle and brawn. Fine you want to pop off, but do you see what we are doing here, 6-7 days a week? iBankCoin is a beacon of hope in an ocean of nonsense. One does not wander these halls in gym sneakers, stinking up the joint. Take your angst to Facebook instead. You can assault your friends and family with our delicious and powerful content.

Twitter is an excellent place to go on a brazen rant. Just because the company is complete garbage shouldn’t stop you. Why not tell everyone how you really feel about that lipstick wearing cock gobbler Ted Cruz? Someone might actually join you–misery loves company.

Do not underestimate shopping centers. Sometimes thrashing people on the internet won’t silence that voice in your head, that voice that you are inferior. An overworked seasonal employee at Banana Republic makes a great mark. They will take your abuse, the manager will kindly attempt to remedy your ill mind with apologies and discounts, and you can get another pair of khakis.

Listen up, the Santa rally is coming. Everyone always thinks Santa will come early. He never does. The market makers pinned your degenerate gambols for zeros, effectively severing your attempt to manufacture a little holiday bonus. Chagrined, you cannot chase solar and it’s the only thing running. And it will keep running without you. But cheer up. Step back, observe the crazy people. It might just give you insight into your own twisted psyche. Better yet, live a fringe lifestyle like me, living in the woods and such.

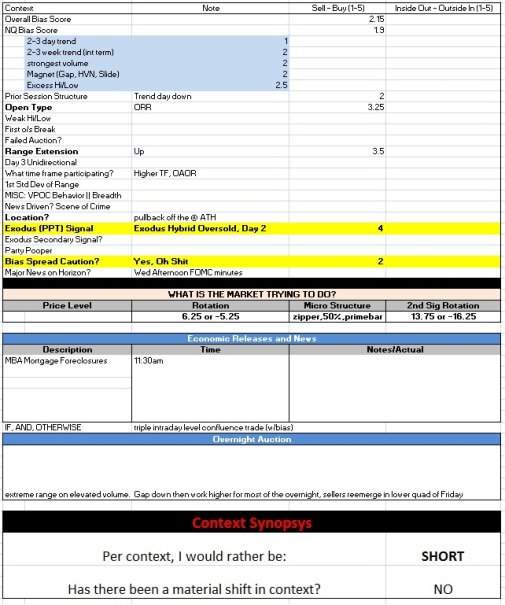

Exodus Members: Did you catch the Strategy Session? It was produced from high in the atmosphere at hours early enough to encourage clairvoyance.

Loyal Readers: I know you’ve missed me. I love being missed. It’s like being licked by puppies. Fret not, come Wednesday I will be back at the Mothership. Stay cool out there and keep it sexy. We have to be upstanding people and really really extremely good looking, especially during the holidays.

Comments »